HSN Codes Explained (Harmonized System Nomenclature)

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get startedContents

HSN stands for ‘Harmonized System Nomenclature.’ The WCO (World Customs Organization) developed it as a multipurpose international product nomenclature that first came into effect in 1988 with the vision of facilitating the classification of goods all over the World in a systematic manner.

How do HSN work?

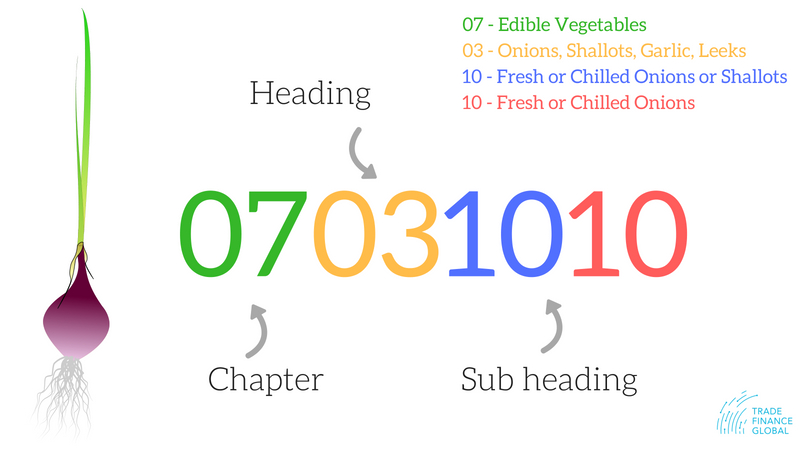

HSN is a six-digit code that classifies more than 5000 products, arranged in a legal and logical structure. To achieve uniform classification, the HSN is supported by well-defined rules and is accepted worldwide.

HSN classification is widely used for taxation purposes by helping to identify the rate of tax applicable to a specific product in a country that is under review. It can also be used in calculations that involve claiming benefits.

Yet that’s not all – it also applies to import and exports. The HSN code aids in determining the quantity of all items imported or traded through a nation.

The Importance of the HSN Code

While the primary purpose of the HSN code is the systematic classification of goods, it can also be used to gather data and solve problems that would otherwise be difficult to obtain. The result is a more efficient international trade system.

Example of an HSN code – schematic

The Importance of HSN Under GST

The HSN system doesn’t only help Customs agents – it also has important implications for GST. It helps in making GST systematic and globally accepted.

By using HSN codes, there is no need to upload a detailed description for each good falling under the GST. This allows for the automation of GST returns, saving time and money for the tax authority.

Get in touch with our Freight Forwarding networking team here.

Testimonials

HSN Codes were required by Sharma Packaging Foods Company to determine what relief it was eligible for from taxpayers.

– Joanna, Sharma Packaging Food Company

Case Study

Goods Distributor

TFG put us in touch with expert HSN experts so that we could ship our goods across the state and also pay the appropriate taxes to the government.

- Customs Resources

- All Customs Topics

- Podcasts

- Videos

- Conferences