We caught up with Peter Jameson, Head of Trade and Supply Chain, Asia Pacific in Bank of America. We discussed the highlights of 2019 and the opportunities in 2020 for the trade, receivables and supply chain finance. There will be continued pressure on trade flows, with reduced volume, commodity prices, and financing demand. Despite this, Asia Pacific’s growth prospects remain favourable as compared to other regions. Businesses continue to seek growth and focus on further developing their banking needs in the region.

In this 2020 interview series, TFG spoke to 20 experts in trade, receivables and supply chain finance.

An Interview with Bank of America

Name: Peter Jameson

Position: Head of Trade and Supply Chain Finance, Asia Pacific, Global Transaction Services

Organization: Bank of America

Interviewed by Nikhil Patel (NP), Analyst, Trade Finance Global

2019 – The year of evolving KYC, increased uncertainty and DLT

Nikhil: In 200 words, what were the key highlights and opportunities of 2019 from an industry perspective in trade, receivables and supply chain finance?

Slowing global economic growth and excess market liquidity resulted in reduced demand in certain trade corridors and increased uncertainty for clients. The impact of various trade disputes led many to look at how to recalibrate their supply chains in response. This, combined with an increasing focus on domestic supply chains, has presented opportunities for more client dialogue on their changing needs such as the need for increased risk mitigation and better working capital management.

2019 was the year when distributed ledger technology (DLT) moved from concept towards practical industry applications. At the same time, there was greater adoption of other digitization tools to drive speed and efficiency. There was also increased adoption of API technology.

From a regulatory and compliance perspective, 2019 was another year of activity, with evolving KYC requirements remaining a challenge. There is increasing focus from regulators on data management – particularly data on-shoring requirements – and widespread adoption of real-time payment networks, which will ultimately benefit trade finance.

Slowing global growth, interest rates cuts, and uncertainty around tariff disputes

NP: What are your top predictions for trade, supply chain and receivables in 2020?

Factors such as slowing global growth, interest rates cuts, and uncertainty around tariff discussions remain key focus going into next year.

There will be continued pressure on trade flows, with reduced volume, commodity prices, and financing demand. Despite this, Asia Pacific’s growth prospects remain favourable as compared to other regions. Businesses continue to seek growth and focus on further developing their banking needs in the region.

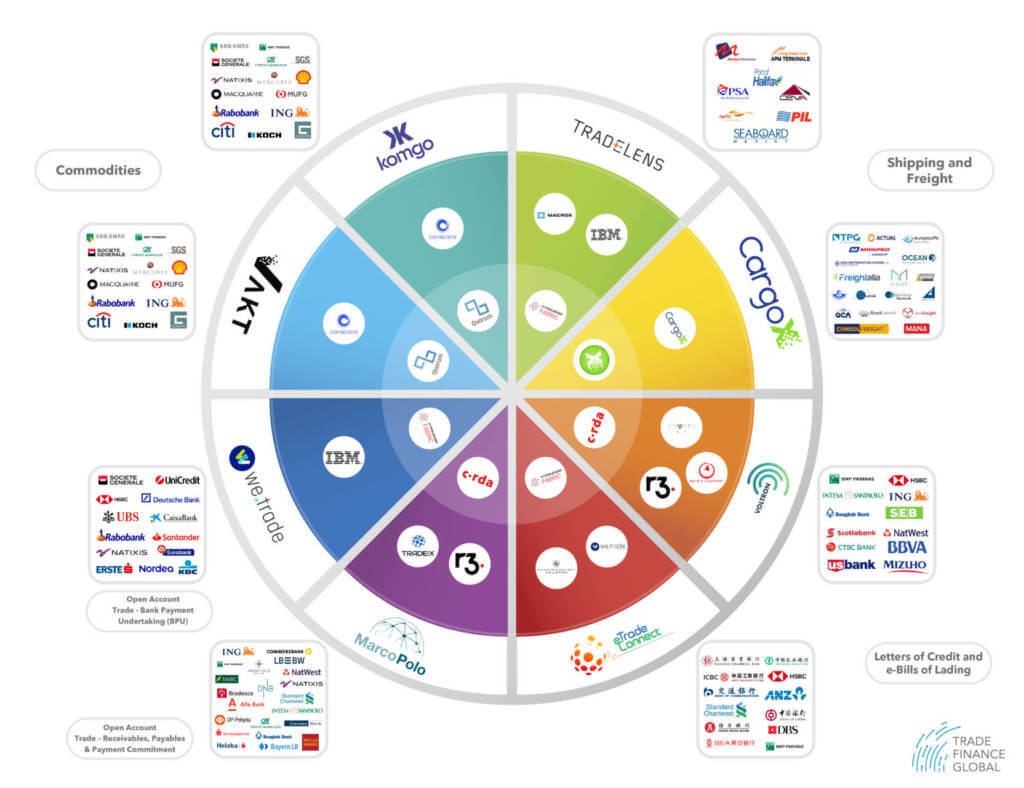

At the same time and – in part – driven by these challenges, the focus on digitization and innovation will remain, as the industry continues to seek efficiency to protect margins. DLT will move towards practical implementation, specifically with industry players coming together to define actionable progress. Banks will continue to focus on other digitization opportunities such as leveraging robotics, artificial intelligence and automation.

See the interactive diagram

Sustainability is fast emerging as a key theme in 2020 and will dominate the decade we are entering. For trade, driving sustainable practices within supply chains and sustainable financing will move further up the agenda, given pressure from regulators, investors and customers.

2020 Predictions in Trade and Supply Chain Finance – A Bank of America Perspective

NP: In 200 words, what are the biggest challenges in trade, receivables and supply chain finance you predict for 2020?

The biggest challenge for trade in 2020 will be the fast-evolving macro, political and economic environment. With multiple variables at play, the possible outcomes are many. For many banks, given the impact of this on volume growth, this will generate pressure on margins. But this presents a significant opportunity for banks to support their clients in managing through this uncertainty.

Additional challenges for trade and supply chain include:

- Closing the trade finance gap – how can the industry collaborate to meet the massive financing needs across the industry

- Continued industry debate around the treatment of supply chain from a corporate accounting perspective, and alignment across the industry around appropriate treatment and parameters

- As the technology landscape continues to evolve, we are seeing numerous ‘digital islands’ emerge in the trade and supply chain space. In a complex, cross-border business with so many diverse players, a major industry challenge will be to connect or integrate these ‘islands’ to create seamless client experiences

NP: What are the key priorities for Bank of America in 2020?

We have a number of key priorities for 2020, these include:

- Continuing to invest in new technology to meet evolving client needs, regulatory requirements and to drive efficiency – e.g. greater integration of AI and robotics within our core operating environment

- Continuing with our active engagement in industry initiatives around new technology such as DLT, so we play an active role in shaping the new trade finance infrastructure of the future

- Continuing to build on existing and new partnerships – either with other banks or non-bank partners – to develop end-to-end trade and supply chain finance solutions that meet our clients’ needs

- Focusing on our client advocacy and advisory activities – to help clients navigate the fast-moving regulatory, economic, technology and market environment

NP: What’s your top prediction for a technology that you think will truly kick off / have the most success in 2020?

Two predictions:

- 2020 will be the year when DLT starts to find practical, actionable reality, with the convergence of industry players and the emergence of some form of standards

- In parallel, banks will realize the power of other digital innovation, which has perhaps been eclipsed by the noise around DLT, but which can provide immediate and material improvements in operating efficiency and client delight

Read our trade finance 2020 predictions here

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.