Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 22

Host: Deepesh Patel, Editor, Trade Finance Global

Featuring: Robert Ronai, Member of their Incoterms® Drafting Group, Incoterms® 2020

Today we’re reminding our listeners that incoterms rules are changing at the start of 2020. With the updates and specific changes to be announced very shortly by the International Chamber of Commerce. We are delighted to be joined by a world-renowned exporting expert, Mr Robert Ronai. He has over five decades of experience in exporting and importing stretches, in international banking and the world of international commerce. Bob now has the honour of being the first Australian and only the second non-lawyer to be invited by the ICC to be a member of their Incoterms® Drafting Group to draft the new Incoterms® 2020. Bob is a prolific speaker and an active voice within Incoterms and trade finance. Joining us today from Australia, Bob has managed two of the most active LinkedIn groups within trade finance and Incoterms, attracting a collective 50,000 followers in the community.

S1 E22 Learning from the experts: Bob Ronai on Incoterms(R) 2020 – Then and Now

Deepesh Patel: I’m Deepesh Patel, Editor at Trade Finance Global. Today we’re reminding our listeners that incoterms rules are changing at the start of 2020. With the updates and specific changes to be announced very shortly by the International Chamber of Commerce, the global trading system has changed considerably over the last half-century. We are delighted to be joined by a world-renowned exporting expert. With over five decades of experience, we’re going to be joined by Mr Robert Ronai at what is a very important time for the International Chamber of Commerce and the world of shipping rules. Bob has the incredible experience of seeing how shipping rules have changed over time, as well as being actively involved with credit regulations, the current international standard banking practices, and trade finance. Bob is a prolific speaker and an active voice within Incoterms and trade finance. Joining us today from Australia, Bob has managed two of the most active LinkedIn groups within trade finance and Incoterms, attracting a collective 50,000 followers in the community.

Bob, it is a pleasure to have you onboard today. Thank you so much for joining us on trade finance talks.

Bob Ronai: Pleasure to be here.

The Back-office Side of International Trade

DP: So Bob, in no more than 30 seconds, please tell us your elevator pitch. Who are you? What do you do? Tell us a bit about yourself!

BR: Okay, I’m Bob Ronai. I’ve been involved in the back-office side of international trade for over 50 years and for at least the last three decades, I’ve been really passionate about getting the trading world to know about the Incoterms rules and to use them correctly.

DP: Thanks Bob, you’re a fountain of knowledge and you really have seen the entire industry of global change over the last few years. What have been some of the most momentous changes in your opinion and why do trade-related rules need to change?

History Lessons in International Trade

BR: The most momentous changes would have to be simply communications. I’ve seen the world progress from cables to telex to SWIFT and, of course, emails. The Incoterms trade rules have changed over time since they were first established – or first published – in 1936. They first changed after World War Two to cover transport by rail across Europe. Then they changed to cover transport by air, and later to include transport in containers.

This time, though, the 2020 rules have been written in plain English, so that traders around the world whose first language might not be English (and who don’t have a law degree) can understand them. That is because previous rules have been written by a preponderance of European lawyers. I guess that one of my roles is to be there representing everyone, along with a person from the United States and one from China. Of course, there are other things, but I can’t tell you about them yet.

Incoterms Tips and Tricks

DP: Thanks, Bob. I think you do important work and the fact you are aren’t a lawyer and are based outside of Europe puts you in a good position. For our listeners that might not have come across Incoterms before, what exactly are they and why do we use them today?

BR: Well, back in the era of the sailing ships, they used jargon like free on board (FOB) and within each industry, users created abbreviations. The International Chamber of Commerce realised in the early part of the last century, that various countries had adopted different versions of these commonplace expressions. So they decided to create a standardised set of rules. That was back in 1936. The whole point of the rules is to help sellers and buyers understand their obligations, their risks and their costs etc. Without standardised rules, the sellers and buyers would have to write all kinds of detail using abbreviations into each and every contract – with no standardisation for how are described in the contract, for instance, every one of them would be different and possibly incomprehensible. That would lead to constant legal disputes.

The Incoterm rules distil things down into three-letter trade terms.

DP: Thanks. That makes a lot of sense. Do you have a favourite incoterm?

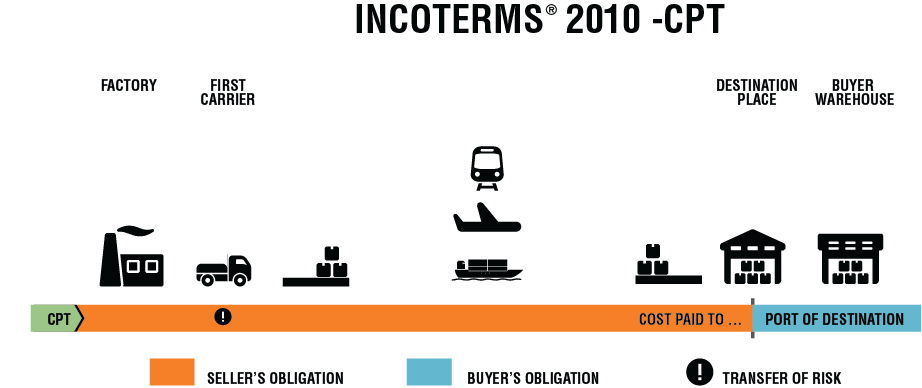

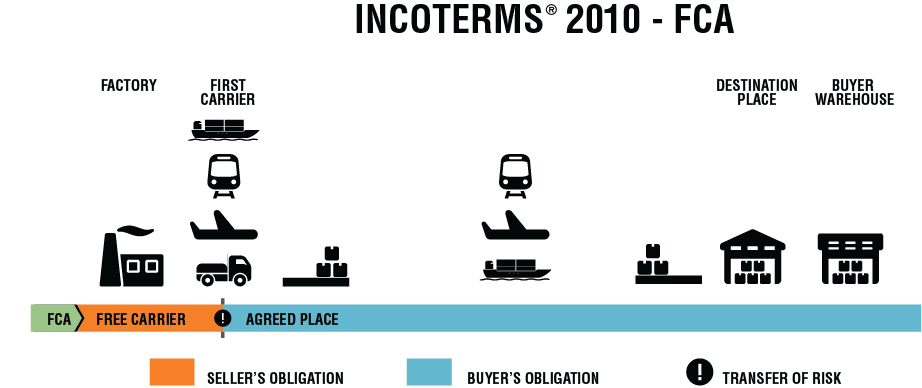

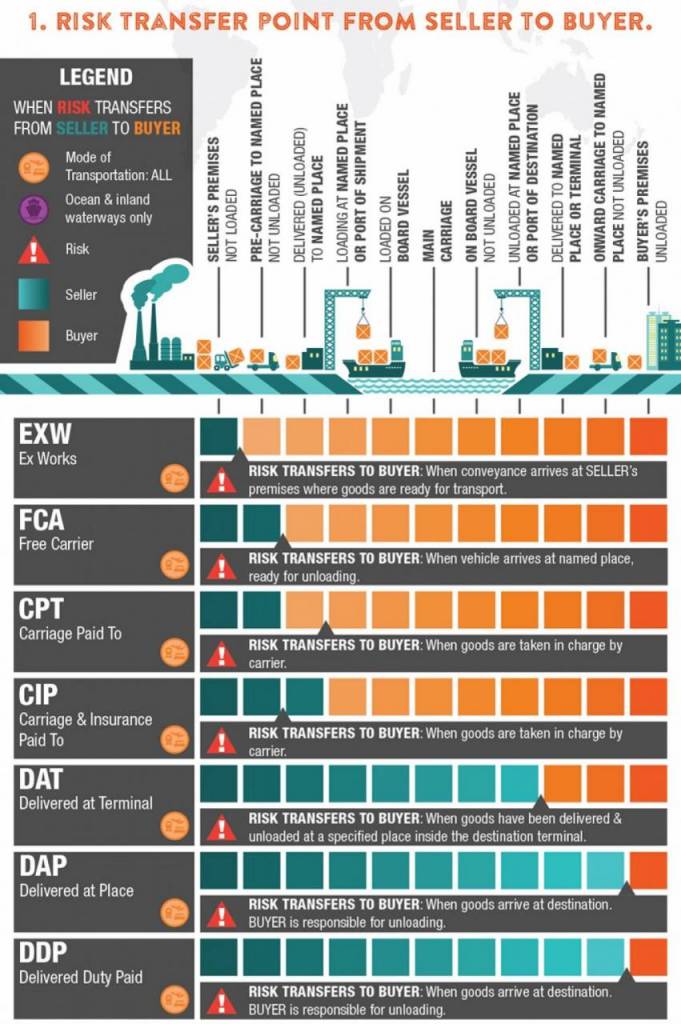

BR: It depends on which point of view. From a seller’s point of view, definitely CPT (Carriage Paid To). A seller who has multiple exports each week wants to control when trucks arrive at the loading dock. They don’t want 50 different trucks arriving from 50 different carriers. So this rule allows them to engage their own carrier or carriers and instruct them when to turn up, or maybe use trucking to pick up 18 different packages that are going to different destinations.

Now, from a buyer’s point of view, I’d have to say FCA (Free Carrier), which is the converse of CPT to an extent. The buyer might want to control the transport and costs through his carrier. For example, he might want to determine whether he wants a vessel that tranships in three ports on the way from some obscure supply country, or one that costs more but is quicker and only has one transhipment port – or maybe even a direct sailing which is even more expensive. So that way the buyer has better control. He also knows there is no margin built into the selling price on top of the freight because a CPT seller can quite rightly treat the freight cost as an input and therefore put a margin on that. Now, of course, even with CPT, the buyer does have control by his import customs broker of when his deliveries actually come into his receiving dock. So it’s not quite the same as the dispatch situation and CPT. On another note, though, I would recommend avoiding the D rules for cross border trade, other than by road or rail. So if cargo is moving by road or rail within the European area, fine. But if you’re moving, let’s say, in my case, from Australia to India, you’d be crazy to use any of the D rules because it puts the seller’s responsibility for risk beyond anything that he can control.

The Importance of Incoterms

DP: I guess it’s really weighing out the commercial opportunities between the risks and responsibilities – whether you’re the buyer or the seller – and it’s also very important to consider the mode of transport. So who uses incoterms and more importantly, what happens if you don’t use them?

BR: Well, who should be using Incoterms is very simple. Every seller and every buyer in every business-to-business transaction! They’re also designed for domestic trade, not just international trade.

But they’re not for business-to-consumer transactions, like on eBay. Can you imagine a buyer being told he’s purchasing CPT and scratching his head?! It’s not going to happen. But for business-to-business transactions, that is where they are vital. If they are not used and something unfortunate happens to the goods, that’s when the finger of blame starts wagging back and forth. And you know who wins? The lawyers.

– Bob Ronai

The Rise of E-commerce

DP: Yes, of course. Understandably, incoterms have gone through numerous iterations over the past years. What have you seen and why have these changes been important for domestic and international trade markets, especially given the rise of mobile phones, the rise of e-commerce and also new trading routes?

BR: E-commerce is an interesting one. If we eliminate the business-to-consumer side of things, then e-commerce is just merely a means of transmitting information. However, I’ve seen the terms change from the 1980s version to the 1990 version, where they put in 10 standardised headings for the seller and 10 for the buyer. Then, in the 2000 version, they were clearer by dividing the rules into the E, F, C and D groups. The 2010 rules modified the rules further by splitting the maritime rules and other modes of transport, where they emphasised certain rules should be used for road, rail, air and containers. I am not allowed to tell you about the 2020 rules just yet!

Sneak Peek into the Incoterms(R) 2020

DP: Well, that’s my next question! OK, I’ll have to change the question. How does the committee come to decide what the 2020 rules will entail? What’s the thinking behind it and what do you take into consideration?

BR: Well, the first step we did was to look at the 2010 rules and try and determine how relevant the wording was. Could we reword it or reformat it to make it more relevant and more easily understood? I recall on the first day I asked a question about two paragraphs in FCA. What did they mean? After 20 minutes of discussion, we all agreed that they didn’t really mean anything so they were eliminated. So we had a first go at redrafting the rules and they were then submitted to all of the ICC national committees. This then elicited a bunch of responses, so we went through them, and we changed what we’d written in an attempt to accommodate those responses. A lot of feedback was irrelevant because they were concerned with rules applying to their country when Incoterms are universal and cannot be written for one country or area.

So after doing that, they went back to the national committees and we got hundreds of more responses. So we looked again and thought about whether we needed to change anything and if the idea was good we would accommodate it. So there’s been input not just from the drafting group, but from the International Chamber of Commerce and national committees, who sought comment from their members. So the idea of the rules is that it’s not just six or eight people huddled together in a room saying “Oh, let’s do some new rules.” It’s a contribution from the national committees who are representing traders around the world.

The Work Day of the Incoterms® 2020 Drafting Committee

DP: That’s very interesting. It seems like a very interesting process to connect opinion from the national committees. I would love to ask your opinion on the US for example who is not well known for using Incoterms as much as other national committees. What are your thoughts?

BR: Well, the US was represented on the drafting group by Frank Reynolds, who has been on the 2000 and the 2010 drafting groups as well. So I guess he’s a very active representative and there were contributions from the US. There were countries that were absent, which is a shame, and there were other countries that were prolific. The drafting group sets a meeting day and we then send out the comments – the national committees need to have time to pass those comments on to others and then get the comments back to summarise them. They then send them back to the drafting group, where the executive will go through them and strike out anything that will definitely not be accepted – to save us from all having to review each and every comment irrespective of its validity. However, I do wonder whether there is a quicker way of doing it because this took three years of our lives – and just for the drafting of the rules, I estimate I have spent over 800 hours. That is a heck of a long time, so if we can somehow improve that in the future, then that will probably be around 2030. Who knows what technology will be like then? If I’m still around and kicking, I would love to be on the 2030 rules, especially as there are still some changes to the rules I would like to see made.

I wasn’t successful with everything through that I wanted because I was not a majority on the committee (and some of the national committees didn’t agree anyway). Nevertheless, as a representative of the practitioners i.e. the people actually using the rules and not the lawyers arguing – for them I would like to see certain changes. Again, I cannot elaborate at this stage because the new rules have not been released.

Everybody who is anticipating the new book, which will be out in September, should go to their local national committee’s training conferences. There are hundreds of them around the world that are posted on the ICC website. But there will be more and more of them. And of course, there’ll be a host of them in 2020. When people realise that there are going to be new rules, they’ll think they better find out what they’re about (and hopefully the book is easier for most people to understand). We do want people to be aware and we want a huge increase in the number of people incorporating these rules into their contracts because if they don’t, you’re whistling in the dark. Of course, you’re hoping that the seller and buyer agree on their own interpretations of the three letters.

It’s amazing really. There are still some people that think Free On Board means Freight On Board, for example. People still think of the rules as principally being a cost matter, “Oh, FOB means I don’t have to pay the freight” but they mean so much more.

How to Prepare for the Incoterms® 2020

DP: Trade Finance Global is actually a media partner of our local national committee and we will be promoting a lot of their conferences, especially with regards to the launch date and the actual release, but also signposting to where our listeners and our readers can buy the Incoterms 2020 book. How should businesses and practitioners, such as finances and service providers prepare, once they know what those changes are?

BR: They should be reviewing the contracts because I’d suggest to you that probably 90-95% of contracts written around the world do not correctly use the Incoterms rules. So anybody that, for example, is shipping in LCL or FCL containerised transport, and is still using FOB (Free on Board), CFR (Cost and Freight) or CIF (Cost, Insurance and Freight). We should always use the correct rule.

I even see people still calling it C & F should really be looking at it and saying “This is not appropriate”. These rules do not apply to containers, they don’t work. Therefore, we should be using the correct rule we should be using instead of FOB, FCA, instead of CFR, CPT, instead of CIF, CIP. And look at the rule and understand why because the point of delivery is before the goods going on the ship. A seller cannot in a containerized transport, organise that container to go on the ship. They don’t even know where the container is, it’s sitting in a terminal somewhere. Worse still with LCL, it’s gone to a consolidator. And they hope that that consolidation will consolidate it into a container that is going to that destination. I’ve got one at the moment just left a couple of days ago going to Qingdao in China, but it’s an LCL. So it’s going from Sydney to Pusan in Korea. Now, none of us knew what container it went into until after the event. And none of us knows what container it will go into in Pusan or what ship indeed it’s going to go on from Pusan to Qingdao. So, you know, it’s got to be one of the correct rules and multimodal rules, and not a rule requiring a container on board. And I see freight forwarders and banks misusing or misquoting the rules, misadvising, telling people please pick from Ex Works, FOB, CIF, DDP or other. None of those four is appropriate for containers or air in international trade. Yet here they are the bank still telling people that on L/C applications, freight forwarders still putting them on their instruction letters. We hope they will learn quickly.

DP: Yeah, we hope so too. I think reviewing the rules and reviewing those contracts is such an important piece of advice. Actually opening out that dialogue between all of the different members and all of the different parties and engaging with them at an earlier stage is more important. It helps ensure that the companies are in compliance with the latest version of the rules and are actually talking to each other. So, you’re a bit of a celebrity, Bob – tell us a little bit more about the LinkedIn groups that you manage.

BR: I have to tell you, I comment to my wife quite regularly that I can’t take it seriously about being a ‘celebrity’. I live in the tropics now in Cairns in North Queensland, which means I live in shorts most of the year-round. I just can’t take myself seriously as a celebrity! Sorry about that! However, I manage two groups on LinkedIn, the Incoterms group with about 19,000 members and the trade finance group with about 35,000 members. Questions in both groups are raised in both of them, although trade finance has a broader range, including letters of credit, collections, bank guarantees and documents. The incoterms group focuses just simply on these rules.

What we also get is people asking questions and asking for help. I was well known in the drafting group discussions – it was always commented on that ‘Bob says “read the book”’ – which is the case! It will answer a lot of questions. But nevertheless, people will throw questions in the group and they will get a bunch of knowledgeable people responding to their questions. Where else these days can many thousands of people in every corner of the world get this kind of real-world learning? It’s the most brilliant tool – and yes, I’m fairly prolific in it. Every now and then I can make a mistake, too. I’m not infallible, but I try to give some information because my attitude to it is: I’ve been in trade, in the back office side of things for more than 50 years, so I’ve got a certain amount of experience and knowledge. Now, I can either just quietly retire into the sunset up here in the tropics, or I can do what I feel is right, which is trying to help people following me by giving them information – either the information in my head or by steering people in the right direction.

Scammers in the International Trade

DP: Yes, I think that’s very important, especially because the way people engage in dialogue with one another is changing consistently, and actually being able to facilitate those conversations with different members of the community and also inform them about the latest rules, is so important for the international community. So, in your lifetime, I think you’ve seen some very interesting arbitration and trade dispute cases. I think you’ve overseen three or so multimillion-dollar disputes. Can you tell us a bit about what happened here and also, more importantly, what was the cause of these?

BR: Most of these have come about by banks referring cases to me because they don’t know where to go. Most of them, strangely enough, have involved scammers. And they’ve been quite amusing. So my role has been to provide expert evidence in them. One was not a scammer, it was just with a transferable L/C where things went wrong as the goods were not up to standard. So we had a buyer and a second buyer. The first beneficiary actually had no real assets, but their bank trusted them anyway. The applicant for the letter of credit sold the goods to somebody else and found that they were not up to standard and refused to pay for them. The applicant of the letter of credit tried to take his bank on to refuse payment, but it got thrown out because, of course, it was under a letter of credit. The contract is an entirely separate transaction to the letter of credit – under the doctrine of autonomy the letter of credit stands alone.

Another one was a scammer who got scammed by a scammer – that was such fun. In the end that didn’t go to court, they settled for a pittance. But the scammer who took it to court got scammed by somebody else, so he started to sue them. He wanted 2.5 million dollars. Now, it was very specific that he wanted 2.5 million dollars for no good reason apart from the fact that he’d lost another court case where he refused to pay the freight on a chartered vessel. That was for 2.5 million dollars. So he figured he was going to finance the loss he made in the court case! Well, bad news for him because it didn’t work that way.

So some of them have been fun. I do get referred scammers and people who are looking at things through rose-tinted glasses and want to go to their bank but don’t understand the banks won’t finance on a whim. The idea is to make sure that people don’t lose money. I’ve seen a few of those where I’ve tried extremely hard to make the person understand if it looks too good to be true, well, you know the answer…

The Biggest Incoterms-related Mistakes

DP: Yes, I think even today, the level of sophistication for these scammers – when it comes to anything from anti-money laundering to counter terrorist financing, etc. – is getting higher and higher. It’s actually a bit of an arms race between the banks, the technology and the scammers. I think it’s important to be prepared by understanding the rules and contracts, and knowing exactly where your obligations and risks lie. In light of the new Incoterms, it is so important for practitioners to read and understand the latest update of the rules and ensure all of their contracts are up to date and working properly. They may even find that their 2010 rules weren’t even up to date or working properly! However, it is often the case that you won’t know when your rules or your contracts are legitimate until something goes wrong – and by then it’s too late.

So, given your wealth of knowledge and experience, over the last 50 years or so, can you share some of the biggest Incoterms-related mistakes you have seen in the industry?

BR: Well, that would have to be simply using the wrong rules for the wrong circumstances, and then finding out that something has gone wrong. One of them, for example, was a specific purpose-built ship, which was to carry some machinery. The buyer had their engineer on board and they’d been advised by the seller about what modifications were needed for this massive machinery that was to sit on board the vessel. And it was wrong! So the seller had the goods sitting on the wharf at this massive factory and the vessel was modified.

There was an argument about who was going to wear the costs of modification, who was going to wear the costs of the goods sitting on the shore, who was going to wear the costs of the authorities who control that river saying you can’t have your vessel sticking out perpendicular to the wharf – all sorts of problems. And you know what? The contract was simply not written correctly, so there was an argument. Yes, I made some money as a consultant saying to the guys “Your contract was not written properly, so how do we interpret what’s happened in light of what you’ve written in the contract? Do Incoterms rules actually apply here, or do we have to look at the facts from a practical point of view?”

There is all manner of things that can go wrong, so the biggest tip I can give to anyone is to “read the book” and make sure you understand the rules. Most importantly, decide what you want to achieve in your contract, then find the rule that best covers it. The biggest mistake is to keep using the wrong three-letter abbreviations without proper reference to Incoterms, you might as well say ABC or XYZ because you won’t have a valid definition of what they mean. Also, don’t start with a rule – work out what it is that you and your trading partner are agreeing on doing and then find the suitable rule.

DP: Thank you, Bob. I think that is a very good piece of advice. So, read the book, understand the rules, and also find the rule that covers what you want with your trading partner, rather than retrospectively fitting it around the desired rule that you think you want. Very, very good advice from you.

Bob, I’m sure we’re going to be in touch in the next few months or so, especially once the Incoterms 2020 rules are launched. We will keep up to date and also for our listeners – as part of being Media Alliance partners of the ICC, and the Incoterms launch here in the UK. We will be signposting and writing a lot of updates on all of the latest rules and changes and keeping you guys up to date on what you need to know for yourselves and also with your trade partners. Bob, it’s been an absolute pleasure having you here today with us on the show Trade Finance Talks. Keep in touch and thank you very much for your time.

BR: It’s been my pleasure. Thank you.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.