To better understand the principles of financial inclusion, equitable regulation, and sustainable growth in the factoring industry, Trade Finance Global’s (TFG) Deepesh Patel spoke with new FCI Secretary General, Neal Harm.

When it comes to export finance, Africa, and each of the many unique markets within the continent, requires uniquely tailored solutions.

To learn more about the challenges that women face in the trade, treasury, and payments space across the African continent, and some of the programmes in place to help balance the scales, TFG spoke with Gwen Mwaba, Director and Global Head of Trade Finance at Afreximbank.

Understand the implications of the UK’s proposed Carbon Border Adjustment Mechanism (CBAM) for sectors like iron, steel, cement, and more.

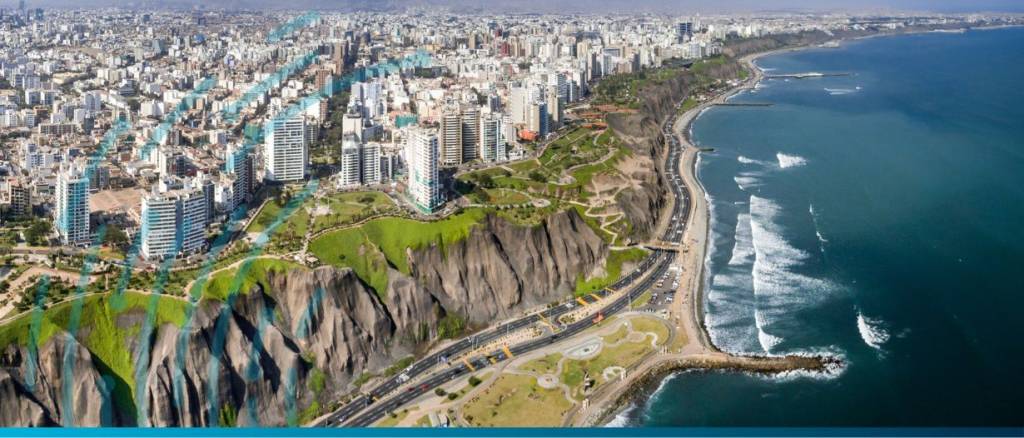

The International Finance Corporation (IFC), part of the World Bank Group, together with the Japan International Cooperation Agency (JICA), has completed the provision of a $400 million green finance package to BBVA in Peru.

Learn about the UK’s membership in the CPTPP. Find out how it will expand the global economy and benefit UK goods exports.

The European Union is on track to introduce tariffs on grain imports from Russia and Belarus as a measure to support its farmers and address the concerns of certain member states, according to officials with knowledge of the discussions who spoke on Tuesday.

BAFT’s inaugural 2024 International Trade and Payments Conference brought together experts to discuss the state of trade and payments.

Rules of Origin are the rules that determine where a good was obtained or manufactured (its economic nationality).

EBRD grants a $25 million trade finance facility to Privatbank to support Ukraine’s trade operations amid global banking challenges.