BII, the UK’s development finance institution and impact investor, has partnered with Citi to launch a $100 million risk-sharing facility.

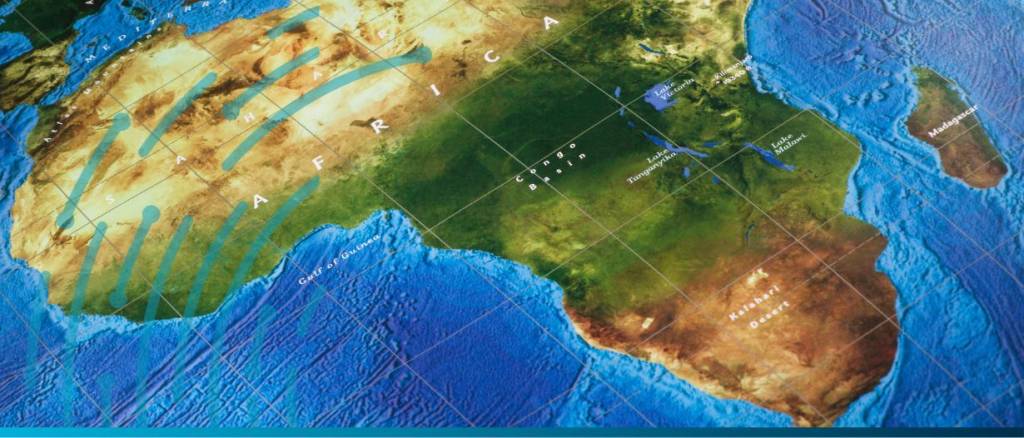

Get insights into BII’s $100M facility with TDB, advancing trade finance and tackling economic difficulties in Eastern and Southern Africa.

In collaboration with the Ukrainian government, Ukreximbank, Ukrgasbank, and DZ Bank, Marsh McLennan has announced Unity, a new insurance facility designed to offer cost-effective insurance for exporting grain and other… read more →

Does a New York court have jurisdiction over an Indian collecting bank that is alleged to have violated the Uniform Rules for Collections (URC 522) for neither collecting and remitting funds to pay for shipments represented by the documents forwarded to it nor returning originals of several of the documents sent to it for collection?

Wheat prices dipped slightly but remain on track for a weekly increase exceeding 9%, amid escalating tensions in the Black Sea contributing to potential disruptions in the grain trade from… read more →

Russia announced on Monday the suspension of a vital humanitarian corridor established to facilitate the export of crucial Ukrainian grains to global markets, just hours before the deal’s termination. The… read more →

US manufacturing experienced a further decline in June, reaching levels not seen since the initial wave of the COVID-19 pandemic. However, there is a positive aspect as price pressures at… read more →

The U.S. trade deficit in goods narrowed in May as imports declined, but the improvement was probably insufficient to prevent trade from being a drag on economic growth in the… read more →

The Food and Agriculture Organization (FAO) of the United Nations reported a significant decline in the world price index for food commodities in May. The index, which tracks the prices… read more →

In response to the challenges posed by the COVID-19 pandemic and the recent crisis in Ukraine, the World Trade Organization (WTO) has introduced the Global Trade Data Portal. This initiative… read more →