TFG spoke to Mitigram’s CEO Milena Torciano, who just raised a Series B round of financing, worth 100SEK ($10.7m USD) from Sampo, on their ambition to become the Bloomberg of trade and digitise trade flows.

East and Partner’s Martin Smith and Simon Klein discusses emerging Australasian trade finance trends and approaches to capitalize on them. Voice of the Customer Analytics In the face of global… read more →

Bank of America Merrill Lynch’s Baris Kalay explores what it takes to implement a successful supply chain finance program.

The use of distributed ledger technology in the trade finance space is moving fast.

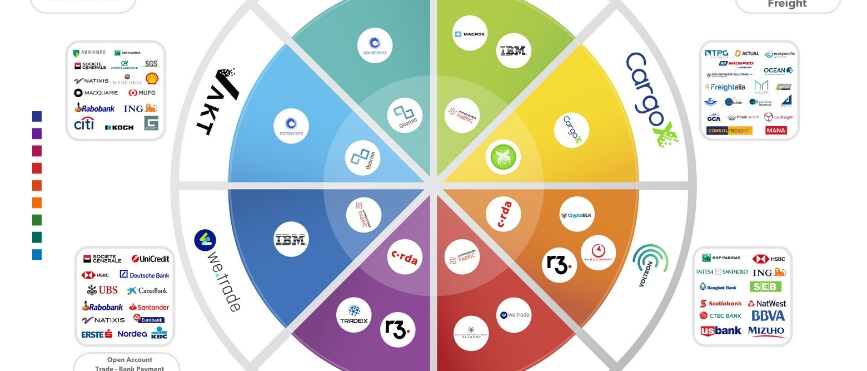

Today’s DLT-trade ecosystem can be sectioned into a series of eight major consortia and networks that are taking strides in various areas of the space.

The Gartner hype cycle serves as a tool to help decision makers and investors gauge the actual current state of a technology in a given domain, separating its real-world utility from its surrounding hype and disillusionment. The cycle was first introduced in 1995 and has since served as an accurate representation of the typical progression of an emerging technology.

Why distributed platforms and networks can achieve global scale and adoption previously impossible with legacy technologies, architecture, and business models.

Consortia have become a common method for businesses to collaborate on the use of blockchain and DLT technology – which developed out of the technology underpinning cryptocurrencies such as Bitcoin. TFG heard from Deepesh Patel, and BCR’s Michael Bickers to find out more.

The superimposition of DLT into the trade and shipping space naturally brings about a major step towards the digitization of trade. The process of trade digitization, however, is still traversing a legislative grey area. In many jurisdictions, including the USA, there are currently no regulations or laws that recognize electronic negotiable instruments in lieu of their written counterparts. Overcoming this immense operating hurdle will be a key initiative to reaching the full potential of DLT in the trade space.

Trade Finance Global today releases a map of networks and consortia in the trade finance and shipping space. Highlighting the key technology providers, DLT involved, banks and participants on each network, the map provides insight into the complex ecosystem of blockchain players in trade finance.

Trade finance has been a very slowly moving space when it comes to embracing digital innovations. However, the coin is now flipping: new data sharing technologies and ambitious plans from major trade originators provide much hope for a new trade finance landscape to emerge in the foreseeable future. Will the new trade consortia succeed to scale, and by when?