As global trade shuffles and reconfigures itself after the recent tariff announcements, some trade links will weaken due to the increased costs, while others will become even stronger. Trade between Europe and China, one of the most significant trade relationships in the world, is on the rise, and will become even more important as both move away from the US.

The Digital Container Shipping Association (DCSA) announced that its framework, which allows eBLs to be exchanged seamlessly across different digital platforms, has become a commercial reality. “What began as an… read more →

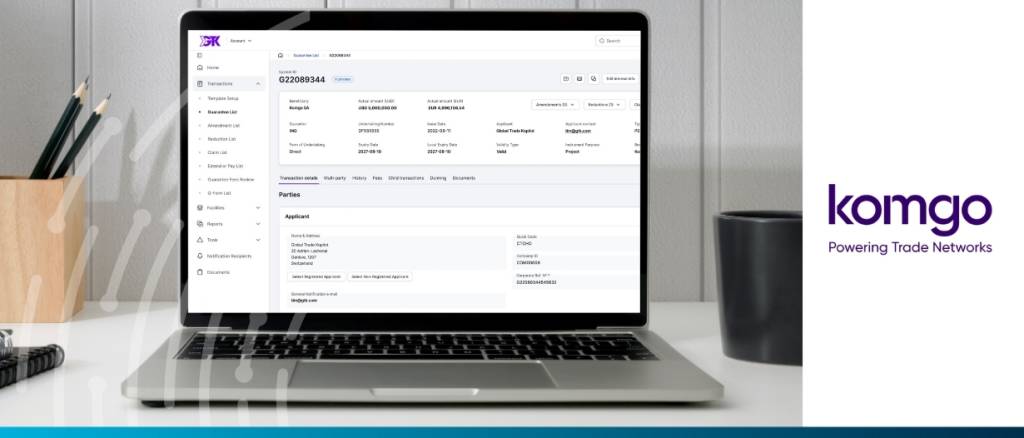

The web-based solution, called Global Trade Konnect (GTK), was conceived as a combination of Komgo’s most successful products over the past six years and will function as a full-stack solution… read more →

The biannual report described decreased expectations of global GDP growth and rising volatility; policy uncertainty, geopolitical risk, trade barriers, and fragmentation unsurprisingly emerged as the main threats to trade in… read more →

Just weeks after the two countries resumed talks, Nidhi Tripathi, economic minister in India’s High Commission in London, reported on Thursday 20 March that the UK and India are “very… read more →

As recent news makes strikingly clear, today’s world is becoming increasingly volatile and fraught with risk. Being part of the trade industry in this unstable geopolitical environment requires adaptability, resilience, and risk management, making insurance more necessary than ever.

Uzbekistan, one of Central Asia’s major economies, is placing itself and the centre of growing regional trade by reintroducing factoring services to its banks. On behalf of Trade Finance Global… read more →

AI holds the power to transform trade, offering opportunities to enhance efficiency, reduce costs, and empower smaller players in the global market. However, it also introduces complexities and ethical dilemmas. The question remains to be seen: will it bridge gaps, lower barriers, and drive innovation? Or will it create hurdles, deepen inequalities, and exacerbate existing challenges?

Africa has been in increasing its foothold in the global economy for a number of years. With the Global South enjoying new influence and wealth, the world’s economic centre of… read more →

This approach enables factoring companies to implement solutions faster and with fewer resources, allowing them to begin offering factoring services to their clients, such as SMEs and corporates, more efficiently.… read more →