To discuss these potential implications and explore how a second Trump presidency will reshape global trade, finance, and geopolitical dynamics, Trade Finance Global spoke with Rebecca Harding, Economist at Rebecanomics; Robert Besseling, CEO at Pangea Risk; Alyssa DiCaprio, former Chief Economist at R3; and Simon Everett, Trade Policy Expert on the day the results were announced.

The Digital Container Shipping Association (DCSA) announced that its framework, which allows eBLs to be exchanged seamlessly across different digital platforms, has become a commercial reality. “What began as an… read more →

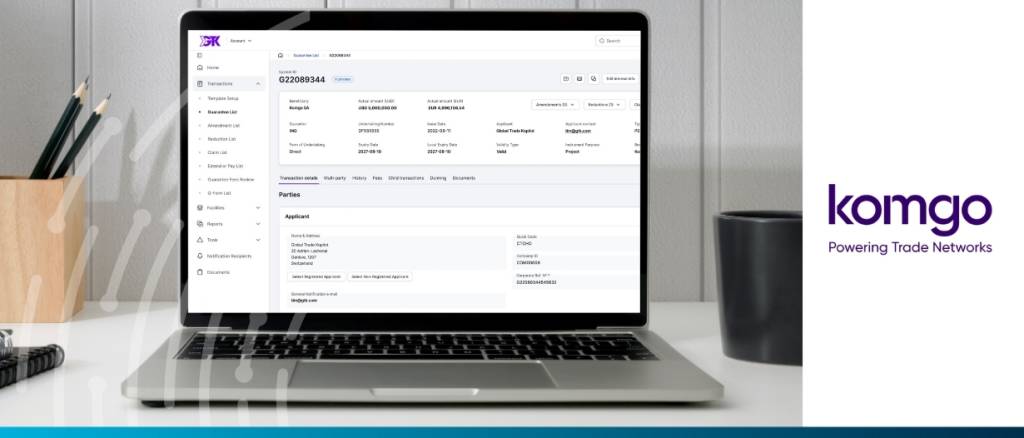

The web-based solution, called Global Trade Konnect (GTK), was conceived as a combination of Komgo’s most successful products over the past six years and will function as a full-stack solution… read more →

The biannual report described decreased expectations of global GDP growth and rising volatility; policy uncertainty, geopolitical risk, trade barriers, and fragmentation unsurprisingly emerged as the main threats to trade in… read more →

Just weeks after the two countries resumed talks, Nidhi Tripathi, economic minister in India’s High Commission in London, reported on Thursday 20 March that the UK and India are “very… read more →

To discuss these potential implications and explore how a second Trump presidency will reshape global trade, finance, and geopolitical dynamics, Trade Finance Global spoke with Rebecca Harding, Economist at Rebecanomics; Robert Besseling, CEO at Pangea Risk; Alyssa DiCaprio, former Chief Economist at R3; and Simon Everett, Trade Policy Expert on the day the results were announced.

Uzbekistan, one of Central Asia’s major economies, is placing itself and the centre of growing regional trade by reintroducing factoring services to its banks. On behalf of Trade Finance Global… read more →

To discuss these potential implications and explore how a second Trump presidency will reshape global trade, finance, and geopolitical dynamics, Trade Finance Global spoke with Rebecca Harding, Economist at Rebecanomics; Robert Besseling, CEO at Pangea Risk; Alyssa DiCaprio, former Chief Economist at R3; and Simon Everett, Trade Policy Expert on the day the results were announced.

Africa has been in increasing its foothold in the global economy for a number of years. With the Global South enjoying new influence and wealth, the world’s economic centre of… read more →

This approach enables factoring companies to implement solutions faster and with fewer resources, allowing them to begin offering factoring services to their clients, such as SMEs and corporates, more efficiently.… read more →