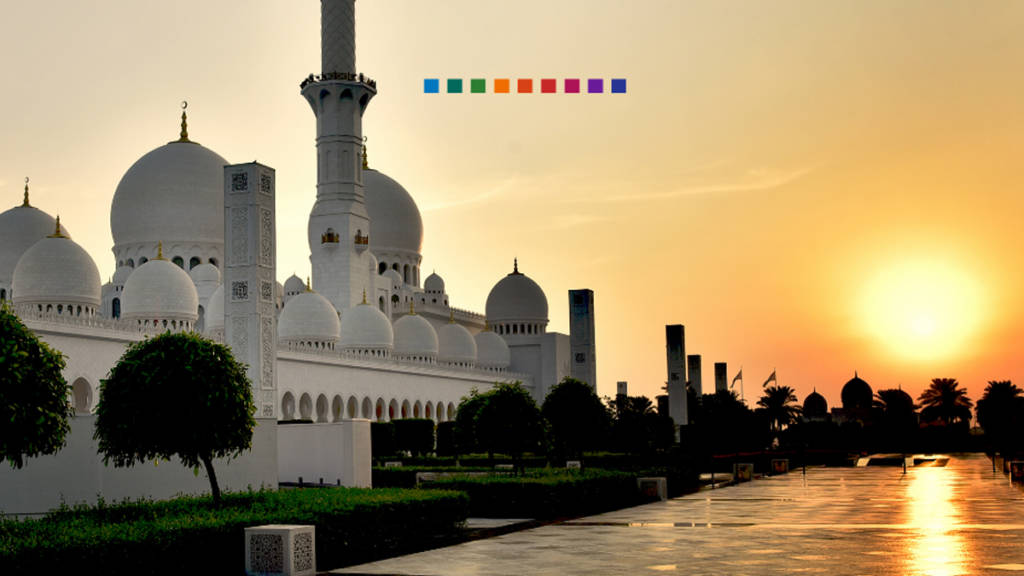

The global push toward sustainability has highlighted the urgent need for innovative financing mechanisms to support green infrastructure. Among these mechanisms, Islamic finance stands out for combining ethical principles with an emphasis on equitable wealth distribution, particularly in emerging and underserved markets.

At the IIBLP’s Dubai Trade Law & Compliance Conference held in Dubai on 15 March 2022, one of the panellists referred to the Solo Industries fraud in a panel discussion addressing the recent Singapore case, Credit Agricole Corporate & Investment Bank (CACIB), Singapore branch v. PPT Energy Trading Co.

As the COVID-19 pandemic unfolded in the first quarter of 2020, governments around the world were forced to take drastic actions to counter the socio-economic challenges posed by the crisis.

Now is the time for trade finance institutions to take the lead in efforts to strengthen SME resilience and leave them in a position to be able to bounce back in the aftermath of the pandemic.

Interim funds to be scaled up through close collaboration with strategic partners to offer trade finance and trade development solutions that meet the direct needs of member countries (Jeddah, KSA, April 06 2020)–… read more →

ITFC signs a Memorandum of understanding with the Africa Union to support African OIC countries to fast track the benefits of the AfCFTA and increase their share of Intra-African trade. The… read more →

Islamic finance is a specialist area that presents exciting growth opportunities for the UK. Sharia (Islamic law) compliant banking assets make up 6% of the world’s banking assets, but globally, approximately one in four people are Muslim. The scope for growth is obvious.

Fintech, Wethaq, has signed a strategic partnership with enterprise blockchain software firm R3 to build the next generation of financial market infrastructure to enable issuers, investors, central banks and regulators… read more →

TFG heard from Eng. Hani Salem Sonbol, CEO, International Islamic Trade Finance Corporation

As TFG prepare for IFN Asia, in Kuala Lumpar, TFG heard from Islamic Finance News Managing Editor, Vineeta Tan, who gave a brief overview of the Islamic Finance and Shariah market