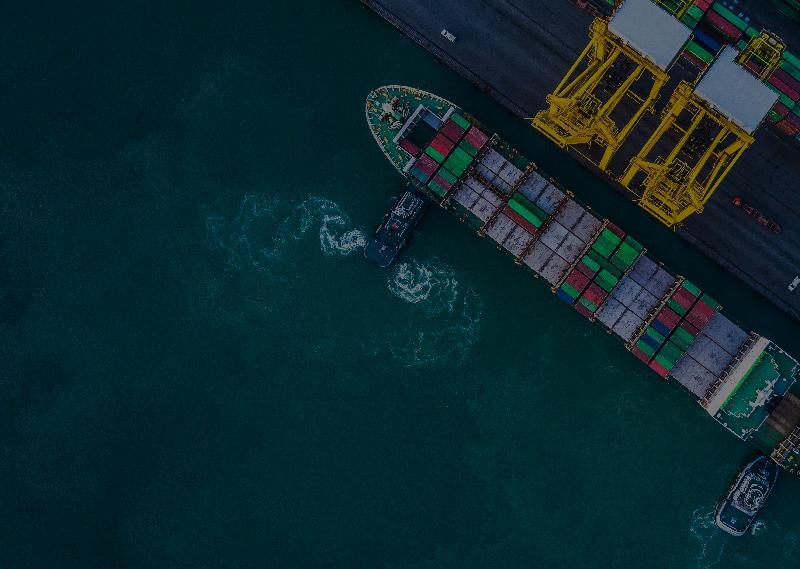

Fourteen leading global financial institutions have launched the Trade Finance Distribution (TFD) initiative to use technology and standardisation for the wider distribution of trade finance assets.

In 2018 the world factoring industry volume continued its upward trend with a total reported figure of over 2,767 billion euro representing over 6% growth compared to the previous year.

TFG exclusive podcast with komgo, we heard from CEO Souleïma Baddi talking about bringing blockchain and distributed ledger technology to commodity finance.

We heard from Nitin Gaur, Director of IBM Digital Asset Labs at the ICC Banking Commission’s Annual Meeting, on the benefits of blockchain / DLT for enabling trust, transparency and security

Trade Finance Global heard from Sean Edwards, Chairman of the ITFA at the NEARC (North East Asia Regional Committee) Seminar held in Beijing earlier this month.

Anti-money laundering is the process of financial institutions and other business entities using in-house (sometimes assisted by external parties – more on this to come) methods to address the risks posed by Trade-Based Money Laundering.

Introduction to Letters of Credit Did you know, SMEs account for 99% of UK business, and 46% of them experience some form of cash flow problems? Most trade in the world… read more →

Letter of Credit FAQs Documents accepted as present An issuing bank could use the term ‘documents accepted Does this mean: The only requirement under such an expression (which is undefined… read more →

Technology and regulations are opening up new opportunities in partnerships, particularly in the new environment of disrupters, intermediaries and paperless trade. This article reviews some of the opportunities, challenges and… read more →

In recent years, the trade finance landscape has seen immense change, driven by a multitude of factors, including policy, consumers, technology and protectionism. A few years ago we were debating… read more →