Try to conceptualise the financial landscape of 1921. In the direct aftermath of the First World War, many European economies were burdened by war debts and reparations, particularly Germany under… read more →

International trade is vital to the growth of income and the country’s economy. It is, however, not possible to carry out any trade devoid of any risks.

Cross-border trade is an inherently risky activity with numerous types of risk that can appear at all stages of trade. But today, we will discuss two types of risk: commercial risk and, transfer risk, a type of political risk.

As our world becomes increasingly digital, the digital divide has widespread implications, and the least developed countries (LDCs) are most likely to be negatively affected.

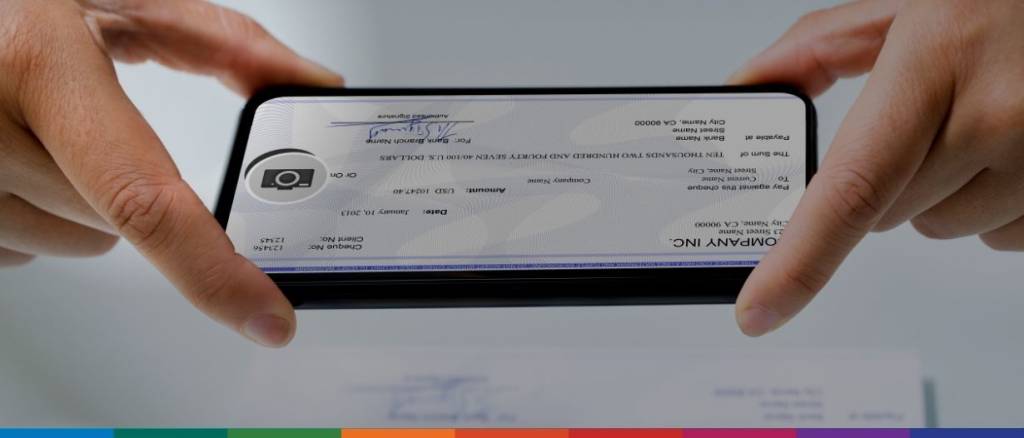

Transitioning from documents to pixels, from cash to virtual payment gateways, and from local markets to international ones, the sweeping transformation of global trade into the digital world is redesigning the trade finance ecosystem. The alliance between ClearEye and J.P. Morgan represents the metamorphosis of the future of trade finance digitisation.

International Lawyers and Economists for Development (ILaED) is a non-government organisation focusing on the economic development of women and girls. By encouraging entrepreneurial skills, it helps them engage in both local and international markets.

Lloyds Bank has initiated a strategic trade collaboration with UBS to bolster its global presence, aiding its UK-centric clientele to conduct business across 170 nations globally. Through this pact, the… read more →

In the shadows of the interconnected world of international trade lies a pervasive threat that silently endangers the security of global markets. Financial crimes, with their detrimental effects on stability and integrity, cast a dark cloud over the world economy, threatening the trust upon which international trade relies. From money laundering to terrorist financing, illicit activities can have far-reaching consequences.

One of the difficulties related to international trade is the large volume of paper documents that make up much of the information flow between the different parties, including various documents such as invoices, bills of lading, certificates of origin, and customs declarations.

The United States Dollar has been the de facto global currency for the better part of the past century. While rhetoric questioning its longevity in this role has been around for decades, the past year has seen more leaders of rapidly emerging economies beginning to question why it still needs to be this way.