The ICC Principles for Sustainable Trade Finance (PSTF), developed in collaboration with Boston Consulting Group and leading financial institutions, addresses a crucial gap in the market: the challenge of applying… read more →

7 August, New York, USA – Standard Chartered announces the successful closing of a six-year USD235 million non-recourse senior secured term green loan facility to fund the development, construction, and operation of a 1.35 million square foot solar photovoltaic manufacturing plant in Wilmer, Texas, USA, for Trinasolar, a leading global renewable company.

Absa Group collaborates with MIGA to unlock financial capacity for Pan-African climate finance projects. Learn how this partnership is driving sustainable investments.

Sustainability and green financing are some of the most important topics within the international trade industry, yet actually implementing policies and strategies is extremely difficult.

The Government of Canada, in collaboration with the Asian Development Bank (ADB), has unveiled a new C$360 million trust fund.

EBRD President Odile Renaud-Basso said that the EBRD remains a pillar of stability in its regions amidst an increasingly fragmented & volatile world

The EBRD serves a vital role in bolstering economic stability and growth within its regions, and the TFP is an integral part of achieving these goals.

CarbonChain has introduced a new solution for emissions reporting, aimed at both mandatory and voluntary disclosures, enhancing its specialised carbon accounting software for the supply chains of commodities.

Explore the unique challenges and opportunities of integrating ESG principles in Africa. Learn how holistic approaches can drive sustainability and resilience.

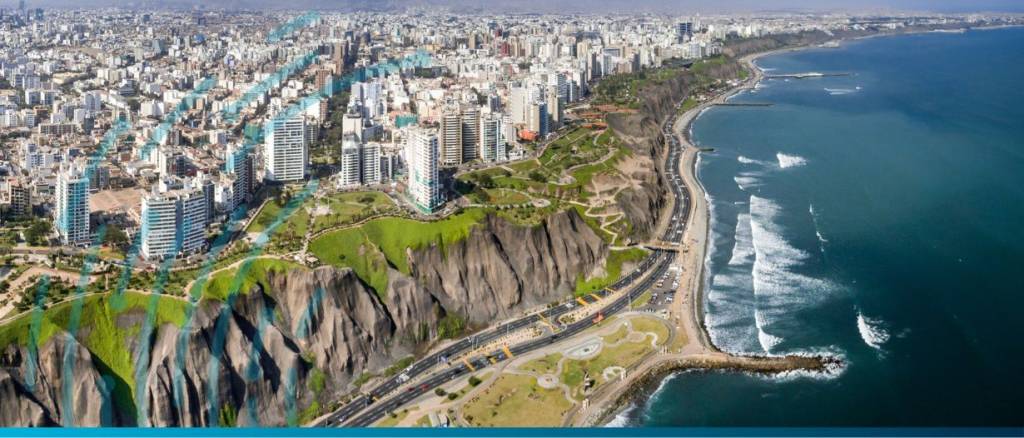

The International Finance Corporation (IFC), part of the World Bank Group, together with the Japan International Cooperation Agency (JICA), has completed the provision of a $400 million green finance package to BBVA in Peru.