IFC’s whitepaper, “Banking on Women Who Trade Across Borders”, highlights the need for gender equality in international trade & trade finance.

The expanded connectivity for TReDS providers means the global standard for privacy-preserving fraud prevention technology is now in India.

Foreign direct investment (FDI) into Europe saw a decline in 2023, decreasing by 4% from the previous year and now stands 11% lower than the pre-pandemic levels of 2019, as per the findings of the annual EY European Attractiveness Survey 2024, which is regarded as the most thorough annual examination of FDI into the continent.

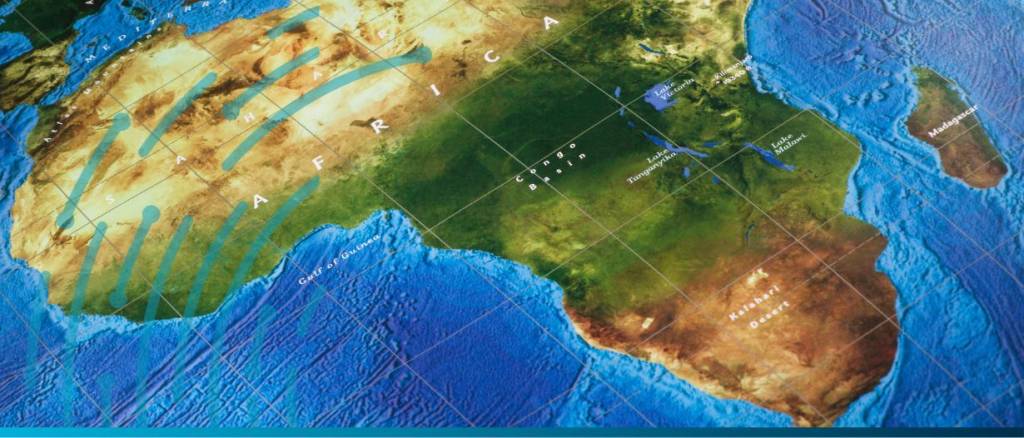

A comprehensive Digital Trade Gap Assessment released by the World Bank provides an analysis of the Information and Communications Technology (ICT) framework across the Horn of Africa Initiative (HoAI) countries.

On April 30, the second phase of Britain’s new post-Brexit border controls for food imports from the European Union will begin.

British enterprises are poised to gain from billions of pounds in new export opportunities, boosting the UK economy, as detailed in the latest strategy from UK Export Finance (UKEF) released today.

BII, the UK’s development finance institution and impact investor, has partnered with Citi to launch a $100 million risk-sharing facility.

The new legislation, which amends the existing General Law on Negotiable Instruments and Credit Transactions and the General Law of Credit Organizations and Auxiliary Credit Activities, entered into force on 27 March 2024.

Atradius a UK trade credit insurer, has reported an 18% reduction in claims from UK businesses compared to the same period in 2023.

In the first quarter of this year, Korea’s exports to the United States exceeded those to China for the first time since the second quarter of 2003.