In an early scene in the Hollywood blockbuster, “The Wolf of Wall Street”, Matthew McConaughey, acting as a senior broker, describes predicting the value of a stock as a ‘Fugazi’… essentially nonsense. Whilst this interpretation is a bit far-fetched, the level of uncertainty within the Euro-zone this year means that predicting the medium term path of the Euro with any certainty is an almost impossible task. This post will take a look at the key factors which will play a hand in determining the outcome for the continents flagship currency, and through this means, take the stance that the best strategy for businesses is to limit exposure to Euro currency risk.

A potential banking crisis

In terms of potential severity, the greatest risk to the value of the Euro is the threat of a banking crisis in Europe. The total stock of non-performing loans (NPLs) in Europe currently stands at around €1 trillion, and with the strong links between sovereign debtors and national banking systems, a collapse could cause a sovereign debt crisis in affected countries.

The greatest risk in this regard comes from Italy and Greece, where 16.6% and 46.6% of all debt is categorised as non-performing. The Banca Monte dei Paschi (MPS) in Italy was recently calculated as having a mammoth $29.6billion in NPLs on their balance sheet, and whilst the Italian government put together a €20 billion rescue package in the final month of 2016, Goldman Sachs have estimated that it will take €38 billion for the bank to adequately recapitalise. If MPS were to collapse, the life-savings of 40,000 Italians would be lost, with huge ramifications for the value of Italian assets, including the Euro. The threat from financial institutions to the Euro is not limited here – Greece looks likely to struggle to meet €7.4billion in Debt payments due in July, whilst a number of big banks across Europe, such as Deutsche Bank and Credit Suisse, have fallen on hard times in recent months. Whilst clearly a banking crisis would be a disaster for the Euro, the mere existence of downside risk in the financial system may be enough to put downward pressure on the currency, by deterring risk-averse investors from taking up debt or equity positions on the continent.

Political risks

Whilst there remains a substantial amount of political risk currently priced into the value of the Euro, the early signs are that the threat of populism on the continent may be overstated. Expectations of a strong performance in Holland from Geert Wilders’ far right Party for Freedom (PVV) proved to be baseless, whilst Angela Merkel is expected to comfortably win Germany’s general election later this year – a result that would represent stability for the Euro. An antagonistic Brexit deal would act to put downward pressure on the Euro, although the reality is that such an arrangement is in neither the EUs’ nor Britain’s interest, and is unlikely to materialise.

The greatest political risk comes from the French elections, starting with first round results on the 23rd April. Marine Le Pen – a far right candidate with ambitions to take France out of the Eurozone within 6 months of being elected – is widely expected to reach the final round of voting. A victory for Le Pen would be catastrophic for the future of the EU, and would be likely to result in capital flight from Europe in anticipation of a collapse of the common market. However, realistically the prospects of such an outcome are slim, with a victory for pre-election favourite Emmanuel Macron the most probable outcome. Such a result would be a boost for the Euro, although as anyone who followed political events in 2016 will know, this should not be taken to be a certainty.

The ECB

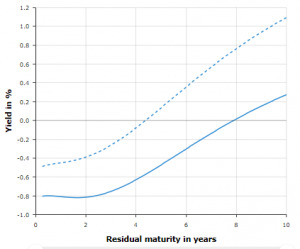

Euro Area Yield Curve

The continued pursuit of low interest rates as part of an aggressive monetary strategy by the ECB should continue to have a depressing influence on the Euro. The base rate currently sits at 0%, and president of the ECB Mario Draghi recently indicated that this pursuit of growth-conducive monetary policy will continue until at least the end of this year. The base rate affects the Euro through its role in guiding the price of sovereign debt and a range of financial derivatives in Europe, which subsequently are less attractive to investors. The yield curve for the EU area AAA rated bonds is given by the solid line in the diagram on the left, and whilst showing future inflationary expectations in the medium term, is relatively flat over the next 2 years – reflecting the uncertainty and low base rate in the region.

The ECB also plans to continue its 2 year quantitative easing programme until the end of this year, which will see it purchase 60 billion euros worth of assets each month. The intention of this is to increase confidence, investment and subsequently moderate inflation in the region, which would have a positive effect on the value of the Euro. However, as the length of the intended QE programme indicates, the benefits of this are unlikely to be felt before next year at the earliest.

One money one dollar

The strength of the US economy, and anticipated further rate hikes by the FED are likely to see the Euro devalue relative to the dollar. One of the biggest fears is the abandonment of the Transatlantic Trade and Investments Partnership (TTIP) – the trade deal between Europe and the USA – as a result of the protectionist stance advocated by president Trump. Such an action would harm demand for European exports, putting downward pressure on the Euro. Trump also has outlined plans to introduce a homeland investment act, with the intention of increasing domestic investment in US companies (and subsequently less abroad). If such a bill were to make it through the senate, clearly this would be bad news for Europe.

The FED has recently increased the base rate to 1%, raising the attractiveness of US bonds, whilst anticipated expansionary fiscal policy under Trump is likely to be positive news for US equity markets. Both these factors make a devaluation of the Euro relative to the Dollar likely, particularly if new investors in US equities raise capital by selling positions they hold in the EU. Whilst fiscal expansion in the US may see an increase in demand for European exports in the absence of any trade interference, the most likely outcome is an appreciation of the dollar relative to the euro over the next year or so.

A tidy hedge

With so much uncertainty in the EU at the moment, the most sensible strategy is for businesses to hedge exposure to foreign exchange risk in Europe. Having said that, the region still offers a number of positive investment opportunities, and in the form of the EFSF and ESM, has two multi-billion dollar rescue mechanisms in the event of a crisis. Trade finance global offer a number of solutions to companies trading internationally to or from the European Union, and who wish to protect themselves against potential downside risk in currency markets.

Do you trade overseas in different currencies?

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.