Estimated reading time: 13 minutes

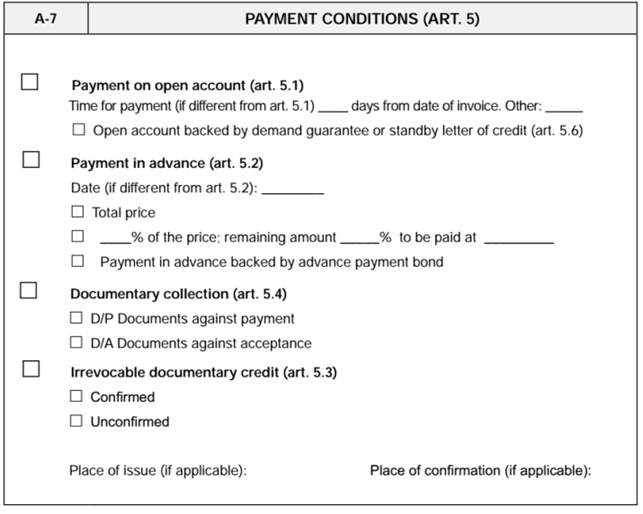

As laid out by the International hamber of Commerce (ICC) of Paris, the “ICC Model International Sale Contract” reports the following payment conditions:

- Payment on open account

- Open account backed by demand guarantee or standby letter of credit

- Payment in advance

- Payment in advance backed by an advance payment guarantee

- Documentary collection (D/P – D/A)

- Irrevocable documentary credit

- Irrevocable bank payment obligation

- Other: (e.g. cheque, bank draft, electronic funds transfer to designated bank account of seller)

This indicates that there are numerous forms of payment that traders can activate in an international sale operation which stems from the fact that the international payments market has been structured to offer tools and solutions to meet the innumerable needs of buyers and sellers.

All these forms of payment perform up to three common functions:

- settlement: a payment instrument

- risk mitigation: a payment instrument that mitigates credit risk for the seller

- financing: a payment instrument that allows a buyer to make a deferred payment but at the same time the seller receives a sight payment.

The functions that each instrument performs are depicted in the table below:

The remainder of this article is going to focus on documentary collections (documentary collection D/P – D/A), which, as the table above indicates, performs only the settlement function while leaving any counterparty insolvency risk with the seller..

In compliance with some conditions that we will see below, the instrument can potentially become risk mitigation or financing instruments.

Documentary collection – All you need to know

According to Art. 2 of the Uniform Rules for Collections (URC) 522 ICC, “collection” means the handling by banks of documents as defined in sub-article 2(b), in accordance with instructions received, in order to:

1) obtain payment and/or acceptance, or

2) deliver documents against payment and/or against acceptance, or

3) deliver documents on other terms and conditions.

Sub-article 2(b) differentiates between financial and commercial documents.

– “Financial document” means bills of exchange, promissory notes, cheques, or other similar instruments used for obtaining the payment of money;

– “Commercial document” means invoices, transport documents, documents of title or other similar documents, or any other documents whatsoever, not being financial documents.

Therefore, documentary collection can be defined as the “treatment” by banks of commercial and/or financial documents to

– obtain payment or acceptance of drafts (bill of exchanges),

– deliver documents against payment (D/P: documents against payment for payment at sight) or the acceptance of drafts (bill of exchanges) (D/A: documents against acceptance for payment at sight with a “demand draft” or expiring with a “usance draft”), or

– deliver documents under other terms and conditions.

The URC 522 ICC regulation also defines the meaning of “clean” and “documentary collection”:

“Clean collection” means a collection of financial documents not accompanied by commercial documents.

“Documentary collection” means a collection of:

– financial documents accompanied by commercial documents, or

– commercial documents not accompanied by financial documents.

The so-called “clean collections” therefore imply the sending of financial documents (like bills of exchange or promissory notes) through the banking system in order to obtain payment from the importer, while commercial documents (such as invoices, packing lists, transport documents, documents of origin, etc.) are sent directly to the importer.

This solution implies a high level of trust between commercial counterparties, as the exporter loses physical control of the goods.

There are five parties potentially involved in the documentary collection operation:

– The “principal” (originator/exporter/drawer) is the person who entrusts the execution of a collection to a bank;

– The “remitting bank” is the bank to which the “principal” entrusts the execution of the collection;

– The “collecting bank” is any bank, other than the “remitting bank”, involved in the process of managing a collection;

– The “presenting bank” is the “collecting bank”, which presents the documents to the “drawee”;

– The “drawee” is the person to whom the presentation of the documents is made, in accordance with the “collection instructions”.

In many instances, the “presenting bank” and “collecting bank” will be the same.

The following are the operational steps of the documentary collection process:

1. Definition of the contractual agreement between the parties who identify, as a form of regulation of the supply price, documentary collection (D/P, more commonly known as CAD – Cash Against Documents or D/A)

2. The “principal” (the exporter/drawer) prepares and ships the goods;

3. The “principal” sends the commercial and/or financial documents to its “remitting bank”, accompanied by the collection instructions

4. The “remitting bank” sends the documents to the “collecting/presenting bank” (or to a collecting bank which, in turn, sends them to a “collecting/presenting bank”), specularly entrusting this bank in line with the instructions received;

5. The “collecting/presenting bank” presents the documents to the importer/drawee, delivering them against payment or acceptance;

6. The importer/drawee collects the documents (or accepts the draft), with which it obtains the goods, and pays for the supply (at sight or at maturity);

7. The “collecting / presenting bank” sends the funds to the “remitting bank” which, in turn, credits them to the “principal”.

Keep in mind that the “presenting/collecting bank” could discount the draft accepted by the drawee on a without-recourse or with-recourse basis and/or aval it in compliance with what is reported in the “collection instruction” and to the extent that this bank is available to perform the required services.

ARTICLE: Negotiable Instruments are going through a makeover – the who, what, where, why

Direct collection

As part of the “collections”, it is also possible to structure the so-called “direct collection”, in order to minimise the time for the transit of documents.

The “principal” could use the “collection form” of its “remitting bank” as a basis to define the “collection instruction” to send the documents directly to the “collecting / presenting bank”, sending – at the same time – a copy of the “collection form” also to its bank (remitting).

In this case, the “collection form” must indicate that the collection is governed by the URC Rules 522 ICC and that the collection operation must be handled by the “collecting bank” as though it was received from the remitting bank.

The collection instruction

An adequate and correct “collection instruction” to the “remitting bank” should contain the following indications:

- Details of the principal including full name, postal address, and if applicable, email, telephone, and facsimile numbers;

- Details of the drawee including full name, postal address, or the domicile at which presentation is to be made and if applicable, email, telephone, and facsimile numbers;

- Details of the presenting bank, if any, including full name, postal address, and if applicable email, telephone, and facsimile numbers;

- Amount(s) and currency(ies) to be collected;

- List of documents enclosed and the numerical count of each document;

- Terms of delivery of documents against (or Terms and conditions upon which payment and/or acceptance is to be obtained):

- payment and/or acceptance

- other terms and conditions

- Charges to be collected, indicating whether they may be waived or not;

- Interest to be collected, if applicable, indicating whether it may be waived or not, including:

- rate of interest

- interest period

- basis of calculation (for example 360 or 365 days in a year) as applicable;

- Method of payment;

- Form of payment advice;

- Instructions in case of non-payment, non-acceptance and/or non-compliance with other instructions, indicating “in the case of need” contact and if he has the full powers for disposal of documents or advisory capacity only;

- Applicable rules: URC 522 ICC (eURC in case digital documents are used)

Documents against acceptance: the financing facilities

As part of the D/A option (documents against acceptance – of a bill of exchange), it is possible to structure the so-called “financing facilities”, using the features of the bill of exchange, which can also be on sight (the Bill of Exchange Act of 1882 provides the so-called “demand draft”).

The “financing facilities” that can be activated are shown below:

Foreign bills for negotiation (FBNs):

The seller/exporter may be interested in receiving the sale funds immediately by asking the “remitting bank” to purchase, with or without recourse, the bill of exchange or documents (to negotiate) not yet accepted by the drawee/importer.

This solution can be implemented if the exporter has an active credit line with the remitting bank.

In this situation, the beneficiary of the bill of exchange will be the remitting bank and the documentary collection performs the function of financing and/or mitigating risks depending on the type of discount implemented by the remitting bank (if the discount is with recourse, there is no credit risk coverage).

Avalisation

To guarantee payment, the exporter may request, in the collection instruction, the collecting bank to add its guarantee (or aval) to the bill of exchange accepted by the buyer.

With this solution, documentary collection performs, in addition to the settlement function, also the function of risk mitigation.

Discounting

In a first option, the exporter may request, in the collection instruction, that the bill of exchange, after acceptance by the drawee/importer, be discounted by the presenting bank.

The presenting bank can still decide, independently, whether to make the discount or not and on what basis.

Alternatively, the exporter may request that the accepted, perhaps endorsed, route be returned to the remitting bank to which the exporter can ask to make the discount with or without recourse.

The exporter could, alternatively, also consider discounting the bill of exchange on the free market.

It should be noted that, in the documentary collection, the described risk mitigation and financing functions are only potential, in the sense that the seller/exporter needs the availability of its bank (remitting) to discount the bill of exchange (or to “buy” documents), and/or the willingness of its customer to accept the bill of exchange and the collecting/presenting bank to aval the draft.

It may happen that a collection is dishonoured with non-payment or non-acceptance of the draft by the importer/drawee.

In such cases, the presenting bank should review the collection instruction received in order to identify which actions to take.

In these cases, the presenting bank must notify the remitting bank via SWIFT of the non-payment or non-acceptance of the bill and may review the instructions from the principal`s nominated representative.

In fact, exporters/principals often indicate, in their “collection instructions” to their “remitting bank”, the references of their representative to contact in the case of need.

In such cases, it is appropriate, if not necessary, to indicate whether this representative has the full powers for disposal of documents or advisory capacity only.

In cases of non-payment or non-acceptance, the documents will not be delivered to the importer/drawee, and the transport operators, depending on the type of transport and the relative document used, may not deliver the goods to the importer, with consequent problems relating to “storage” and insurance.

It should be noted that even in the presence of specific instructions contained in the collection instructions, banks are under no obligation to undertake actions of any kind on the goods.

In the event that the banks take action to store and/or insure the goods, “they do so without any obligation or liability on their part”.

It should also be noted that even if a transport document indicates the bank as the consignee, banks are under no obligation to take physical possession of the goods.

The goods remain at risk and the responsibility “of the party dispatching the goods” (the shipper).

Finally, it should be noted that it would be advisable to avoid indicating banks as consignees in the transport documents unless there is a prior agreement to this effect with the bank.

Documentary collections and Incoterms®

An important aspect of the correct management of the instrument is related to the control of the transport of goods and the related document by the seller/exporter.

It is necessary to use an appropriate delivery term, avoiding the use of the Incoterm® Ex Works (EXW), or the “F Incoterms®” – Free Carrier (FCA), Free Along Side (FAS), and Free on Board (FOB).

Controlling the transport and the related document requires the use of the “C Incoterms®” – Carriage Paid To (CPT), Carriage and Insurance Paid to (CIP), Cost and Freight (CFR), and Cost Insurance and Freight (CIF) – or the “D Incoterms®” – Delivery at Place (DAP), Delivered at Place Unloaded (DPU), and Delivery Duty Paid (DDP).

Generally, the C terms are preferred over the D terms since under these, the seller is obliged to deliver to the customer/importer a proof of delivery which, under the D terms can only be a freight-paid transport document, signed by the consignee upon arrival which does not reconcile with documentary collections.

It is also specified that in terms C the seller delivers on departure (“over the carrier” in the terms CPT and CIP and “on board of the vessel” in the terms CFR and CIF), leaving to the buyer counterpart the risk of transporting the goods.

VIDEO: Incoterms and letters of credit

Airway bill

Some operators use documentary collections with air transport, indicating the bank of the buyer-importer as “consignee” in the airway bill.

This solution, from a technical point of view, appears to be a good solution taking into account that banks have no obligation to take possession of the goods that remain “at the risk and responsibility of the party dispatching the goods”.

Please note that it would be advisable to obtain the agreement of the “presenting bank” before indicating this bank as “consignee” in the air transport document.

Conclusions

Since documentary collection is not, in fact, a risk mitigation tool (except for the above), it is appropriate to use this form of payment with caution.

In particular and in the opinion of the writer, it is appropriate to use documentary collections in compliance with the following guidelines:

- Few doubts about the customer’s solvency;

- Relatively safe import country with no currency restrictions;

- Transport control;

- Transport by sea (or by air with the presenting bank as consignee);

- Multimodal transport with transport document, taking into account that “a combined transport document may act as a document of title to the goods and may be issued in the negotiable form”;

- Fungibility of the goods;

- Short transit time;

Furthermore, it seems appropriate to advise operators to follow a scientific approach in the management of this payment instrument.

As part of my now consolidated professional experience, I note, in fact, a rather empirical approach, with insufficient instructions from the seller to his bank and, at times, atypical, not to say imaginative, conditions for delivering documents to the destination.

ARTICLE: International Payments: Settlement, Risk Mitigation, or Financing?

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.