Unusual times call for unusual measures. Member States of the Tripartite Free Trade Area have also been compelled to put in place various measures to try and curb the spreading of COVID-19. However, some of these measures have become a drawback to intra-Tripartite trade. There is therefore need for Member States to enhance their cooperation and have a coordinated response against the virus which in turn will promote trade liberalisation and integration.

What is the Tripartite Free Trade Area?

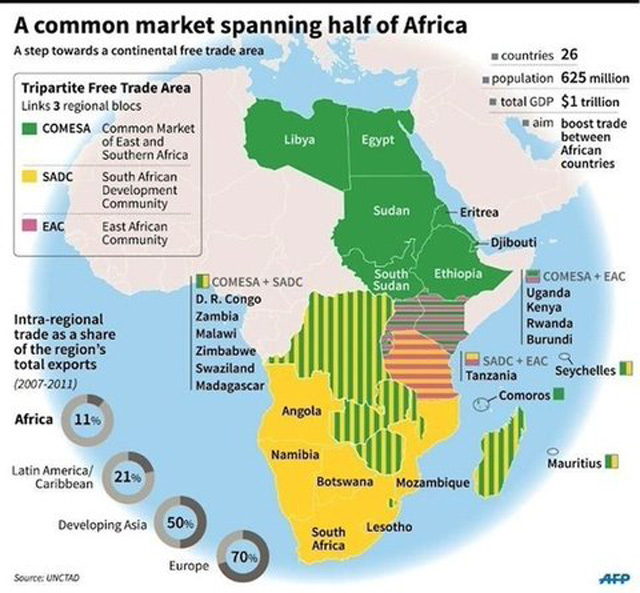

On 10 June 2015, Heads of State and Government for SADC, EAC and COMESA held a meeting in Egypt for the setting up of a Tripartite Free Trade Area (TFTA). The TFTA was envisioned to “increase intra-Africa trade, stimulate economic growth and lift people out of poverty” EAC (2014). Moreover, it was a means to address the issue of overlapping membership within the three Regional Economic Communities. For the Agreement Establishing a Tripartite Free Trade Area among the COMESA-EAC-SADC to enter into force, 14 Member States have to deposit instruments of ratification. Currently, only 8 Countries have ratified the Agreement and 6 are in advanced stages of ratification. The ratification of the Agreement is timeous mainly because the TFTA is supposed to be a construction block for the highly anticipated AfCFTA.

Trade within the Tripartite Region

With an estimated aggregate GDP of USD 1 Trillion and a population of 625 million, the TFTA is quite a big trading block. Regardless, levels of intra-Tripartite trade remain significantly low. According to a report by Trade Finance Global, though intra-African trade has significantly increased from 5% in 1980 to 16% in 2018, it remains relatively low to intra-regional trade in other regions including Europe and Asia. This is mainly because most of these countries are raw material exporters in a global system dominated by manufactured goods.

The main trading partners for the region are China and the EU. The following statistics were compiled in the ITC Trade Map for the year 2018;

- EAC imports from China increased by 6% from USD 6.9 Billion in 2017 to USD 7.3 Billion in 2018. Its exports to China increased by 22% from USD1.5 Billion in 2017 to USD 1.9 Billion in 2018;

- For COMESA, in the year 2018, exports to the EU accounted for 32% (USD 36.1 Billion) and to China 6% (USD 7.3 Billion). Imports from the EU accounted for 32% (USD 36.1 Billion) and 8% to the US (USD 12 Billion);

From the above, it is clear that trade with external partners has been on the rise within the Tripartite Region. Such a surge in the increase of imports and exports from the rest of the world has often been cited as one of the major reasons for the decline in intra-Tripartite regional trade. In COMESA for instance, the decline is estimated to be between 5-10%. This therefore shows the urgent need for enhanced cooperation so as boost intra-Tripartite trade.

The effects of COVID-19 on Intra-Tripartite Trade

COVID-19 alias coronavirus started as an infection in Wuhan and spiraled into a global pandemic. It is much of an economic catastrophe as it is a health crisis. In its Policy Brief No.77 published in May 2020, South Centre propounded that COVID-19 is expected to be the world’s worst economic crisis since the Great Depression of 1930. The economic effects could be more devastating in developing countries and could augment hunger and poverty.

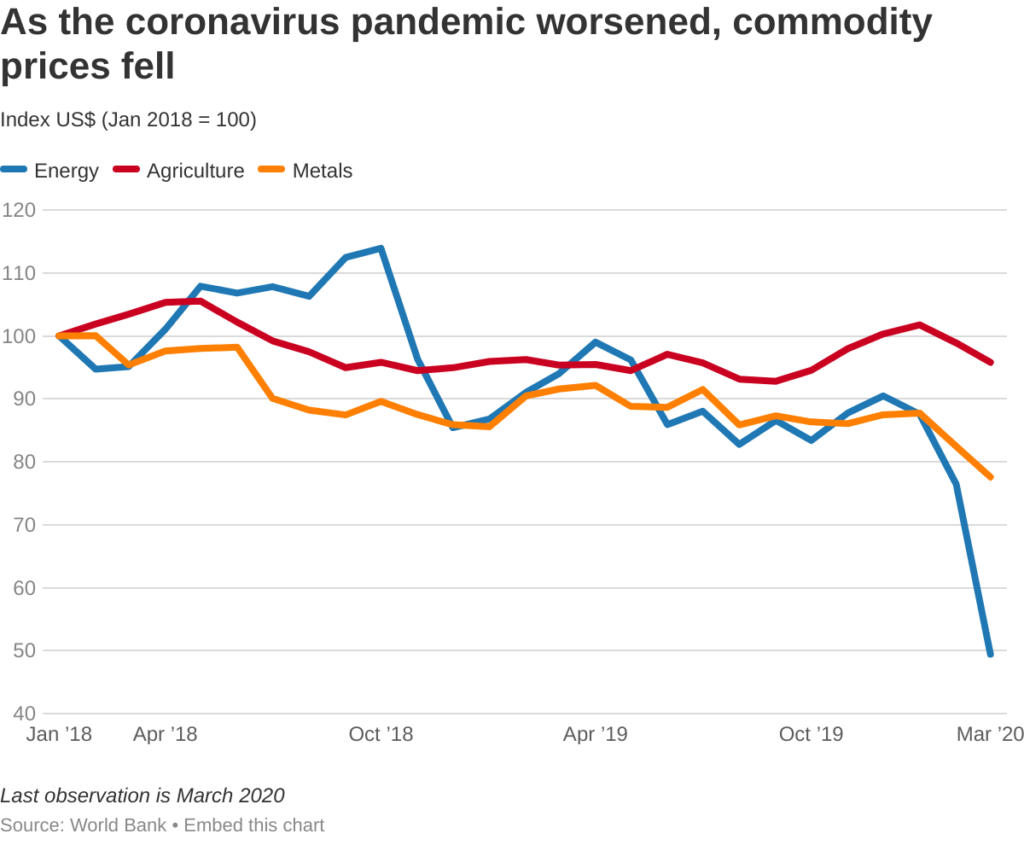

The economic effects of the pandemic can be seen from below. The chart shows how commodity prices fell globally as a result of the various measures that were taken by States to respond to the pandemic.

Prior to the outbreak of COVID-19, intra- Tripartite trade was already in torment due to persistent NTBs and poor infrastructure among other factors. The pandemic has successfully heightened the tension.

Measures taken by TFTA Members States against COVID-19

Member States took various measures against COVID-19 such as border closures and lockdowns. Unlike in the EU, the response within the TFTA region is highly uncoordinated. The lack of coordination has led to non-tariff barriers to trade which have disrupted supply chains. In essence, non-tariff barriers (NTBs) are restrictions to trade that are not of a tariff nature such as delays at border posts and they often lead to an increase in cost.

In Article 4 of the Agreement Establishing a Tripartite Free Trade Area among the COMESA-EAC-SADC, Member States made a commitment to eliminate all tariffs and non-tariff barriers to trade. Article 10 encourages the elimination of all NTBs. Member States can only be absolved from Art. 4 and Art. 10 obligations if they implement measures necessary to protect human life and health. This is in terms for in Art. 40 of the Agreement which provides for the general exceptions. It should be noted however, that such measures implemented under Art. 40 are not supposed to be in a manner that would constitute unjustifiable discrimination or disguised restrictions to trade.

‘Beggar-Thy-Neighbour Tariffs’ Aren’t Good For Trade: World Economic Forum Warns the World

Though it can be argued that some of the measures implemented by Tripartite Member States in light of COVID-19 fall within the general exceptions as provided for in Art. 40, they are to a greater extent inimical to the mandate of TFTA. As already highlighted above, the mandate of the TFTA is to increase intra-trade and some of the measures do in actual fact restrict trade. Below are some of the measures.

- The mandatory quarantine of truck drivers has led to unwarranted delays at Chirundu, Livingstone border posts in Zambia and Molaye, Galafi border posts in Ethiopia. In the case of Zambia, complaints were registered (NTB 000-951 and NTB 000-953)

- Mozambique suspended the issuance of visas to commercial truck drivers and it has affected Member States that use the port of Beira. As a result, NTB 000-949 was registered against Mozambique.

- In Kenya, trucks are allowed to cross into South Sudan but returning crews are required to self-isolate. In turn, there has been a shortage of drivers thus disrupting supply chains.

In addition to the aforementioned NTBs, Member States have taken diverse approaches to import and export tariffs. In the extreme left are countries like South Africa and Egypt which have imposed export bans on products such as gloves, shields and face marks. In the case of South Africa, exports are permissible on condition of a permit. Conversely, in the extreme left there are members like Zimbabwe and Mauritius that have eliminated import tariffs on medical and protective equipment which again points to a lack of a coordinated response. It goes without saying that such export bans are causing shock in the supply chains within the region. South Africa and Egypt are large economies and their actions have a ripple effect on other countries within the region. This begs the question, is the TFTA ill-fated?

What’s next?

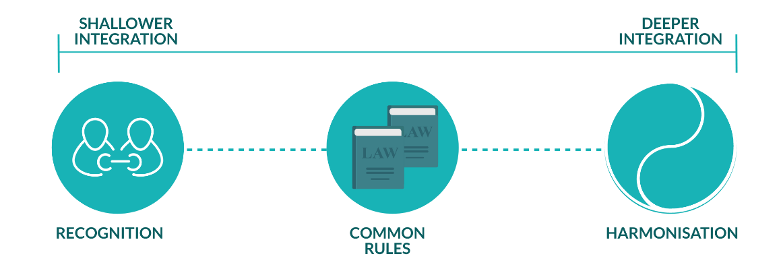

On 22 April 2020, the Tripartite Task-force issued a statement of solidarity. It urged Members to conform to uniform standards and regional guidelines so as to minimize disruptions in the supply chain of essential goods and food across the Tripartite Region. The time for the TFTA Member States to work towards a deeper form of integration is now. Members do not only have to recognize the regional guidelines and obligations, rather they need to adhere to them not only during this pandemic but also for post-pandemic economic recovery.

Lessons can be drawn from ECOWAS and also the EU on how they managed to present a united front against the pandemic and its devastating economic effects. The status quo has exposed shortfalls that the Tripartite Members ought to address so as to achieve the main objective of the TFTA. Without actual cooperation, the TFTA will just become another failed attempt towards the trade liberalisation and open markets in Africa.

Conclusion

By and large, the pandemic can be an opportunity for TFTA Member States to weaponise cooperation not only for fighting against COVID-19, but also to achieve deeper integration which in the long run will boost intra-Tripartite trade. It also provides an opportunity for these States to redefine development for post-pandemic recovery which will strengthen their value chains.

This article was written by a member of TFG’s 2020 International Trade Professionals Programme. Find out more here.

Disclaimer: The views that have been expressed on this page are that of the author, which may or may not be in line with their company, Trade Finance Global or London Institute of Banking and Finance’s view.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.