Dr Liam Fox said he has the experience and vision to revitalise the World Trade Organization (WTO) after making it through to the second round of the selection process for… read more →

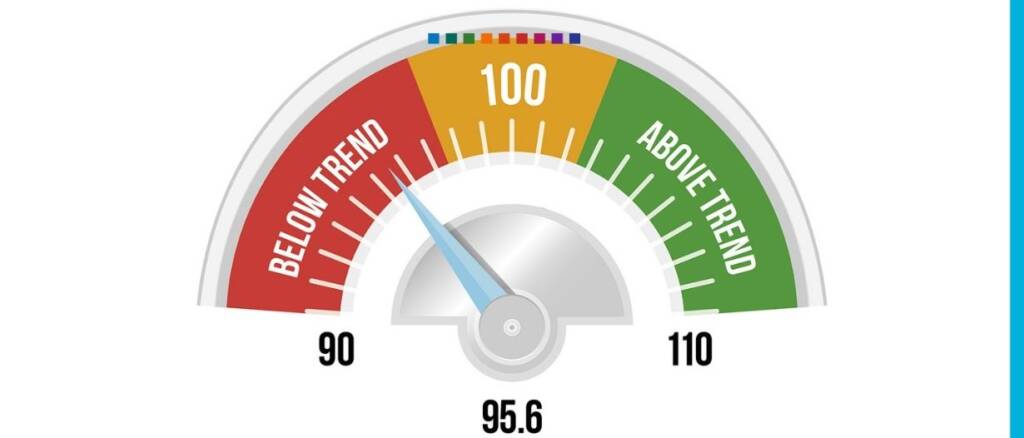

World services trade likely remained far below trend through the second quarter of 2020 amid the economic fallout from COVID-19, but the latest reading from the WTO Services Trade Barometer… read more →

• Creates a new digital pathway to credit for wholesalers for better cash flow management and inventory investments • Collaborative solution digitally integrates Fast Moving Consumer Goods (FMCG) marketing campaigns… read more →

LONDON, September 17, 2020 – The global economy will lose up to $10 trillion in GDP in 2025 unless governments repeal or reduce tariffs and non-tariff barriers that currently obstruct… read more →

The new initiative aims to harmonise African standards for pharmaceuticals and medical devices thereby enhancing intra-African trade, reducing substandard counterfeit products, and building resilient regional health systems. (Jeddah, Cairo, Nairobi,… read more →

The UK has today secured a free trade agreement with Japan, which is the UK’s first major trade deal as an independent trading nation. The UK has secured a free… read more →

The UK has today taken a major step in the process of joining CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership). The UK has taken a major step in the… read more →

TFG heard from BofA on the possibility of SCF’s structural shift to localisation.

Jeddah, Saudi Arabia, 9th September 2020. The International Islamic Trade Finance Corporation (ITFC), member of the Islamic Development Bank (IsDB) Group, signed a US$100 million Murabaha-structured line of trade finance with Mizuho Bank in… read more →

SMEs (small medium-sized enterprises) are a fundamental pillar of the economy. The World Bank estimates they make up 90 percent of businesses globally and more than 50 percent of employment… read more →