Reserve Based Lending

Trade Finance without Barriers

Informing Today’s Market, Financing tomorrow’s Trade.

Get Trade FinanceContent

Overview

The oil and gas sector functions in a very challenging and unstable price environment. There are different phases within the lifetime of an oil and gas project such as exploration, development, production, plateau, decline and decommissioning. Each phase requires great flexibility in terms of funding. This funding is typically focused on the cash flows that come from the underlying assets. Such funding needs a solid engineering analysis of the functional capabilities and reserves of the oil and gas companies in question.

How does it work?

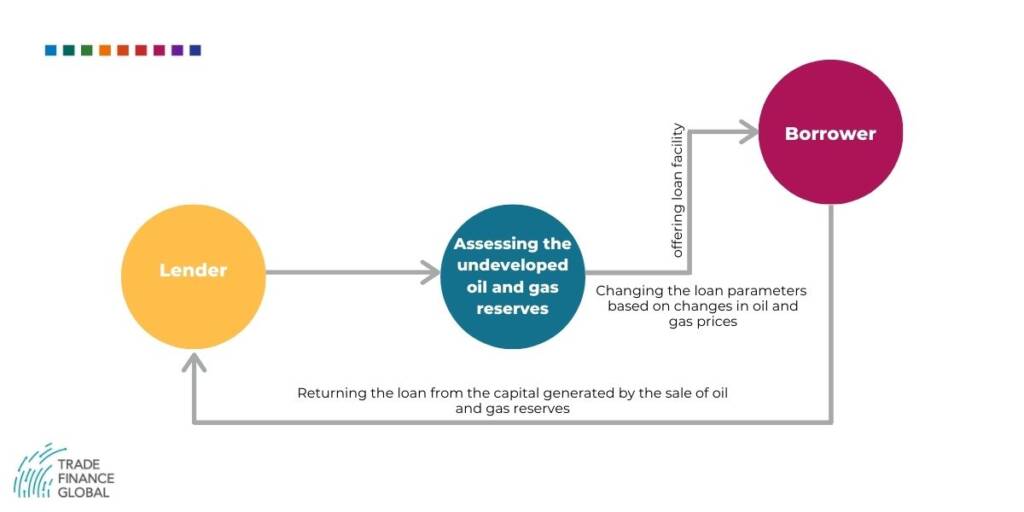

Reserve based lending is a type of funding in which a loan is obtained with the assistance of undeveloped oil and gas assets. The value of oil and gas reserves determine the quantity of a lending facility accessible to the borrower. A loan is later repaid using the cash generated from sales in the field or portfolio.

As Reserve Based Lending is constantly changing, the amount of the facility fluctuates during the tenure of the loan to mirror modifications in assumptions like production, oil, and gas prices etc. The reserve based lending market also sets the standards for the difference between various upstream markets in terms of how acceptable an asset is, gearing of lending structures and security packages. This type of financing is usually used for acquisitions, improving production rates, and developing projects. The process has been clearly illustrated in figure 1 below.

Different Reserve Based Lending approaches

There are three different approaches to reserve based lending:

- International OECD Market (North Sea Model): This model is followed in the U.K and Norway mostly and is about 40 years old. The North Sea model does not include Reserve Ownership. It is usually secured by share pledges and a debenture. It considers probable and possible reserves and is applicable for borrowing base facilities and development.

- Gulf of Mexico Model: This model is the oldest available Reserve based lending approach. It has been followed for nearly 45 years in the United States of America. The Gulf of Mexico model takes security on the reserves and the assets. It keeps ownership but only takes into account proven reserves. This approach is only applicable for borrowing base facilities and isn’t generally available for development funding.

- International Non-OECD Market: Followed in Africa, this model has been in the market for roughly 20 to 25 years. In the African model, the primary focus of security is by way of share pledge, control over accounts and cash flows. It is available for both development finance and borrowing base facilities. The major drawback with this approach is that it usually doesn’t take security on assets or reserve licenses.

Advantages for Reserve Based Lending – Lenders and Borrowers

Lenders

- The flexibility of Reserve Based Lending diminishes the risks associated with the uncertainty in the market in relation to values of goods.

- Technically, the account capital structure and access to capital is taken into consideration by the borrowing base limits for the development of non-producing reserves.

- Lenders are permitted to switch loan variables in whichever way they need to, in order to manage convenient loan-to loan and cash flow coverage ratios, to keep track of the Borrower’s activity.

Borrowers:

This is applicable for those oil and gas companies that are either already producing oil or are in a development phase, in which production seems very likely to happen.

- There is the possibility to increase the facility to adjust for rising production and reserves or additional acquisitions.

- Reserve based lending offers an appealing financing option, where the available amounts are decided based on anticipated production.

- The evolving nature of Reserve Based Lending enables advance payments without any extra charges, such as interest costs and offers a lasting source of capital.

Challenges for Reserve Based Lending in unconventional production

Reserve Based Lending is being heavily used in the not so popular sectors like shale gas and shale oil. However it faces challenges in unconventional production:

- Even though there is lower geological risk, wells are more expensive and rising decline rates for wells are hard to ignore as they lead to more unstable cash flows.

- Bigger concession blocks and more infrastructure is required, which leads to greater risks.

- There is public interest litigation and landowner and local community challenges, which can’t be overlooked.

- Drilling schedules are less flexible in the new concessions, which need drilling in appraisal and exploration stages.

- There is fear of cash flows getting delayed because of the longer times between drilling, completion, and production.