Media & Entertainment Receivables Finance

Trade Finance without Barriers

Informing Today’s Market, Financing tomorrow’s Trade.

Get Trade FinanceContent

Receivables finance is often used by rights owners, producers and distributors of content in the media and entertainment sector. This form of financing is used to help fund the sales of existing content, titles or licences; and accelerate the receipt of cash flow or finance new projects. Why? Because it’s difficult to pay for the production when you only receive your income after a long period of time from the point of distribution or sale of a digital asset.

Receivables financing is a way around this. The promise or obligation to pay in relation to these media asset sales (agreed contracts) is used as security when receiving finance. Afterall, the invoice/receivable refers to something that’s already sold, but you just haven’t received the money for it yet. Thankfully, there are banks and alternative financiers willing to use this as the backbone of some financing.

Receivables financing for media firms

Traditionally, invoice financing firms will require X amount of invoices per month to prove sturdy historical performance, and a potential borrower or seller will use the future ones as collateral to gain financing. A borrower may even hand over the responsibility of chasing up the payments, to the financing third party. This system doesn’t work appropriately in media and entertainment, because many firms do not make regular sales each month with a steady flow of invoices. Instead, it’s a long, costly project with one big payout at the end. This larger payment is usually made over a longer time horizon (typically 1-6 years.

In order to gain financing when producing a film for example, the producer must create a detailed cash-flow budget as well as a timeline of its production. Like most loans, they must provide some collateral, such as “pre-sales”. A common way to pre-sell a film or album is to sell its license distribution rights. This means that before the film is finished being produced (or in some cases, before it’s even started being produced), a producer may find themselves agreeing a deal with a distributor such as Netflix or Youtube.

What is entertainment finance?

Entertainment finance is provided by lenders and factors within the sector related to global entertainment. This will be cinema, TV, streaming channels, broadcasters and radio. When these media outlets show content it is usually acquired from somewhere; the place that it is produced or the rights owner. The distributor, producer or rights owner will produce or buy and then sell or licence to large entertainment broadcasters. These broadcasters will usually demand sales on credit terms from the suppliers; which can vary from 30 days to 6 years. The supplier will naturally want to receive funds as soon as possible, so that they can pay down existing loans, re-invest in new content and grow their business line. Examples of (potential) entertainment receivables are those outlined below. Please note that these receivables are examples and not factual.

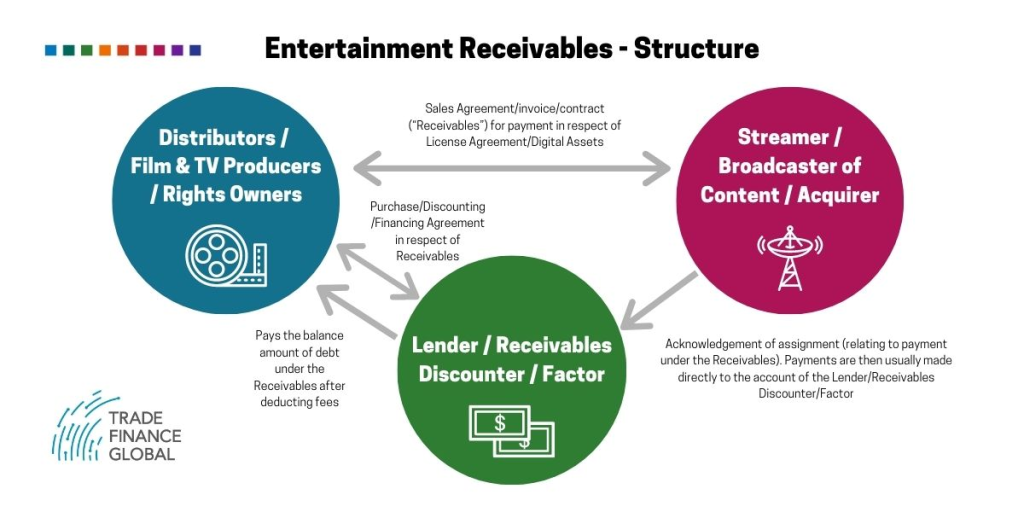

Media and entertainment receivables finance – structure diagram

Background

Generally, the distributor will have a minimum guarantee. That is, the film producers are guaranteed a certain amount of payment for delivering the movie. This contractual guarantee is used as security on the loan in bridging or production finance facilities (not media receivables finance), prior to delivery of the film. Sometimes, though, a company can actually ‘sell’ their minimum future guarantee (at usually ~80% discount), making the financier responsible for the collection of payment.

More likely, a company won’t exactly receive their distribution payout early in advance. It’s just used as evidence. These pre-delivery or asset sales as treated as production loans and will be priced accordingly. Typically, the longer a borrower is required to wait for a distribution payment (the security), the more they will be charged.

How invoice financing actually works

Invoice discounting and invoice factoring are two terms people often use interchangeably under the umbrella term ‘invoice financing’. They do differ, however, and it’s important to note the differences.

Invoice factoring is where you essentially sell the receivable(s), of course for a discounted rate, and the financing firm becomes responsible for its collection. They usually hold back 10% to 20% of the funding, which is released to you once all outstanding invoices are collected. This can potentially damage the relationship with a client, because a borrower doesn’t know how they’ll be treated by the financing company. The upside though, is that a borrower or seller can sit back and let the financing company do all the hard work for you.

Invoice discounting on the other hand is where a borrower or seller remain in control over their invoices and payment chasing. This means the distributor may not be aware of the financing.

In the Media & Entertainment world, receivables finance is a mix of the two. This means that the seller receives a high advanced payment on day one in relation to the long dated receivable, invoice or contractual obligation to pay (1-6 years).

Advantages of Media & Entertainment Receivables Finance

- Because the accounts receivables are being used as ‘security’, typically the producer will not need to put forward traditional asset security. Usually, loans require a substantial asset for collateral such as a property. This benefits new and/or smaller production companies and distributors with limited assets.

- Receivable financing allows you to raise funds on delivered sales or assets, whilst retaining full ownership over the production/media company.

- As this financing is used when media assets (films, songs, programmes, libraries) are distributed or sold, it is a cheaper form of finance when compared to other pre-production or delivery loans. This can help new and existing projects develop more smoothly by paying the actors, musicians, editors and so on, on-time. It also means that there is a lesser requirement to take out more expensive pre-delivered financing on other projects.

- Unfortunately, there’s limited government grants out there to fund such projects, so receivable financing is a low cost route.

- Payment dates are long in the entertainment space and it can take between 1-6 years to receive funds from the large streamers, broadcasters or acquirers of content. Therefore, media & entertainment receivables finance could be very beneficial, due to providing much needed cash flow when compared to other industries who wait 30-120 days for receivables payments.

- If you have a distribution or sales agreement already in place, gaining finance can be a relatively quick process. Not always, but often it’s faster than more traditional forms of financing — such as the 2+ month process of getting a bank loan. You’re also far more likely to be denied for a bank loan.

Disadvantages of invoice financing

- Like any financing, this comes with a cost. This will cut into the profits of the overall project. However, it is usually much lower cost than other forms of media related finance.

- It’s not the most well-regulated industry and many banks are unable to provide financing in a cheap or efficient way, so make sure to read all of the fees, costs and small print along with any other potential charges.

The difficulties of traditional financing

One bank, which spoke to TFG, stated that, “generally, banks do not take any form of delivery risk, performance risk, or box office risk, so it’s a very small group of independent producers who can expect to receive film financing from a bank.” TFG’s view is that a media company should always attempt to work with a lender who understands the business and we have seen further financiers come into this market.

Some banks will use the pick-up agreements for loan security if the distributor is a reliable, trusted one. In this scenario, a bank loan is the preferred option, as they will usually be the cheapest, safest option. However, the biggest obstacle here, even if you’re approved, is the length of the process. The forecasts, timeline and other evidence required will be extremely comprehensive. Therefore, it is important to look at other market participants along with alternative capital sources that have stepped into the market.

Any other FAQs

Examples of entertainment receivables finance

- Netflix Receivables – House of Cards (Series 1) was delivered to Netflix for the French territory, for a three year viewing window. The receivable of 80m USD was to be paid quarterly over 38 months. A financier came in and paid the supplier of content (distributor) the 80m USD minus their discount charges, so funding could be used (by the supplier) for other content.

- Amazon Receivables – Amazon acquired the licence to show the Marvelous Mrs. Maisel. For Series 2 at the cost 50m USD, the distributors wanted to discount those receivables as Amazon were paying over a 2 year period and payable monthly. A financier will pay the film distributors after the invoice is issued and the debt will be assigned to this lender; so they receive payment from Amazon.

- Disney Receivables – The new Disney online streaming service has meant that Disney have increased their acquisition of content from other suppliers, distributors or producers. Due to Disney’s purchasing power they usually pay over a longer period. A French supplier provided an animated film to Disney. Disney agreed to pay monthly over a 2 year period and the supplier wanted finance on day one; so utilised receivables finance on day one, following the invoice being sent.

- Hulu Receivables – Hulu is an on demand video service and is majority-owned by Walt Disney, so they acquire a lot of content. The film 28 days later was purchased from a UK based distributor and there was a licence window to show for 3 years. The 1.9m USD was to be paid by Hulu every quarter. The supplier wanted to accelerate these entertainment receivables and so wanted payment on day one.

- Viacom Receivables – The film Inkaar was created in 2013. The sale of content to Viacom was at an estimated 6.3m USD. With payment terms of 36 months and quarterly window payments, the distributor wanted payment upfront, so it could be re-invested in other projects.

- HBO Receivables – The television network purchased a licence to display Westworld. The first series was sold for 10m USD and HBO were paying over 12 months, on monthly payments. A receivables financier came in and discounted the full 12 month contract value on day one.

- Universal Studios Receivables – As a leading producer and distributor of films, Universal studios licences content globally. An example could be the title Jurassic Park that is displayed on multiple streaming platforms. A three-year window could have been sold to Netflix, paying over a 2 year period. Receivables finance would allow Universal to receive the full amount (minus fees) on day one.

- Sony Receivables – Jumanji may have been licenced for a 2 year window to a streaming giant. As the repayment may take 4 years, a receivables financier could come in and discount this.

- BBC Receivables – The BBC acquired the Scandinavian drama series, A State Of Happiness. At a possible 7m USD purchase, usually payable every month and over three years, the supplier would have wanted to receive funds immediately following the date of sale. This is so that they could re-invest in further content. This is achieved through discounting the receivable being paid by BBC.

- Apple Receivables – Through the Apple TV and movie streaming service, they have bought and licenced many pieces of content. Due to Apple’s strength they can demand payment terms up to 5.5 years, but producers and distributors want to be paid earlier. Therefore, receivables finance is a tool that makes this possible.

- Lionsgate International Receivables – Lionsgate produces and acquires titles globally. In 2013 they acquired the UK rights to the comedy Missing Link that was developed by the studio, Laika. This may have been a purchase at a value of 5m USD and Lionsgate may have decided to pay quarterly over 3 years. Receivables finance allows the supplier to be paid following the sale and there will be an assignment over the payment from Lionsgate, to the lender or receivables purchaser.

- Paramount Receivables – Many studios such as Paramount, both acquire and produce content. An example of a sale is where Disney acquired the distribution rights to a number of titles, including Captain America and Iron Man. A large sale like this may have been priced at 20m USD and could have been paid over 3 years by Disney. If Paramount wanted to receive the capital on day one, then they could have discounted this receivable with a financier and in this case, the financier would take credit risk on Disney.

- Warner Media Receivables – Being one of the largest media and entertainment companies and running the online platform HBO Max, they acquire a large amount of content. When securing the rights for “The Big Bang Theory” at a reported $500 million; a payment like this may be made quarterly over five years and the supplier will usually want their cash flow upfront. In this case, the supplier would use a receivables financier, so that they could receive full payment (minus fees) following the sale of the show.

- AT&T Receivables – It is important to note that Warner Media is a subsidiary of the telecom operator AT&T. Both companies consume and purchase a large amount of content. We usually see those most powerful in the market stretching out payment terms to 5 or 6 years. Entertainment receivables finance allows suppliers to receive payment on day one.

- Viacom – Viacom acquired the rights to the ‘Garfield’ characters at the end of 2019. Viacom are known to have longer payment terms, being around 5.5 years. Producers and distributors sometimes favour payment following sale, so a receivables financier will allow the supplier to receive payment following sale.

- ITV Receivables – The story of ITV acquiring the domestic rights to the FA Cup for the 2021-25 cycle is common in the entertainment world. As this may be paid over 2 or 3 years, a receivables financier usually comes in and takes an assignment over the payment from ITV; and pays the sellers following the purchase of rights being agreed.

- Music Rights (Receivables) – Media rights receivables are very common in many forms. An example is where streaming platforms buy the rights to use music content and pay over a period. A more common practice is where a music-streaming platform may agree with an artist to use their content and have a pay per play model. It is standard practice that following a certain window, the artist will invoice the platform (an entertainment invoice or contractual payment) and receive funds after a period later e.g. 30 days. The artist may elect to bring an invoice discounter in, if this scenario happens and pay the artist following issuance and confirmation of such invoice.

What is media finance?

Media finance is a facility used by many of those suppliers of information, content or data to large media companies. Companies such as Google who acquire information, will agree to pay the supplier over a specific terms. Usually, the larger the debtor, the more they will push payment terms to the suppliers. This may be from 14 days, to a number of years, depending on the type of contract, value and structure. A financier allows the supplier to discount the invoice or contractual payment that is due for payment from the end buyer; the media company.

Few examples of media receivables

- Google Receivables – A data supplier to Google may provide information every month and be paid 90 days later, from date of invoice. Following financing of the supplier, Google will pay the proceeds of the invoice to the lenders’ account.

- Microsoft Receivables – A supplier of animated video content to Microsoft is requested to bill on a 120 day basis. The lender agrees to pay the supplier on day one and take an assignment over the receivables that are payable by Microsoft.