What is IGST, CGST and SGST?

Access trade, receivables and supply chain finance

We assist companies to access trade and receivables finance through our relationships with 270+ banks, funds and alternative finance houses.

Get StartedContents

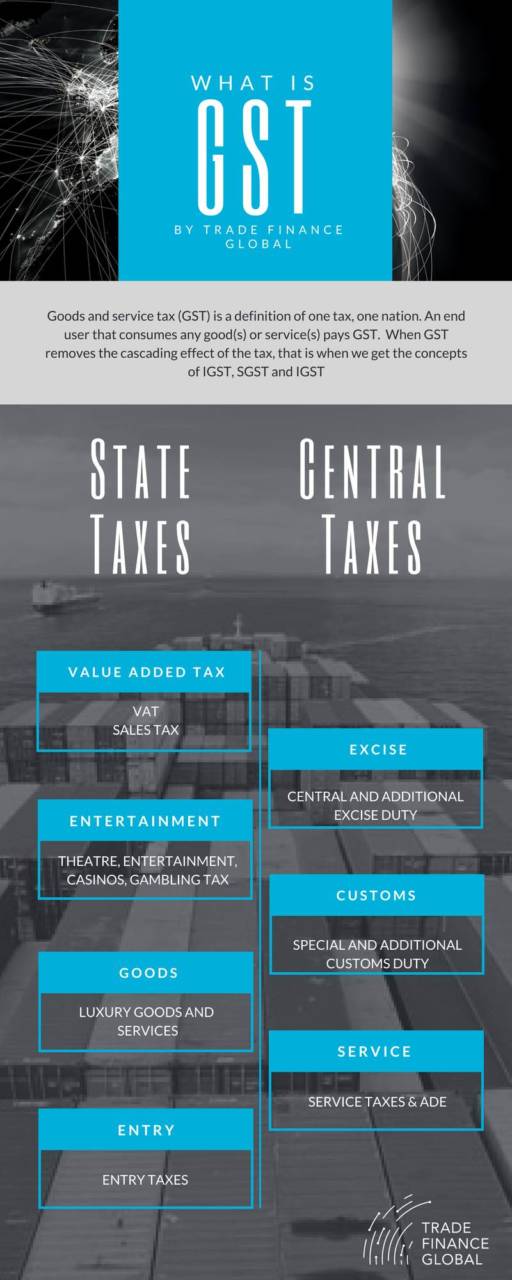

The Goods and Service Tax (GST) is a term signifying one tax, one nation policy. An end-user that consumes any good(s) or service(s) pays the GST. We get the concepts of IGST, SGST and CGST when we observe the ways in which GST removes the cascading effect of taxes.

These terms have the following meanings:

IGST

Integrated goods and service tax

SGST

State goods and services tax

CGST

Central goods and services tax.

GST replaces which taxes?

Before the introduction of GST, there were multiple taxes, such as the service tax, central excise, and state value-added tax (VAT). However, GST is just one tax with three categories—IGST, SGST, and CGST—that depend on whether the performed transaction is intrastate or interstate.

What determines which category of GST is applicable?

We need to understand whether the transaction is an intrastate or an interstate supply of goods and services to determine which category of GST is applicable.

- Intrastate supply (SGST and CGST)

This arises when the place of supply (buyer), as well as the location of the supplier (seller), happen to be in the same state. In this case, a seller must collect both State Goods and Services Tax (SGST) and Central Goods and Services Tax (CGST) from the buyer —here, the SGST gets deposited with the state government, and CGST gets deposited with the central government.

- Interstate supply (IGST)

This arises when the place of the supply (buyer), as well as the location of the supplier (seller), are in different states. Another scenario that counts as interstate supply is in cases of the import or export of goods and services, or when the goods and services are supplied to—or by—the SEZ unit. If the transaction is inter-state, then the seller collects Integrated Goods and Services Tax (IGST) from the buyer.

Now that we know where each category of GST is applicable, let’s explain them.

Testimonials

A business owner Dipesh from Rajastan had sold his finished goods to Jyoti from Gujarat worth a total value of Rs. 10,00,000. The GST rate is 18%, which is split into a total of 18% of IGST. In this case, the dealer must charge Rs. 180,000 as IGST, which will go to the Centre.

– Dipesh B, Goods Manufacturer

Case Study

Goods Distributor

Trade Finance Global along with their partner freight forwarders and tax assistants helped us file our returns, arrange transportation and sort out our duties in India.

- All Topics

- Key Terms

- Incoterms Resources

- Podcasts

- Videos

- Conferences