International TFG Trade

Awards 2020

In cooperation with BAFT

Following a year of geopolitical uncertainty, technological disruption and competition, the 2020 International Trade Finance Awards by Trade Finance Global recognise and award those who have succeeded and provided an outstanding contribution to international trade. Trade Finance Global Awards are totally independent and judged by an expert panel of trade specialists.

Global

- Best Trade Financier – Standard Chartered

- Best Receivables Financier – Banco Santander

- Best Supply Chain Financier – Citi

- Best Export Credit Agency – UK Export Finance

- Best Multilateral Development Bank – Asian Development Bank

Regional

Funders

Best Financiers Category

Best Trade Financier – Standard Chartered

Standard Chartered strives to help people and businesses prosper across the world.

“We are honoured to be recognised as the Best Trade Financier at the Trade Finance Global Awards. Trade is a core business in Standard Chartered and we will continue to invest in new and improved client centric solutions.”

– Michael Spiegel, Global Head of Trade

2019 Highlights

Standard Chartered and International Financial Corporation (IFC), a member of the World Bank Group, have established a US$1.0 billion facility to boost trade finance in emerging markets, helping to sustain trade flows in developing countries and narrow the gap in global trade finance.

Standard Chartered has launched the Trade AI Engine, a joint solution developed in partnership with IBM to enhance the client experience in trade document processing through increased operational efficiency and strengthened operational control. The solution is currently live in key markets across Asia, Africa and the Middle East, with more markets across the Bank’s footprint to follow.

Standard Chartered has launched the world’s first Sustainable Deposit, dedicated to financing sustainable assets in developing countries aligned to the United Nations’ Sustainable Development Goals (SDGs).

What are the biggest challenges that Standard Chartered faces in relation to international trade or finance right now?

The ongoing trade war and recent Coronavirus have provided a wake-up call for a lot of companies, in particular to the resilience and agility of supply chains.

Companies are adopting new innovative technology and are moving towards digital supply chain networks in order to be more resilient. This shift in physical supply chains is making banks such as Standard Chartered rethink the way we look at and finance supply chains.

What should we be looking forward to in 2020, and what are the short to medium term priorities of Standard Chartered?

Standard Chartered has a strong presence in emerging markets where a lot of buying is sourced from; we want to leverage our strong network, to be able to facilitate financing for SMEs in those markets. With an estimated SME financing gap of USD$5.2 trillion (IFC and the SME Finance Forum), we want to make it easier for these SMEs to get access to not only financing, but also other financial solutions.

What is the strategic focus for Standard Chartered in the short to medium term?

With the increasing focus on sustainability, our clients are looking deeper into their supply chains – looking at how they can support not only their suppliers, but also their suppliers’ suppliers and so forth (beyond first tier). Blockchain is one tool that enables them to do just that.

We have had success in leveraging blockchain to help us make better financing decisions, to connect our clients to their trading partners, to facilitate real-time payments (Ripple) and to even digitise letters of credit (Contour). With its many uses, blockchain technology has also disrupted supply chains and the way we finance them.

Our focus is to make things easier for our clients and their ecosystems. We want to be the connector that supports our clients’ needs to move, manage, invest and finance their money across both financial and physical supply chains that link all parties in the ecosystem. To achieve this, we need to think beyond just innovating within the Bank, but also collaborating and co-creating with our clients and other industry leaders

Best Receivables Financier – Banco Santander

Banco Santander provides working capital solutions for major worldwide companies through the discount of a diversified portfolio of receivables.

We feel really proud and grateful to be able to receive this award which compensate all the efforts and strategy put in place in the last few years when this business was defined one of the the bank’s core focus area.

– Rogier Schulpen, Global Head Trade & Working Capital Solutions

2019 Highlights

- Digitalization of our receivables business to be able to offer an online platform to our clients to monitor the status of the offers and which is fully integrated with the systems of the Bank

- Develop new risk models which allow us to increase our receivables offer to not only portfolios of corporate clients but also to very atomized portfolios of individuals and SME´s

- Start collaborating with different important third parties in the industry such as fintechs or trade finance funds to be able to offer a more complete, structured and differentiate offer to our clients

What are the biggest challenges that Santander faces in relation to international trade or finance right now?

Increasing competition in the industry from different parties together with more sophisticated and global companies which ask for more complex and holistic solutions to cover a wide range of segments and geographies which force not only Santander but all the institutions to keep developing new structures and new risk model which are able to meet the demand.

What should we be looking forward to in 2020, and what are the short to medium term priorities of Santander?

In a capital scarce environment, one of the main Santander´s short term priority will definitely be to enhance our distribution capabilities so we can keep offering a one stop shop for our clients while we keep maintaining our capital requirements.

On top of it, Santander bet on the receivables business space for our Corporate and Investment Banking clients will be to keep building centers of expertise for the different products, from which the most specialized professionals from structuring teams, to Middle Office, risk and legal and digital platforms can offer global solutions for our customers.

‘‘We feel really proud and grateful to be able to receive this award which compensate all the efforts and strategy put in place in the last few years when this business was defined one of the the bank’s core focus area. Since then, the bank embarked in a transformation and internationalization strategy with heavy investments in product development, recruitment of trade specialists and technology in order to serve our customers globally.

These efforts result in more than 100 Structured Receivables Programs executed with leading Fortune 500 corporates, more than 80 mln of debtors accepted globally, more than EUR 50 bn receivables purchased annually, sellers based in more than 25 jurisdictions and funding provided in 12 currencies.

This was also possible thanks to the joint effort and hard work of the different teams – risk, middle office, legal, methodology, technology, back office and local front office teams in all the countries – who operating as one team, have been able to consolidate Banco Santander as the Best Receivable Finance Provider, standing out from our competitors in terms of growth, leadership, innovation and the client experience.” – Rogier Schulpen

Best Supply Chain Financier – Citi

Citi Treasury and Trade Solutions (TTS) provides integrated cash management and trade finance services to multinational corporations, financial institutions and public sector organizations across the globe.

Citi is pleased to have been recognized as the winner in the Best Supply Chain Financier category for the 2020 Trade Finance Global Awards. We have been focused on providing high quality Supply Chain Finance solutions to our clients for almost two decades and are continuously investing to make experience seamless and digital. Our alignment with BAFT and FASB on best practices in supply chain finance has allowed us to provide these capabilities with the highest standards.

– Parvaiz Dalal, Managing Director, EMEA Head of Supply Chain Finance, Citi Treasury and Trade Solutions

2019 Highlights

In recent years, we have expanded our supply chain programs to support clients’ business needs, including their growing relationships with emerging market suppliers. Citi’s on-the-ground presence and expertise helps our clients to navigate through these typically more complex environments and successfully reduce risks.

Over the past year, Citi’s team has continued to help organizations to improve working capital ratios, efficiency and automation of payments while enhancing supplier loyalty.

- Citi Supplier Finance Improved UX– launched an upgraded user-interface with an improved navigational UX experience and simplified design.

- New Global Program Dashboard – launched an integrated platform for holistic program monitoring providing clients with enhanced self-service reports with data sourced by location.

- Citi Supplier Finance, now with Citi WorldLink® Payment Services – With a single implementation, access one seamless platform to leverage the power of Citi Supplier Finance with the global reach and efficiency of WorldLink, a recognized cross-currency payments tool.

What are the biggest challenges that Citi faces in relation to international trade or finance right now?

International trade flows continue to be impacted by geopolitical and regulatory changes, combined with global economic shifts. At Citi, we are dedicated to providing clients with supply chain finance solutions to help navigate these challenges through the use of standardized, industry best practices and an innovation approach.

Citi is the market leader for Supply Chain Finance globally. Our longest-standing program brings over 15+ years of experience, and we have invested in over $50 million in supply chain finance platform technology since inception. We are continuing to invest in creating a truly global, proprietary Citi owned SCF platform that many multinationals can leverage across the world.

What should we be looking forward to in 2020, and what are the short to medium term priorities of Citi?

Citi Treasury and Trade Solutions are uniquely positioned to deliver innovative and relevant trade services, finance, and export and agency financing solutions to clients across the globe. With our interactive client engagement model, advance advisory services, industry expertise and continuous dedication to revolutionizing and enhancing our solutions Citi is positioned to be the global leader in Trade solutions worldwide. We will continue to invest in and develop our suite of Supplier Finance offering in tandem with the evolving needs of our clients and their suppliers.

Best Export Credit Agency – UK Export Finance

UK Export Finance helps exporters win, fulfil and get paid for export contracts.

“UKEF is delighted to receive Trade Finance Global’s award for best ECA. This award is a real marker of our innovation, success and commitment, to deliver support to UK exporters, and particularly to ensure no viable UK export fails for lack of finance or insurance.”

– Louis Taylor, Chief Executive Officer

2019 Highlights

In March, we announced our new General Export Facility (GEF), an innovative new product that will allow us to support exporters’ overall working capital requirements. A wider range of exporters will now be able to access our support, notably SMEs and companies with shorter manufacturing cycles. GEF can also be used to support larger firms such as Jaguar Land Rover (JLR), which received a £500 million guarantee to support the development of its next generation of electric cars. The automotive industry accounts for 12% of the UK’s total exports and JLR is a significant player, exporting almost 80% of its production.

UKEF also refreshed its foreign content policy in 2019, announcing a new principles-based approach that recognises the full contribution of the UK supply chain. We used this flexible approach to support Solarcentury’s construction of two solar plants in Spain – developments that will be able to power over a quarter of a million homes with renewable energy. We provided £230 million for the Formosa 2 wind farm in Taiwan. This support will enable the construction of 47 turbines generating 376 megawatts of green energy.

Trade promotes economic development and helps countries out of poverty in a way that aid spending alone cannot, and we supported several transactions that will have substantial long-term benefits. For example:

- Ghana: UKEF provided £130 million in support to; 1) develop Kumasi Central Market, a vital resource used by 800,000 people per day, 2) modernise Tamale international airport, and 3) build Bekwai hospital – helping to transform the country’s economic development.

- Angola: 1) Our US $75 million loan to the Angolan government will finance an agriculture project that will help reduce the country’s reliance on food imports. 2) Support from UKEF worth nearly € 90 million will help connect 7,000 homes with electricity.

- Sri Lanka: UKEF connected rural communities with health, educational and other services through supporting the construction of 250 bridges in the country, benefitting more than 100,000 people and businesses.

UKEF’s support for these vital infrastructural improvements will have a transformative effect on their communities and will help underpin future growth while at the same time delivering exciting opportunities for UK companies to expand their overseas footprint.

What specific areas is UKEF currently focusing on?

UKEF is committed to building its pipeline of business with small and medium enterprises through marketing campaigns and through our origination process.

It has enhanced and expanded the ‘leading with finance’ approach to bringing business to the UK. UKEF’s supplier fair model is an ambitious programme to help increase UK content in overseas projects UKEF is supporting through procurement-focused events, working with trade associations and the Department for International Trade to activate the UK supply chain. These day-long matchmaking events connect relevant UK suppliers with international buyers who are actively looking for British products and services for their overseas project or projects; this helps the buyer make successful commercial decisions and the UK supplier win overseas contracts.

UKEF held 3 supplier fairs in 2018-19, connecting over 300 exporters with opportunities potentially worth hundreds of millions of pounds in sectors as diverse as healthcare, construction and energy, with more to come.

What should we be looking forward to in 2020, and what are the short to medium term priorities of UKEF?

Our role is to fill gaps in private sector provision, so it is vital to ensure that companies know UKEF support is available at the point they made need it.

We will continue to build awareness and understanding in order to ensure that exporters and overseas buyers can access UKEF support, through targeted and GREAT campaign activities both in the UK and internationally.

In the UK, our ‘Exporters’ Edge’ GREAT campaign has successfully engaged our target audience of small to medium exporters through PR, online advertising, social media, events, partnerships, direct marketing and re-marketing.

We will continue to use the momentum of this campaign

to renew our work with partners and increase the volume of business introduced to UKEF by banks, insurance brokers and other private sector and government networks.

What is the strategic focus of UKEF in the short to medium term?

For the UK government as a whole, the priority is delivering on the UK’s departure from the EU, and UKEF will continue to play an important role ensuring that we are supporting UK businesses to grow their trade relationships all over the world as the UK establishes itself as an independent trading nation.

The UK Government’s Export Strategy has an ambition of increasing exports as a share of GDP from 30% to 35%. To achieve this, it sets out several ways that the Government can help UK businesses succeed abroad and puts finance – and UKEF – at the heart of that offer of support to exporters. For UKEF, the Export Strategy gives a very clear focus to our work. Our support is already instrumental to international success for many UK exporters, from helping UK companies access overseas opportunities via our innovative supplier fair programme, to improving understanding and uptake of trade finance among UK suppliers to help them realise international sales. Ensuring that we continue to help UK exporters win, fulfil and get paid for overseas sales, and continue to challenge ourselves to do it better, will remain our clear strategic focus.

Best Multilateral Development Bank – Asian Development Bank

ADB’s Trade Finance Program (TFP) closes market gaps to support economic growth and job creation that improve peoples’ lives.

“It’s a real honor to be recognized by the industry. Many thanks to all our partners! Looking forward to continuing our work together.”

– Steven Beck, Head of Trade and Supply Chain

2019 Highlights

The ADB TFP operates in some of Asia’s toughest markets and has supported $5.4 billion worth of trade finance through 4,800 transactions, 85% of which are SME related. Moreover, it has mobilized $3.5 billion in co-financing from the private sector.

The ADB TFP also strives to solve problems and close gaps through path-breaking knowledge products. For example, the internationally-recognized Trade Finance Gaps, Growth and Jobs Study quantifies market gaps, identifies why they exist, and how they can be closed; a Twinning Programme between banks to boost their support for trade; implementation of a Gender Initiative to promote their participation and leadership; an initiative to streamline trade finance processes to stamp out money laundering and financing of terrorism (AML/CFT), while continuing to provide access to finance.

What are the biggest challenges in trade, receivables and supply chain finance for 2020?

Trade-based money laundering will become an area of increasing focus. The industry will need to work closely with regulators to address concerns and improve our ability to detect and prevent crime in transactions. Decoupling inhibits international cooperation and creates more space for bad actors to use the financial system. ADB, an active member of the Financial Action Task Force’s (FATF) Trade-Based Money Laundering (TBML) Working Group, will continue to play a convening role between private and public sectors.

Making choices about what IT initiatives to undertake and purchase will become even more difficult. Technology becomes obsolete quickly. It requires tremendous resources and operational upheaval to implement. Inter-operability is always an issue.

What should we be looking forward to in 2020, and what are the short to medium term priorities of the Asian Development Bank?

- Intensified efforts to streamline and improve anti-money laundering to drive more transparency in the trade and financial system so it isn’t used by criminals, including human traffickers.

- Enhanced sustainability in trade by developing operational training and tools for banks to assess the environmental and social impact of transactions.

- Expand the Trade Finance Program’s gender initiative to more banks and more countries. The initiative centers on enhancing the human resource policies of banks so they attract, retain, and promote more women in finance and trade.

As Head of Trade and Supply Chain of Asian Development Bank, what is the strategic focus of the company in the short to medium term?

- Initiate the Digital Standards Initiative in partnership with Government of Singapore and International Chamber of Commerce.

- Spearhead initiatives to tackle challenges in anti-money laundering and counter-terrorism financing.

- Innovate supply chain finance transactions.

- Deliver excellence in client service to our partner banks.

Geographies

Best Finance Providers by Geography

Best Trade Financier in Asia – SMBC

SMBC is one of the world’s largest commercial banks.

“We are delighted and greatly honoured to win the Best Trade Financier in Asia award. We have over 160 trade finance specialists serving our broad range of clients in the tremendously dynamic markets of Asia through 17 offices in the region, and this award reflects their dedication and commitment. Through continuous innovation, a global approach, and listening to clients we look forward to continuing to support the trade finance needs of the very important Asia region.”

– Masakazu Hasegawa, Managing Director and General Manager, Global Trade Finance Department

2019 Highlights

We are most proud of three aspects.

Firstly, structuring the provision of trade finance services in an integrated manner, providing the full range of products to our clients across a wide spectrum of tenors delivered through a single global trade finance department comprising teams in 32 offices around the world, of which half are in Asia. The range of products includes documentary trade & trade-related loans through a wide relationship with financial institutions to support import flows; receivables finance and supply chain finance supporting clients’ working capital needs; comprehensive trade finance services to clients in the commodity producer and commodity trader sectors; and providing export credit facilities in partnership with ECAs and multilateral institutions. By integrating the products and the network into one global department I believe we can provide the best service to our clients.

Secondly, digitalisation and the use of blockchain technologies is expected to radically transform the provision of trade finance. SMBC is at the forefront of such efforts as one of the most active participants in the Marco Polo consortium, a leading driver of trade finance digitalisation.

Thirdly, SMBC is committed to efforts that contribute to sustainable development goals and “green” initiatives to alleviate environmental degradation. As clients and industries transition their business models towards demonstrating sustainability, many “clean” and other technologies will be supplied through cross-border trade. Supporting the sustainability and “green” needs of clients most effectively requires it to be on a commercial basis at acceptable risks to banks, including through partnerships with multilateral institutions.

What are the biggest challenges that SMBC faces in relation to international trade or finance right now?

Among the challenges I highlight two items.

Firstly, trade finance continues to be a manually intensive, document heavy business, which combined with the high volume of transactions generates considerable cost overheads. The widespread adoption of secure integrated technologies based on common standards is a key imperative for the industry as a whole and one in which SMBC is taking an active role. Such technologies, by reducing cost barriers, are also expected to address the “trade finance gap” by making trade finance more widely available especially among poorer countries and for small and medium sized enterprises.

Secondly, strict compliance with regulations is a fundamental responsibility. Due to the inherent nature of cross-border trade and the many parties involved in a transaction, high levels of skill and experience combined with effective screening systems are critical requirements.

What should we be looking forward to in 2020, and what are the short to medium term priorities of SMBC?

Among the changes we can expect in the next few years, I would like to highlight two.

Firstly, the commodity trading space is steadily expanding not only through the activities of independent commodity traders but also state-owned energy companies and oil majors establishing their own trading desks and entities. We expect this trend to create greater globalisation and dynamism in the commodities sphere. Events such as trade disputes, geopolitical tension or conflict, the outbreak of epidemics etc. create sudden unexpected changes in supply and demand. In our highly interconnected world such events can have rapid global impacts. Commodity traders are very well positioned to react quickly to such events using their networks and logistic resources to redirect trade flows from areas of oversupply to areas of unmet demand.

Secondly, we expect the focus on sustainability and alleviating climate change to become a significant feature of the business environment over the medium term. This will impact certain sectors more heavily than others. Overall we expect this will create significant opportunities for trade finance banks to support the adoption of new clean technologies by clients in a commercially viable manner.

Best Trade Financier in Australia Pacific – ANZ Bank

ANZ Institutional provides world-class solutions for our clients across Australia, New Zealand, Asia, Europe and America, Papua New Guinea and the Middle East. ANZ aims to be the best bank in the world for clients driven by regional trade and capital flows.

“We at ANZ are so very proud to have received this recognition from, both, Trade Finance Global and BAFT. It’s great to see all the hard work we have put in over the years bear fruit. We are truly honoured.”

– Adam Grant, Head of Trade and Supply Chain Product, ANZ

2019 Highlights

Trade Information Network: ANZ announced that it is one the 7 leading international trade banks and the only Australian bank currently working on the build of a digital Trade Information Network. Once operational, the Network will have the potential to transform international trade and become the first open and inclusive multi-bank, multi-corporation information hub in supply chain finance.

Trade Ecosystems: Regulators in Hong Kong (HKMA) and Singapore (MAS) are currently working to establish digital trade platforms in their respective markets. ANZ is the only Australian bank involved in these projects which have kicked off in 2018. The vision of these platforms – the Networked Trade Platform (NTP) in Singapore and the Hong Kong Trade Finance Platform (HKTFP) in Hong Kong – is to digitise trade data and become one-stop trade ecosystems, enabling electronic data sharing between all trade participants such as logistic providers, financial institutions and government bodies.

Data Insights – ANZ built a data capability that sources data from transactional systems to help front line and operations teams better understand the Trade & Supply Chain relationship with customers as well as monitor the overall performance of the business. The capability was built to combine multiple data sources to achieve a more comprehensive view and evolve to adapt to user needs over time.

Machine Learning – ANZ started using machine learning for extraction of entities for sanctions screening, denied party approval and collections and we are planning to apply it to other processes such as letter of credit (issuance and advising), trade payments, trade guarantees, document examination and supply chain finance. Machine learning automates thousands of processes and saves many hours of manual work, providing multiple efficiencies that can then be passed on to our customers.

What are the biggest challenges that ANZ faces in relation to international trade or finance right now?

ANZ continues to work on a series of initiatives to simplify, digitise and revolutionise trade. This digital transformation will require the adoption of automation technologies such as machine learning, smart optical character recognition, artificial intelligence, image recognition and natural language processing.

The increased use of automation and digitisation has been one of the key strategic priorities, and biggest challenges, for our Operations & Service Delivery teams to improve consistency, productivity and enhance customer experience. While human validation of machine’s work will always be present, the use of new technology represents a change in operational process.

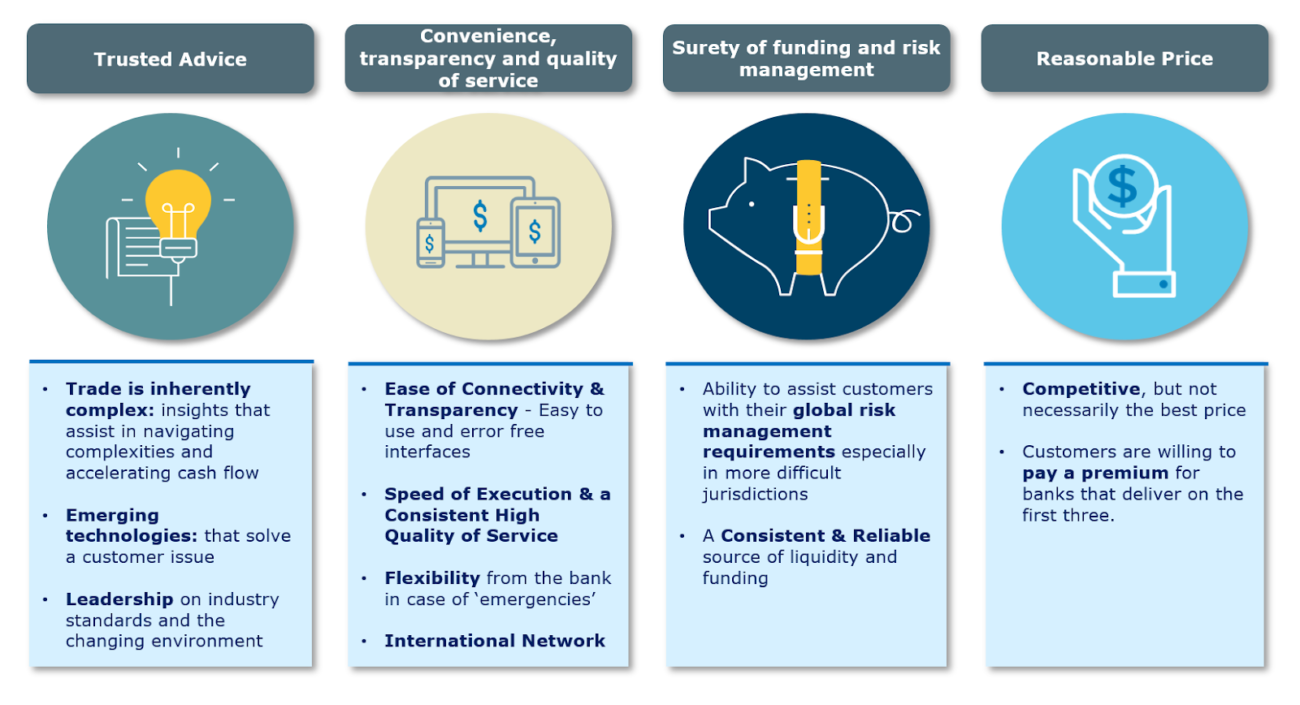

What should we be looking forward to in 2020, and what are the short to medium term priorities of ANZ?

- Doing the basics exceptionally well through the use of channels & technology. Ensuring ease of connectivity, speed of execution and customer self-service.

- Continuing to differentiate ourselves via quality of advice

- Delivering brand enhancing innovation to solve our customers’ problems

- Efficiently recycle our capital to ensure we are a reliable, consistent source of funding and risk management for our customers.

As Head of Trade of ANZ, what is the strategic focus of the company in the short to medium term?

Best Trade Financier in North America – Wells Fargo

Wells Fargo (NYSE:WFC) is a global financial services company.

“At present there are many geopolitical challenges facing our customers. Wells Fargo is focused on providing a stable and reliable infrastructure based off of our worldwide network to facilitate our clients’ global trade needs during times of market uncertainty, and we are delighted to be recognized for our efforts.”

– John McQuiston, EMEA Region & US Large Corporate Head, International Trade Services

2019 Highlights

- An integrated approach to supporting clients in their global trade and supply chain finance needs, from the most basic documentary collections all the way through to sophisticated straight-through-processed supplier finance and receivables purchase programs.

- Partnering with our customers to address in a creative and innovative fashion liquidity and risk mitigation needs in the Middle East North Africa region

What are the biggest challenges that Wells Fargo faces in relation to international trade or finance right now?

Within the trade and Supply Chain Finance world generally, the primary challenges faced by all the banks are:

- AML/Sanctions/Financial Crime risk

- New technology impact

- Highly liquid markets resulting in spread compression

- Basel 4 is coming, where returns are expected to be lower for trade assets, putting further pressure on the industry

What should we be looking forward to in 2020, and what are the short to medium term priorities of Wells Fargo?

- Main theme for 2020: accounts receivable financing

- Priority for Wells Fargo: offering a holistic and integrated trade and supply chain finance solution set to address the working capital needs of customers, be they our SME customers, international banks and private equity firms, or our largest and most sophisticated large cap multinational clients.

As Senior VP of Wells Fargo, what is the strategic focus of the company in the short to medium term?

Enable Wells Fargo to service the broad trade and supply chain finance needs of its customers globally, whether in the US, APAC or EMEA. This requires:

i) a best in class compliance and governance structure;

ii) a product suite that is fully enabled across a variety of geographies and jurisdictions;

iii) state of the art technology;

iv) efficient distribution structures.

Best Trade Financier in Latin America – BBVA

BBVA aims to bring the age of opportunity to everyone.

”We are absolutely delighted. It is an honour that recognizes our long standing commitment with the region, the efforts of our TF teams there to cope with the needs of our customers and our leading position in innovation, trade digitization and advisory.”

– Francisco Javier Fernández de Trocóniz, Head of Global Trade & International Banking

2019 Highlights

The signature of the Principles for Responsible Banking promoted by the United Nations Environment Programme – Finance Initiative, with the aim of tackling the climate crisis and sustainability challenges facing today’s society.

BBVA Microfinance Foundation first private development financing institution in Latin American Region according to OECD.

BBVA remaining the global mobile banking leader for the third year in succession.

What are the biggest challenges that BBVA faces in relation to international trade or finance right now?

A decline in trade activity due to protectionist tensions.

The impact of banking regulation and compliance issues in the trade finance business.

How to deal with an offer differentiation in a banking consortia ecosystem.

Interoperability and standardization in a more digitized and sustainable environment where AI, machine learning, DLT and big data, are playing a major role.

New emerging risks: Fraud, cybersecurity, digital on-boarding, climate change.

What should we be looking forward to in 2020, and what are the short to medium term priorities of BBVA?

Low growth environment, our focus will be on profitability, efficiency and critical mass.

Banking commoditization, we stress the need on advice to differentiate.

Disintermediation, which compels us to face new client acquisition strategies: Be where the client is.

Sustainability, playing an active role in transitioning to a sustainable world.

Use of data as a tool to boost productivity and personalize our offer.

As Head of Global Trade and International Banking of BBVA, what is the strategic focus of the company in the short to medium term?

Advisory. Redefine coverage model to offer differentiated services

Sustainability. Improving financial health and helping our clients to transition.

Robust operating model in terms of talent, efficiency and use of capital.

Data usage for risk predictions.

Trade Finance Services

Best Trade Finance Services Category

Best Trade Finance Law Firm

Allen & Overy

Allen & Overy is the world’s leading transactional law firm with over 40 offices globally.

“We are proud to be awarded Best Trade Finance Law Firm at the 2020 Trade Finance Global Awards. Trade and commodity finance has been a large growth area and focus for us as a firm in recent years. This award demonstrates our commitment in continuing to make this a market leading trade and commodity finance practice. The number and value of deals we do ensures that we appreciate our clients’ challenges and ambitions and that we can give our clients deep and valuable insight into current market trends.”

– Catherine Lang-Anderson, Partner

2019 Highlights

Breadth and depth: our growing trade and commodities team is truly global with dedicated, diverse teams in the London, Paris, Amsterdam, Singapore and New York which sets us apart from our competitors and allows us to work seamlessly across borders. We’re proud to be one of the few firms able to credibly advise on the full range of trade finance structures across key jurisdictions. The continued growth and success of our global practice was reflected in 2019 with the promotion of Catherine Lang-Anderson to Partner and Daniel Birch to Counsel.

- Commitment to the market and versatility: our practice covers all aspects of trade finance from bilateral trade and receivables financings, advice on UCP in relation to letters of credit, through to the most complex trade financing restructurings seen in the market. We are proud to support our TCF clients across all of their business.

- Landmark deals: We continue to be engaged in the most high profile deals in the market and are the go to firm to act on increasingly more ambitious and creative financings in the trade and commodity space. This is reflected in the calibre of our clients, the global nature of our trade and commodities team and the industry recognition we continue to receive.

- Restructurings: We have continued to act on a number of restructurings and litigations in the trade and commodity finance space this year including the Noble Group restructuring. We are market leaders in this area and are sought after to act on the most complex TCF distress situations due to our in-depth product and sector expertise combined with our world class restructuring and litigation practices.

What are the biggest challenges that Allen & Overy faces in relation to international trade or finance right now?

The challenging geopolitical context, increased regulatory burden/scrutiny and demand within banks for more globally streamlined trade products make TCF transactions increasingly complex.

As an example, we have been heavily involved in advising our clients on sanctions issues. The current geopolitical climate and increased enforcement risk means that the recent developments have come into sharp focus with banks needing our sanctions experts and market overview to help them navigate through.

We have also been involved with supporting our clients in the fast moving landscape of technology-based change. and have worked on very interesting blockchain projects with our clients in the TCF and other sectors. There is now huge momentum and the challenge from a legal perspective is establishing a certain and predictable legal framework around this new and fast-developing way of doing business.

In 2020 LIBOR transition will be a major focus for many of our trade finance clients . We have been leading the way on this and recently acted for the lenders on a USD 10bn revolving credit facility for Shell which was the first loan agreement governed by English law in the European loan markets to incorporate the Secured Overnight Financing Rate (SOFR), the emerging standard risk-free rate which is intended to replace LIBOR for USD loans. We are proud to be involved in this landmark transaction and help set a market precedent.

Sustainability is another key challenge and Market participants will also continue to engage with and develop new financing solutions with a sustainability focus. Allen & Overy has the subject matter expertise to guide our clients In the trade and commodities sector safely through the increasingly legal ESG landscape. ESG is increasingly becoming a complex form of corporate governance involving significant legal issues. As the framework becomes underpinned by legal requirements, advice is

required to head off the risks and take advantage of the opportunities this new investment environment presents. Our ESG Team’s advice is informed by decades of collective experience in environmental, social and governance matters, and by tracking the latest developments in ESG-related regulation and litigation around the world.

What should we be looking forward to in 2020, and what are the short to medium term priorities of Allen & Overy?

Ambition: 2020 will bring more innovative and complex structures as traditional trade finance techniques continue to be used in creative ways. A common theme to many of our deals is using traditional trade finance techniques in more ambitious ways, whether that is to achieve a broader purpose, to achieve more committed forms of financing to tap into wider sources of finding or being included in a structure which combines other forms of banking products.

Innovation: we will continue to see the development of blockchain and other technology led solutions. There is now huge momentum and we are seeing that come to the fore in a much more concrete way.

Products: we continue to see supply chain and receivables finance and borrowing base financings as a key growth areas in the TCF sphere. We will see continued interest in these financing solutions from a wider variety of market participants.

Our priorities are to stay at the forefront of these trends in all aspects of our trade finance practice globally by being actively involved as they develop. This is what enables us to bring valued insights and market knowledge to our work for our clients, whether borrowers, lenders, commodities traders or other market participants.

What is the strategic focus of the company in the short to medium term?

Our focus is on continuing to support our trade finance clients globally in achieving their ambitions and facing their challenges in an increasingly complex environment.

Best Trade Credit Insurance Provider

Euler Hermes

Euler Hermes insures companies so they can trade with confidence.

“Being recognised as trade credit insurance firm of the year is an incredible achievement and testament to the hard work delivered by Euler Hermes employees around the globe to give our customers the confidence to trade.

“We’re looking forward to building on this achievement over the coming year to ensure we’re constantly leading the way in customer service, innovation and transformation in trade credit insurance.”

– Jean Claus, CEO Euler Hermes Middle-East

2019 Highlights

- On top of our Trade Credit Insurance growth, surety business has brought a lot of new business in 2019. Several partnerships with financing marketplaces has reinforced our value proposition to these emerging segments of customers.

- The EH data lab went full speed on key projects with commercial and risks algorithms.

- We have released a new training platform for our employees and new internal social media channel to reinforce collaboration and skills.

- In 2019, only 9 months were enough to host more corporate social responsibility events worldwide than over the previous dull year.

What are the biggest challenges that Euler Hermes faces in relation to international trade or finance right now?

- Global economic growth is likely to remain muted in 2020-21 after bottoming out at the turn of 2019. In a context of lower growth, global insolvencies are expected to rise by +6% in 2020 compared with +9% in 2019.

- U.S.-China trade tensions should not escalate nor de-escalate much further in 2020. We expect the U.S. average tariff to remain at 7%, compared to 3.5% in 2018.

- Capital markets should remain in a low volatility regime as the dampening effect of unconventional monetary policy prevails. In a context of the wait-and-see posture of investors, linked to the U.S. elections and progressive erosion of profits, the global equity market is expected to register an inflexion in its upward (monetary driven) trend.

- Domestic sectors will outperform. The very expansionary stance of monetary and fiscal policies will primarily benefit domestic demand. Domestic-driven companies (services and construction) will outperform companies relying on foreign revenues and globally integrated supply chains. The automotive sector will continue its muddling through.

What should we be looking forward to in 2020, and what are the short to medium term priorities of Euler Hermes?

We will continue to deliver on the 5 pillars of our Strategy 2021:

- Growth driven to develop beyond our traditional lines of business

- Data powered with a comprehensive data strategy to strengthen our competitive edge over time

- People centricity to allow each and every one of us to develop the right skills for tomorrow`s digital world

- Nimble to simplify and digitalize our processes and work methodology

- Passionate about our mission statement, proud to create trust to trade and, therefore, economic prosperity

As CEO of Euler Hermes, what is the strategic focus of the company in the short to medium term?

- Safeguarding businesses against global economic headwinds by providing them with the confidence to trade freely through our insurance offering.

- A digital transformation strategy that will grow our IT capabilities to broaden and improve our offering to clients

- Boldness in our approach to be able to implement these efficiently

Best Logistics Provider

Maersk

A.P. Moller – Maersk enables its customers to trade and grow by transporting goods anywhere.

”It is our privilege to receive this recognition at the International trade finance awards. Access to capital, still remains to be one of the largest obstacles to the growth of trade and the opportunity is still huge. It is a recognition from the industry that we are on the right track and are continuously re-inventing ourselves to build a purpose driven organization.

We thank the panel for their consideration and reinforce our commitment on staying the course.”

– Vipul Sardana, Global Head of Maersk Trade Finance

2019 Highlights

2019 was a year of strong improvements for Maersk in terms of earnings and free cash flow from improved operational performance and cost measures.

Maersk is progressing on the transformation strategy. As part of the strategic plan to become the global integrator of container logistics, Maersk is tracking key metrics on a quarterly basis. The metrics are related to creating synergies across businesses as one company and generating free cash flow on the back of improved earnings to ensure a strong balance sheet and create value for our shareholders.

Maersk continued to see strong improvement in profitability. With revenue on par at USD 38.9bn (against USD 39.3bn in 2018), the continued focus on improving profitability across the businesses resulted in a 14% increase in EBITDA to USD 5.7bn (against USD 5.0bn in 2018) and a margin of 14.7% (up from 12.7% in 2018).

On sustainability front, Maersk has achieved relative CO2 reduction of 41.8% as compared to the baseline of 2008. Operational energy efficiency has shown significant improvements in the last two years especially. The 2019 progress shows an additional 3.2% improvement towards the 2008 baseline and represents a 5.2% improvement relative to the 2018 level. Maersk is well on track for the 60% reduction target in 2030 and has the ambitious target of becoming net carbon neutral by 2050.

What are the biggest challenges that A.P. Moller – Maersk faces in relation to international trade or finance right now?

2020 presents uncertainties related to external factors that are not under control of Maersk. There is a low visibility in terms of what is in store for the industry in the short and mid term because of these external factors.

Internally, Maersk is still on its multi-dimensional transformation journey and in a critical phase right now where it needs to keep the momentum.

The other challenges faced by the company and the industry as a whole include declining revenue, low profitability, weak cash flow and high financial leverage. This is combined with low and volatile oil prices, as well as low and volatile container freight rates.

What should we be looking forward to in 2020, and what are the short to medium term priorities of A.P. Moller – Maersk?

In 2020, Maersk will continue to perform while we transform. Focus remains on developing our end-to-end offering through an even stronger Ocean product while expanding and scaling our logistics and services portfolio. Also, we are committed to securing long term profitability in our terminals business and continue the strong developments from 2019. Cost leadership is imperative in a competitive market with uncertainties.

To further fund the transformation, we continually improve our operating results while delivering strong free cash flow and reducing investments in the Ocean business. We continue to reduce CAPEX spend. The year 2020 will be marked by new regulations on sulphur emissions (IMO 2020) that went into effect on 1 January. We fully support the industry move towards low sulphur fuel to reduce pollution. We are well prepared to comply while mitigating the increased fuel expenses by lowering our bunker consumption and passing on the additional cost to customers.

The outlook ahead is for low economic growth and low demand growth for seaborne goods. We plan accordingly, and maintain flat capacity to support utilisation and low cost.

What is the strategic focus of the company in the short to medium term?

In line with our overall ambition, Maersk Trade Finance would continue to focus on working with our customers to further make trade finance accessible. We will continue to focus on building our product focussed on SMEs and Supply Chain Finance.

Our focus as always will be on co-creating products in partnership with our customers and keep things simple with the purpose of enabling global trade.

Sustainable Finance Award

ICC Banking Commission

ICC banking Commission is the world’s essential rule-making body for the banking industry.

“ICC is very happy and honoured for having been awarded on our sustainable works. Developing guidance as to channel Trade on more sustainable transactions, hopefully compatible with SDGs is one of the top objective of ICC.”

– Olivier Paul, ICC Banking Commission Director

2019 Highlights

- ICC’s 100th year anniversary celebrated at the ICC Banking Commission Annual Meeting in China (April) and throughout the year

- Set up of the Digital Standard Initiative

- Launch of the unified approach on sustainable Trade and Export Finance

What are the biggest challenges that ICC Banking Commission faces in relation to international trade or finance right now?

- Digitalization of Trade Finance

- Development of guidelines on KYC and AML

- Set up of guidance on Supply chain techniques

What should we be looking forward to in 2020, and what are the short to medium term priorities of ICC Banking Commission?

ICC Banking Commission Annual Meeting in Dubai (UAE) 20-23 April 2020

First deliverable on Standard creation of digitalization of Trade through DSI

Best Tradetech Company

Marco Polo Network

The Marco Polo Network is the first network of distributed platforms which allows participants to offer and access a complete suite of trade and working capital finance solutions all in one place, within their own company.

“Thank you to Trade Finance Global and BAFT for the 2020 award for ‘Best TradeTech Company’. It is truly humbling to be recognised by highly respected peers within the trade finance community.”

– Robert Barnes, Chief Executive Officer

2019 Highlights

- Our financial institution partners have grown exponentially on the Marco Polo Network to more than 30 financial institutions in 2019

https://www.marcopolo.finance/largest-blockchain-open-account-trade-finance-trial/

- Successfully piloted the distributed trade finance platform with over 70 leading corporates and financial institution.

- The launch and roll out of our Receivables’ Financing module on the Network in October 2019

What are the biggest challenges that MP faces in relation to international trade or finance right now?

Inertia is the biggest challenge as many companies and providers have settled with sub-optimal and not really scalable solutions, but they do the job. The new technologies that will optimize these financing programs and make them really scalable, are complex, require a collaborative development and lots of fine-tuning.

Secondly, the market is overcrowded with providers of all sorts that add complexities to the decision-making processes of the corporate treasury and procurement teams.

The market will see more polarization and divide and not all providers will survive. The good news for corporates is that there are many new solutions that will become available to them in 2020. But the decision making will become more complex as competition increases with the introduction of new technologies which are expanding the product features.

What should we be looking forward to in 2020, and what are the short to medium term priorities of the Marco Polo Network?

In 2020, our goal is about further expanding the Marco Polo Network from a member perspective as well as with new trade finance solutions and modules such as Payables Finance, Payment Commitment as well as supply Chain management solutions for buyers and sellers.

The main focus is to continue recruiting corporates onto the network with a streamlined on-boarding process for them to add their suppliers, partners and service providers in order to fully benefit from the solutions and the network of Marco Polo and become the largest trade finance network.

Marco Polo will become a network that is delivering machine-to-machine Supply Chain Finance with fully automated processes that puts the corporates back in the driving seat for managing their commercial activities and optimizing their working capital.

As CEO of TradeIX & the Marco Polo Network, what is the strategic focus of the company in the short to medium term?

- Education on the Marco Polo Network and on TradeIX’s offerings

- Onboarding of financial institutions, corporates and other service providers onto the Marco Polo Network and expanding our global footprint

- Continue developing new and improved trade finance solutions, and modules

“Our journey to innovate and transform antiquated processes and siloed systems that have been in use for hundreds of years and build a new trade ecosystem is of great complexity and difficulty. This award is definitely a strong vote of confidence in our capability to deliver enormous value to you and your community. Thank you for the recognition.” – Robert Barnes

Innovator in Global Trade

Finastra

Finastra provides deep expertise and unrivaled pre-integrated financial services solutions.

“It’s truly a great privilege to been awarded the Innovator in Global Trade Award, following the ICC Banking Commission as last years winner. Being recognized in this way is great for Finastra and the Trade Team and reflects on our commitment to making a difference for our clients, their clients and the market.”

– Iain MacLennan, VP, Head of Trade & Supply Chain Finance

2019 Highlights

In order to prepare our Fusion Trade Innovation clients for the upcoming SWIFT 2020 Standards Release we adopted an iterative drop approach in 2019. This allowed us to give early line of sight of the Category 7 changes to clients, this has assisted a number of clients to get “ahead of the game” in terms of their SWIFT upgrade planning.

Finastra launched FusionFabric.cloud our open developer platform and marketplace in 2019, which allows us to open up our core systems. We utilized FusionFabric.cloud in Trade to make a number of Trade OpenAPI’s available to support documentary compliance checking via Conpend.

What are the biggest challenges that are being faced in relation to international trade finance right now?

There are a number of challenges that are being faced in Trade Finance currently, these include Protectionism, lack of Digitalization, Regulatory Policy and the overall Finance Gap mainly in Developing Markets.

Protectionism has lead to a level of Global uncertainty, this uncertainty has impacted investment and overall trade flows, to name just two impacts.

International trade and trade finance still heavily relies on cumbersome paper-based processes, which slow down transactions and undermine their security.

Finastra is determined to drive digitalization of Trade by offering more agile innovative solutions that address these key challenges and more, we achieve this through our suite of products or via best-in-class strategic fintech partners. Regulatory Policy continues to lag innovation and tends to focus on compliance and placing a continued onus and cost impact onto the Financial Institutions.

We know that there is financing gap, via the Asian Development Bank most recent report this is indicated as $1.5Tn but could widen significantly and we need to work together to address this.

What should we be looking forward to in 2020, and what are the short to medium term priorities of Finastra?

We are looking forward to;

Continuing to open-up Fusion Trade Innovation via FusionFabric.cloud to our clients and Fintech Partners via OpenAPI’s.

Building out our Supply Chain Finance offering to meet our strategy of “One Platform, Two Products”.

Taking our cloud offering and partnering with two key partners to offer Trade as a Service to a new series of clients..Continuing our track record by ensuring that Fusion Trade Innovation will be SWIFT certified for the SWIFT Standards release in November 2020.

As VP of Trade & Supply Chain Finance of Finastra, what is the strategic focus of the company in the short to medium term?

We will continue to develop our offerings via FusionFabric.cloud with our commitment to open up our core platforms and to extend the Trade Digital Ecosystem for our clients.

Our current systems and business architecture will evolve significantly over the next twenty four months, this change is already in flight.

We are defining how we can extend our current product offering into other areas that we view as complementary or extensions, with a number of key partners.

MENA Speciffic

Middle East and North Africa Specific Categories

Best Trade Financier in the Middle East and North Africa – First Abu Dhabi Bank

FAB is the largest bank in the UAE by total assets and market capitalisation, with the strongest combined credit ratings of any other bank in MENA.

“FAB is proud to receive the “Best Trade Financier in MENA” award from the Trade Finance Global and BAFT team. This award, recognises our efforts in developing bespoke, innovative solutions for our clients in supporting their diverse trade needs. We continue to develop our products and offerings both in traditional trade as well as in the open account space which will be offered to our clients digitally and in a simplified manner.”

– Manoj Menon, SMD & Head of Global Transaction Banking, Global Head of Trade

2019 Highlights

• We are recognised as one of the safest and strongest banks worldwide (Global Finance- Safest Bank rankings: #1 in the UAE & MEA, #4 in emerging markets, #22 safest commercial bank worldwide)

• FAB has been ranked 71st out of 500 banks in terms of brand value- which is equivalent to USD 4.02 billion (Brand Finance report)

• FAB is rated as one of the top 1000 banks worldwide (The Banker: #1 in UAE by tier 1 capital strength, #2 in MEA by tier 1 capital strength, #86 globally by tier 1 capital strength, #108 globally by total assets)

What are the biggest challenges that First Abu Dhabi Bank faces in relation to international trade or finance right now?

• 2019 marked another year of growth for FAB, despite challenging market conditions regionally and internationally.

• The Group’s solid financial results for the full year of 2019 are testament to the strength of our leading corporate and retail businesses, and demonstrate clear progress in our strategy as we continue to better serve our clients in the UAE and across our global network.

• FAB’s diversified business model, strong financial profile, and leading role as a strategic partner to Abu Dhabi’s economic growth and diversification plans, position us well to successfully navigate an ever-evolving economic and regulatory landscape, and transform challenges into opportunities

• In 2020 the outlook is cautious due to persistent market uncertainties: global market pressures and impact caused by COVID-19 virus, general slow-down of world economy

What should we be looking forward to in 2020, and what are the short to medium term priorities of First Abu Dhabi Bank?

• Maintaining cost and risk discipline

• Strengthening our leading position in the UAE by growing market share in chosen segments, and deepening client relationships

• Enhancing and rolling out product capabilities across our global network to support fee-based business, client flow activity, and cross-sell

• Accelerate growth in strategically-targeted markets

• Continuing to invest in key strategic and digital initiatives to support business growth and efficiencies

What is the strategic focus for First Abu Dhabi Bank in the short to medium term?

• Our vision is to create value for our customers, employees, shareholders and communities to grow stronger through differentiation, agility and innovation.

• As a leading and responsible bank, our long-standing commitment to sustainable finance is firmly embedded in our business model and strategy.

• As the UAE approaches its Golden Jubilee, FAB will continue to be a key partner to support the government’s long term sustainable growth agenda, and help build a better world for future generations

• Looking ahead, we remain firmly committed to maximising shareholder returns, and supporting our employees, customers and the communities we operate within as we grow stronger, together

Best Trade Financier in Africa

Trade and Development Bank

TDB helps to foster trade, regional integration and sustainable development through trade & project finance

“We are honoured to have been recognized among the best players in the African trade finance industry. It is a testament to our dedicated board, exceptional management team and talented professionals’ commitment to drive quality growth and impact in our region. We look forward to continue working to develop innovative world-class solutions to further bridge the trade finance gap, and deliver triple returns for our partners, clients and shareholders.”

– Admassu Tadesse, President and Chief Executive

2019 Case Studies and Highlights

Examples in trade finance:

- TDB’s $22M sugar blockchain trade finance transaction whereby 50,000 tons of white cane sugar was shipped from India to Ethiopia, with a Singapore-based trader and supplier, Agrocorp. TDB was the first African DFI to close a trade finance transaction using blockchain technology. It is also the first sugar trade finance deal completed via blockchain globally, and the largest single-trade transaction to date to have been completed by dltledgers, the world’s largest production blockchain platform for global trade finance, via which TDB has been able to close the transaction.

- TDB’s $300M structured trade finance facility to facilitate the import of refined fuel products to Mozambique. TDB acted as sole arranging and funding bank in the facility and our quick execution of the facility under extremely tight timelines was able to avert a fuel supply shortage in the country.

What are the biggest challenges that TDB faces in relation to international trade or finance right now?

Overall Africa’s share in global trade is still less than 5%. Along with other challenges, for example in infrastructure and availability of foreign exchange reserves, lower levels of development of the African banking sector and skills available on its market, are barriers to the expansion of intra and extra-African trade.

Likewise, an increasing number of large correspondent international banks are responding to the call of regulators and shareholders to reduce risks, and as a result severing relationship with African banks, and in some cases, closing shop in Africa.

Africa’s trade finance deficit is estimated by the International Chamber of Commerce at US $110 billion to $120 billion – representing about 25 per cent of the demand for trade finance in Africa.

It is both an opportunity for, and the duty of African investment-grade banks such as TDB to play a greater role in facilitating and de-risking trade finance in more challenging environments, through innovative solutions, which will ultimately serve to reduce the trade finance gap.

As such, working with trusted partners and clients from around the globe and in the region, TDB has become the ideal intermediary for global and regional capital in the region.

Along with significant increases in levels of disposable income on the continent, African trade has come a long way, increasing almost 5-fold as compared to 2001 as a result of diminishing transaction costs including tariffs, opening of financial borders, and mostly, of the reality of the ‘Africa rising’ story. Much remains to be done but there is reason to be optimistic about the future of African trade and development as a whole.

What should we be looking forward to in 2020, and what are the short to medium term priorities of TDB?

Our current Corporate Plan VI (2018-2022) lays out the strategic and corporate objectives of the bank, which are to continue mobilizing resources to support growth in trade and development financing for a range of priority sectors. The Bank will be looking for its financing and interventions to advance greater development impact and address inclusiveness and sustainable growth in the region, with a focus on economic transformation through infrastructure, enterprise and trade financing, including in growth sectors such as agriculture and manufacturing.

In 2020 we will take stock of our progress towards achievement of these strategic objectives while continuing to execute our current pipeline to deliver sustainable, high impact interventions.

As President and Chief Executive of TDB, what is the strategic focus of the company in the short to medium term?

Our trade finance business has three primary strategic drivers. First, leveraging our investment grade credit rating, we are expanding our Financial Institution strategy to provide funded and unfunded solutions to address the African trade financing gap caused by the pullback of funding by global banks. Second, we are partnering with strategic suppliers selling into or exporting out of our Member States, to ensure the availability of vital commodities and the growth of foreign exchange earning export industries. Third, we are advancing introduction of open account trade solutions such as receivables financing and invoice discounting. Through these strategic objectives, we intend to facilitate greater intra and inter-African trade, facilitate increased regional integration and position our business to capitalize on future opportunities arising for secular industry trends.

Best Islamic Financier

International Islamic Trade Finance Corporation

ITFC is the leading provider of trade solutions for OIC Member Countries’ needs.

“ITFC’s overarching goals are directly aligned with the UN SDGs. Our mandate is to advance trade and improve lives in all OIC member nations.”

– Eng. Hani Salem Sonbol, CEO

2019 Highlights

In 2019 the cumulative trade finance approvals reached US$51 billion while disbursements stood at US$40.6 billion, with trade support extended to the critical sectors of Energy, Agriculture, and SMEs, among others. At the same time, total cumulative funds mobilized from partner banks and financial institutions reached US$31billion, reflecting ITFC’s crucial role as a catalyst to attract funding for the Member Countries’ large-ticket trade transactions.

On the trade finance side, ITFC extended trade financing to governments, private & public sector companies, and Small & Medium Enterprises (SMEs) through lines of financing extended to local and regional Banks. In 2019, ITFC continued to extend financing to a number of Member Countries under multi-year framework agreements for many of the large-ticket sovereign clients.

In the area of trade development, the Corporation extended its services, technical assistance and capacity building activities through various programs some of which were launched in 2018 such as: (i) Indonesia Coffee Export Development Program; (ii) West Africa SME Program; (iii) ; and (iv) The Gambia Aflatoxin Project.

What are the biggest challenges that ITFC faces in relation to international trade or finance right now?

The slow growth of Global Trade:

Because of the high degree of uncertainty associated with trade forecasts under the current circumstances, the estimated growth rate of global trade in 2019 has been within the range of 0.5 percent to 1.6 percent. Member countries of the Organization of Islamic Cooperation (OIC) have also had their share in declining growth rate projections. The average overall GDP growth of the Member is at 2.7 percent in 2019 lower than the 3.4 percent growth in 2018

The fall in energy commodities prices:

The negative outlook is expected to continue to 2020 in most of the commodity prices as stated by the World Bank in its recent statement end of October 2019. After falling sharply in 2019, energy and metal prices will continue to fall due to weak global growth expectations and the consequent decline in demand. According to the bank’s experts, crude oil prices are expected to average $ 60 a barrel in 2019 and then fall to $ 58 a barrel in 2020. These forecasts are $ 6 and $ 7 a barrel lower than expected in their statement in Q1 2019. Overall, energy prices, which also include natural gas and coal, fell by about 15% in 2019 compared to 2018 and continue to fall in 2020.

The fall in agriculture commodity prices

Agricultural commodity prices fell in 2019 but expected to stabilize in 2020. Resolving trade tensions could lead to higher prices for some agricultural commodities, such as soybeans and corn, while lower energy prices could lower fuel and fertilizer costs, reducing energy-intensive crops such as oilseeds.

What should we be looking forward to in 2020, and what are the short to medium term priorities of ITFC?

In 2020, ITFC is embarking on offering new products to add to the range of products that are provided to our clients and will witness the launching of innovative Shariah compliant trade financing products.

More intra-regional integration through flagship programs led by ITFC such as the Arab Africa Trade Bridges (AATB) Program and others. To support global and regional initiatives like the African Continental Free Trade Agreement (AfCFTA) and contribute to the SDGs.

Work closer with the strategic partners to alleviate poverty and generating job and employment through women empowerment and youth, SMEs development and food security.

ITFC is now placing emphasis on ‘future-proofing’ the business by exploring new opportunities across Digitalization, Innovation and Trade Advisory. The purpose is to augment ITFCs Vision in the market as the “Leading Provider of Trade Solutions for OIC Member Countries’ Needs”.

What is the strategic focus of ITFC in the short to medium term?

focus on :

- Enhancing Intra-OIC trade

- Contribute to the Growth in Islamic Trade Finance

- Supporting the Diversification of Member Countries Economies (through trade financing)

Specifically, ITFC’s Strategic Objectives are supported through three Strategic Pillars:

Private Sector Development:

-

-

- ITFC’s contribution to private sector development within member countries is significant, given that trade is the most significant driver of economic development.

-

Co-operation between Member Countries:

-

-

- Expanding co-operation between member countries is facilitated by ITFC’s trade solutions, which specifically aims to increase trade between member countries.

-

Islamic Trade Finance Development:

-

- ITFC focuses on developing Islamic Trade Finance solutions both through its own provision of products, as well as by working with local banks to increase their capacity to provide such products.

“ITFC’s overarching goals are directly aligned with the UN SDGs. Our mandate is to advance trade and improve lives in all OIC member nations.

Our goal is to support member countries’ strategic sectors and to improve their trading capacity.

A key component in our strategy is to work through strategic partnerships with key stakeholders with vested interest in the socio-economic development in Member Countries. This allows ITFC to develop Integrated Trade Solutions with Trade Finance and Trade Development components to help remove barriers to trade while providing stronger access to the financing of new trading opportunities. ” – Eng. Hani Salem Sonbol, CEO

MENA Fintech Innovator Award

komgo

komgo provides a blockchain based software to support trade finance execution ins a simple, secure and efficient way

“We are very proud to receive this award that we dedicate to the komgo team and all shareholders. This is a remarkable milestone of our journey”

– Souleïma Baddi, Chief Executive Officer

2019 Highlights

- Closing of second fund raising with 3 new investors

- Opening offices in Asia

- Onboarding more than 100 clients, 20000 LCs and SBLCs opened

What are the biggest challenges that komgo faces in relation to international trade or finance right now?

Lack of adapted regulations on e-documents to fully digitize trade finance

What should we be looking forward to in 2020, and what are the short to medium term priorities of komgo?

- Continue growing the komgo network

- Servicing our clients across all geographies (Americas, EMEA and Asia)

Refining our product offer

As Chief Executive Officer of komgo, what is the strategic focus of the company in the short to medium term?

With an established community of users across Europe and the UK, and growing adoption in Asia and the US, global expansion of the platform that is becoming the central one stop shop in the trade finance community

Methodology and Process

Trade Finance Global (TFG) takes the judging of the International Trade Finance Awards to be a serious matter. In the interests of transparency around the selection process, the methodology is detailed below.

TFG have a team of both in house analysts and external consultants who would’ve conducted a mixture of quantitative and qualitative reviews on a number of trade finance banks and liquidity providers, as well as SAAS companies, fintechs / non-bank liquidity providers, law and insurance firms.

1. TFG announced a ‘call for award nominations’ on the 2nd December 2019, which was published through TFG’s email, social and online channels, as well as BAFT’s channels. Nominations were put forward by both TFG and nominees (i.e., companies self nominating)

2. The award nominations window closed on the 20th December 2019. Nominations that were received were also selected are then sorted into respective award categories. A staff member passed these nominations to the first stage TFG internal judging team and then to an internal member of staff to further judge

3. The TFG judging team, independently of each other, read each of the submissions and decide if it (A) Meets the criteria of the category (B) Is worthy of being a finalist

4. The TFG judging team grades each submission 1 to 5 (with 5 being the most suitable for the finalist list). The first stage judges pass on the top five nominations for each category to the steering committee. If there are less than five entries all nominations go on to the second stage of judging

5. The above marking criteria (point 4) was based on a mixture of, public information on deal volumes, and transactions numbers by market, as well as the company’s ability develop innovative finance structures and products in the changing market

6. TFG also looked at public reviews on client satisfaction, the quality of, and content produced (on site) around their products, as well as brand share in the category, looking extensively at social coverage and brand advocacy

7. The TFG steering committee members then take part in the judging process, selecting winners from the shortlist. The steering committee board members are industry experts from the field and academia in structured trade and commodity finance, fintech and technology or law. A staff member sends an information guide of the finalist selections to each advisory board member for each award category they have selected to judge

The steering committee comprised of:

- Sean Edwards, ITFA

- Cecile Andre Leruste, Accenture

- Peter Mulroy, FCI

- Rudolf Putz, EBRD

- Alisa DiCaprio, R3

- Erik Timmermans, WOA

- Johanna Wissing, Lloyds Bank

- Robert Besseling, ExxAfrica

- Silja Calac, ITFA, SwissRe

- Harri Rantanen, Standardised Trust

- Emmanuelle Ganne, WTO

- David Bischof, ICC Banking Commission

- Vinco David, Berne Union

- Stacey Facter, BAFT

- Ian Sayers, International Trade Center

- Dr. Benedict Oramah, Afreximbank

- Ziyang Fan, World Economic Forum

8. With attention to confidentiality, the awards submissions are returned to TFG staff members who sorted the information. Data is then cleaned (any conflicts of interest or votes being abstained)

9. In the unlikely event of a tie following the second stage of judging, the tie will be broken by an impartial industry expert on the TFG staff or contributing editorial board

10. TFG collates quotes and assets from the winning companies under embargo, for release on the 19 March 2020

See the full terms and conditions here.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.