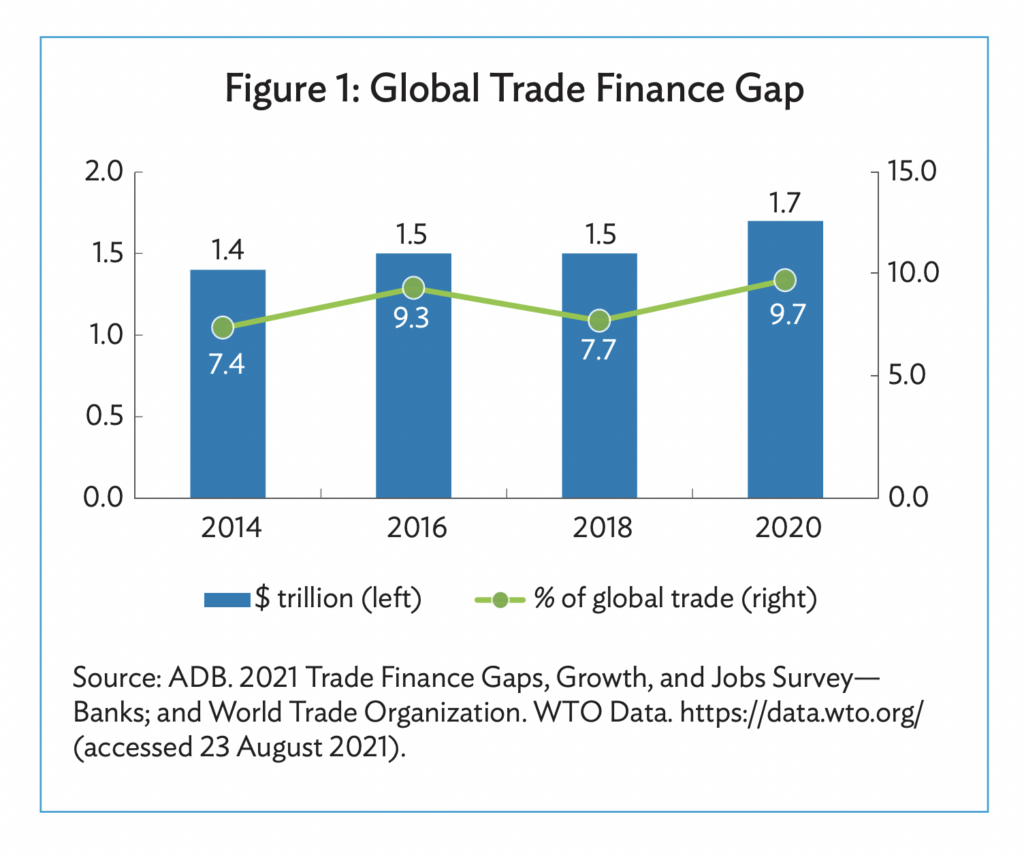

The global trade finance gap hit a new all-time high of $1.7 trillion in 2020, eclipsing its previous high of $1.5 trillion recorded in 2018, says a new report from the Asian Development Bank (ADB).

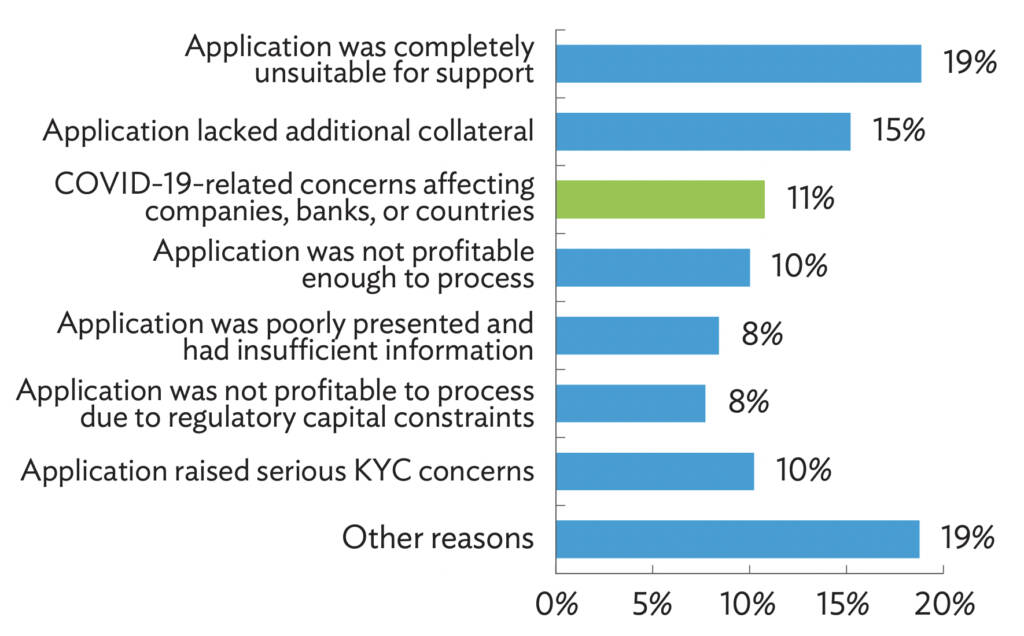

Supply shocks and economic uncertainty due to COVID-19 have exacerbated the trade finance gap worldwide, the report found, resulting in a surge of rejected trade finance applications during the pandemic.

In its report, published today, ADB found that small and medium-sized enterprises (SMEs) were the hardest hit during the pandemic, accounting for 40% of rejected trade finance requests.

Likewise, women-owned SMEs faced difficulties accessing trade finance, with 70% of their applications reported as totally or partially rejected.

Steven Beck, head of trade and supply chain finance at ADB, spoke with Trade Finance Global (TFG) about the findings of the report.

“Trade is critical for the global economy to recover from the pandemic, but the financing shortfall makes it much harder to create jobs and growth,” he said.

“Moreover, the data for this study was accumulated nine months ago, before the huge spike in energy and food prices.

“This will exacerbate the gap significantly, as each deal will use up more of what country and counterparty limits exist to support trade, reducing capacity to support other deals.

“Importantly, energy and food consume a lot of the poor’s income, and this has to be a major concern.”

Bank interventions

According to the report, banks took extra measures to support SMEs, with 27% reporting that they offered debt moratoriums, and 23% increasing capital availability levels.

ADB also offered such support, with its trade and supply chain businesses increasing their transaction volumes by 50% in 2020.

They also and expect to process more than 7,000 transactions worth a combined $6 billion in 2021.

“We’re stepping up, but a lot more needs to be done. We need to draw in the private sector even more than we have been doing,” said Beck.

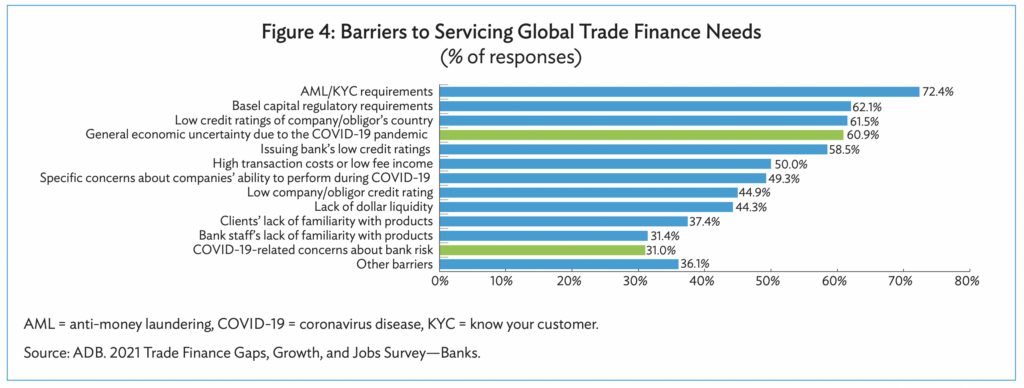

Weaker balance sheets during the pandemic are also thought to have enlarged the trade finance gap, while regulations designed to curb money laundering and fraud continue to pose obstacles to servicing trade finance needs, the survey found (figure 2).

Mark Abrams, head of trade finance at TFG, said: “’This widening of the trade finance gap further highlights the requirement for greater liquidity and trade support, to assist in rebuilding fragile supply chains.”

Drop in applications

The report also found that trade finance applications dropped 9% in 2020, so the $200 billion increase in the trade finance gap is likely a low-ball figure.

Peter Mulroy, secretary-general of the factoring association FCI, said the findings of the ADB survey come as no surprise to him.

“Various FCI members reported a rejection in new business cases initially, especially at the beginning of the pandemic in H1 2021, when no one knew its true severity,” he said.

“However, the factoring community quickly reacted thereafter, with a significant increase in SME applications.

“But even though over two thirds of the industry’s client base are SMEs, there are still so many SMEs under-served, either due to the fact that factoring is not well known, or due to the legal and regulatory infrastructure not being properly in place.”

Credit crunch

Speaking to TFG, Andrew Wilson, global policy director at the International Chamber of Commerce (ICC), voiced his concern that trade finance credit conditions are tightening as a result of COVID-19.

“There is clearly a major risk that shortages of trade credit will place a significant drag on any post-pandemic recovery, further exacerbating supply chain disruptions that are already stoking inflationary pressures in many economies,” said Wilson.

“In the short-term, governments must respond with the necessary urgency to backstop the provision of trade finance to the real economy – with the primary policy objective of enabling trade as a vector of recovery.

“In the mid-term, it’s high-time for a fundamental rethink of how trade finance is recognised and regulated, given its genuine importance to the real economy.”

Hopes of going digital

Chris Southworth, secretary-general of ICC UK, seconded Wilson’s call for a transformation in the way that trade finance is delivered.

“We can fix the trade finance gap and scale solutions if we reform laws to handle trade documents in digital form, find smarter ways of handling compliance bureaucracy, and establish a more proportionate regulatory regime for trade finance, which is low-to-zero risk, but is treated as high risk,” he said.

“Regulators and governments know this, and there is no reason why the trade finance gap is so large, since we know what the solutions are.

“If governments are serious about driving the economic recovery and driving SME growth, then they must act to fix the market.”

As ADB noted in its report, the tightening of trade finance credit during the pandemic led to a downward spiral among smaller lenders, whereby access to trade finance was denied for SMEs outside of the lenders’ most familiar sectors and territories.

As Jolyon Ellwood-Russell, partner at British law firm Simmons & Simmons, told TFG: “There is no doubt that, despite the amount of liquidity in the world if we look at bid prices, the concept of disintermediation – whereby banks retrench to their home markets and primary customers – has only accelerated throughout COVID-19.”

Ellwood-Russell added that the ADB survey does at least offer one consolation, in that the trade finance gap opens up an opportunity for non-bank lenders, private credit, and other fintechs to lend to SMEs, given that such funding is short-term, self-liquidating, and in high demand.

“This is a trend that is emerging. The natural progression of this trend is how these platforms scale,” he said.

“The solutions seem to be coming from the distribution programmes looking to connect SME trade assets to private debt, securitisation models, and indeed banks’ own balance sheet management.”

SMEs, ECAs, and liquidity challenges

As some lenders continue to retrench from the market, export credit agencies (ECAs) are also looking to fill the liquidity gap for SMEs.

As Carl Williamson, head of trade finance at UK Export Finance, told TFG: “SMEs have faced major liquidity challenges during the pandemic, but international markets remain open for businesses.

“ECA-backed finance is key to bridging the trade finance gap, as some lenders retreat from riskier markets.

“Trade credit insurance and bond support are also in high demand, as exporters want to secure and fulfill existing contracts.

“We will continue to work with lenders and brokers to ensure capital continues to flow as the UK recovers from the pandemic.”

Alexander Malaket, president at OPUS Advisory Services International Inc., added: “The latest survey results are sobering, given that trade and SMEs will both be critical to global economic recovery post-COVID-19.

“This is a clear call to action for policymakers, practitioners, innovators, and other stakeholders to redouble our efforts to narrow the trade finance gap.

“The inclusion imperative, underscored by increasing attention to sustainability and ESG in trade, further highlights the role of multi-laterals in addressing market gaps, including access to timely, affordable trade financing for SMEs and developing markets.”

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.