Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 34

Host: Deepesh Patel, Editor, Trade Finance Global

Featuring: Nick Barnes, Manager of the Marco Polo Business Network, TradeIX

Simon Ring, Global Market of Financial Markets Compliance, Pole Star

Today we’re delighted to be joined by Simon Ring at Pole Star and Nick Barnes at TradeIX and the Marco Polo Network. This podcast is really about the intersection between freight forwarding, trade and regulatory technology.

Deepesh Patel (DP): Today we’re delighted to be joined by Simon Ring at Pole Star and Nick Barnes at TradeIX and the Marco Polo Network. This podcast is really about the intersection between freight forwarding, trade and regulatory technology. So I’m going to start with a quick introduction. So Nick, great to have you on the show. Can you please introduce yourself?

Nick Barnes (NB): My name is Nick Barnes. I am the Manager of the Marco Polo business network, with TradeIX. My role within TradeIX is to holistically manage the development and the propagation of the Marco Polo Network and to provide the operational support to enable this.

DP: Thanks very much, Nick. Simon, over to you.

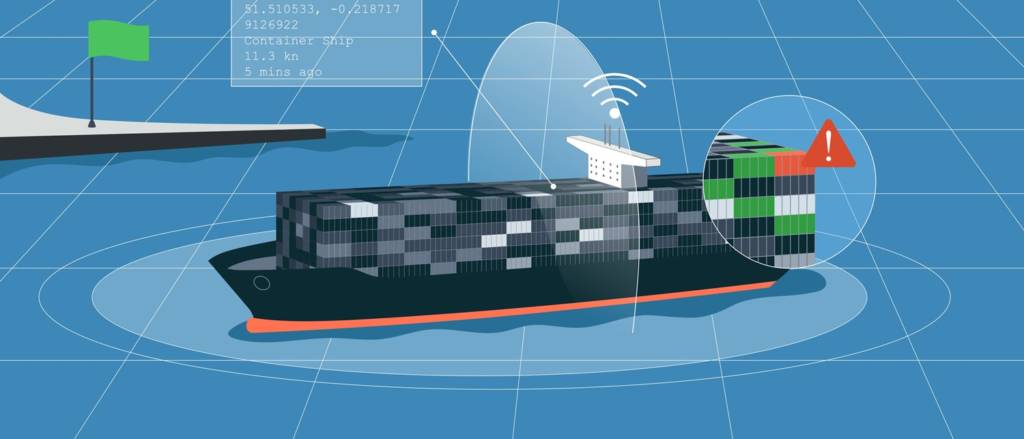

Simon Ring (SR): I’m Simon Ring, from a company called Pole Star Global. We’re one of the world’s leading maritime technology companies and I head up our financial markets and regulatory technology systems called PurpleTRAC. These are systems and solutions that were built with the commodity and trade financing banks, trading companies around the world and these aim to automate and streamline and record complex compliance processes; saving time and money. The company itself operates across many different dimensions in the maritime sector, we have around 1100 shipping companies that use our technologies, over 50 governments, flag administrations and an ever-increasing number of actors and players in the trade and financing sectors.

DP: Thank you very much, Simon. So Nick, the very exciting announcement this week, which was a partnership between the Marco Polo Network and Pole Star. Can you explain to our listeners, what this partnership is about?

NB: So the partnership with Pole Star is very exciting to me because one of the aims of the Marco Polo Network is to grow the use of trade finance, and with that, you are growing the volumes. Now, when you’re growing the volumes of trade finance, there is only so much that can be done manually and in a truly compliant way. With the solutions that Pole Star provides, this allows our banks and corporates to have access to a solution to this problem. To continue to be able to process more transactions and do more business whilst at the same time not having to dramatically increase headcount.

Marco Polo, Corda and R3 – What is the connection?

DP: Great. So I think let’s take things back to the basics. So what is TradeIX? What is Marco Polo? What is Corda and what is R3?

NB: We’ll start with the Marco Polo Network. So the Marco Polo Network is a network of connected banks, corporates, insurance providers, logistics providers, and technology providers, such as Pole Star. The aim of the network is to allow interconnectivity; connect to once to connect to many. In order to facilitate this, TradeIX is the developer and the technology provider on the network. Now, overarching all of this, Marco Polo is built on R3’s Corda solution. Corda is a distributed ledger technology (DLT), that has proven popular and the headline solution in the financial services industry. R3 is the developer of Corda.

DP: Okay, that makes a lot more sense now and thank you very much. Simon, why this strategic partnership?

SR: I think there are a few key things. Nick and his team have been speaking with our team for well over a year now, we have been working quietly behind the scenes. While it is nice to work with like-minded people, there are a few more core things that we recognised from the get-go. Paper-based trade faces many complexities, and that’s the reason why there is so much disruption in these areas. The idea that no single company is going to fix these big industry issues is now a given. Our alliance partners; Dow Jones, in conjunction with the TradeIX teams; Marco Polo, the banks and R3 have been key in making this announcement. I think lastly, is the realisation that our technologies and the technologies of Marco Polo are in fact very similar. What trade needs is automation, it needs speed, it needs to be streamlined, a lot of it needs to be recorded and shared, and these are shared principles between our companies, and the cornerstone foundations of PurpleTRAC’s systems.

FinTech and the Regulatory Hurdles in Trade

DP: Thanks very much. So Nick, what are the current trends in reg technology and how can technology help overcome some of the compliance regulatory hurdles?

NB: Compliance and regulatory hurdles move in a ratchet – they jump and never go backwards. So essentially, what’s happening then is that you move to a position where you can no longer throw more people at the problem; it becomes not only inefficient, but it just doesn’t get you any further.

So, from my perspective, the current trend is around looking for technologies that can be designed and integrated into workflows in such a way that it’s not the IT equivalent of an ‘in and out tray’; where you got processes and decisions that happen within an orchestration in a traffic light ‘yes/no’ fashion – if you provide someone with a 30 page report to someone who’s processing a trade finance transaction, you’re just increasing the workload; there isn’t an overarching yes green or no red light. So from my perspective, that’s the overall trend.

The next theme is the convergence of multiple data sources and perhaps looking at sort of compliance by consensus, where you’re not dealing with a single source anymore; you’re dealing with multiple versions of the same source across the network. And that’s really one of the aims of the Marco Polo Network.

DP: Thanks very much. Simon, how does the technology actually work in real life, between banks, traders, and financiers?

SR: The reality of our alliance collaboration is built around the fact that 90% of everything on our planet is moved by shipping. On the other hand, regulators recognise that shipping is the primary method of moving illicit goods. We have thus seen an enormous increase in regulatory focus on all areas of maritime trade and supply chains; not just banks, but the corporates that are importing and exporting goods, the insurers, and flag administrators – there’s been a real sea change (excuse the pun) and you can see that from most of the major regulators!

Our system (PurpleTRAC) has been in existence for 4 years now and has users in the top tier banks, commodity trading, trade financing institutions, and a growing number of supply chain institutions that suffer from regulatory exposures. What good RegTech should do is aggregate data, make things faster, automated and recordable. By also understanding that the trade financing community has different risk parameters, our technology has been built to match those bespoke risk parameters and make a process that is complex something that is simple, fast and doable in seconds. And the reality of that speed and automation is very much in line with the Marco Polo ethos, hence the partnership.

Marco Polo Network in Action

DP: So let’s say I’m a large commodity trader, and I currently use PurpleTRAC to track my goods, undertake KYC and do my due diligence, how can this partnership help?

SR: In the first part, you must have a screening process that the banks go through; vessel screening is now a binary process for most institutions. The reality of engineering a solution around screening a vessel before you engage with it is key. And then there’s the monitoring of that transaction; so if you’re the bank financing or the trader trading, the reality of monitoring that vessel is not just around the logistics, but also being able to monitor the regulatory status of the ownership and the management around it, during the transaction. And of course, it’s vital to be able to record that in an automated fashion. That’s how people will use our systems. And I think one of the reasons this partnership works extremely well, in terms of our collaboration with TradeIX and Marco Polo is based on the fact that we can turn complex processes into automated ones and provide the banks on the Marco Polo network stop-go results in seconds.

DP: Okay, so I’m going to play devil’s advocate here. Are people concerned about the peer to peer nature of DLT, and also the idea that you could be sharing competitive data on the same network?

NB: Marco Polo / R3 is permissioned across the network in a peer to peer fashion. As a company or financier, you will need to dictate what data gets shared. So when you start dealing with numerous partners involved in certain processes such as a payables solution, where there’s a bank that is financing payables along the way, the ability to stipulate what is being shared is vital. The reason why we’re interested in Pole Star as a technology provider is because a binary ‘stop no’ is vital for these processes; all it needs to say is a ‘yes / no’ from a party within the transaction. And that’s all that needs to be shared – not even shared on the network – it’s just whether or not they wish for it to be shared with other participants in a transaction.

Challenges in the Cargo Shipping Landscape

DP: Simon, what are the other wider challenges you see within the cargo ship landscape?

SR: As we mentioned earlier on, that there is a focus now across the whole supply chains in the maritime sector, which have a cause and effect. Somebody told me recently that financial market regulations change, on average, every seven or eight minutes! And it’s a very complex landscape. We deal a lot with regulators as well as listening to our customers. So at Pole Star, we have a very good idea of what people need to do in terms of these third party regulations and exposures, and we’ve got a pretty good functionality roadmap of what we think will be coming in the future. And coming back to the integration with Marco Polo, it’s important that your technology keeps the pace of complex regulatory change. The primary driver for what we are doing is keeping things simple. For example, if a bank is using our technologies, we are giving them the ability to use our test nodes on Corda which are already built and available for testing. The reality is, nobody knows how fast the migrations will happen from current business as usual to the Marco Polo platform. This provides a single service solution that is API enabled.

The Importance of Collaboration in the Maritime Compliance

DP: Is a bank who is not already on the Marco Polo Network, but already using Pole Star’s technology able to get started?

NB: You need to be a member of Marco Polo, from a legal standpoint, in this case. The great news though is that the systems are independent but work together. If you’re a bank and you have deals with a participant that is on Marco Polo, but if there’s a certain jurisdiction that they have to use another bank for, there’s nothing to stop them at the bank using PurpleTRAC. This flexibility is important from a developer’s perspective, particularly if there is a titanic shift in the maritime compliance space, one, we are most probably not going to know about it as quickly as Pole Star would, two, if it’s a bespoke solution within my network, I then got to fit that in with our other priorities. Moving forward, that is why collaboration is so important.

SR: Just to add to that, what we’ve seen recently, for example, is US treasury, OFAC, issuing advisories. So advisories incorporate shipping company’s names of vessels – these won’t be captured by your normal screening solutions, because they’re not designated entities. So the idea that we can work in collaboration with Dow Jones on those kind of data requirements for banks is really where these collaborations really work. We can define those parameters and people can choose whether they want to screen against those advisories for non designated entities or not.

ROI in TradeTech Space

DP: So Simon, what’s next? How do banks and traders demonstrate ROI through this partnership?

SR: ROI and compliance – there’s a subject matter that’s been going around for a long time! I think the reality is, that with all of the concepts, all the disruption we’re seeing in all areas of trade and financing, there is a reality that speed and automation in processes are going to save a lot of time and money. When you get into the world of screening and logistics, there’s a huge amount of can be done that supports the financing programmes of banks, and we think that having the banks within Marco Polo talking to us about these issues around this will make this whole process much more simplistic and faster to achieve.

DP: Thanks! That was one of the key points that came out of our DLT for Trade Whitepaper that we launched towards the end of last year – the industry does still operate in silos, and the more we can increase collaboration between the different verticals, the better. One final question, Nick, what are the key takeaways you would like our listeners to take away from this podcast with regards to this partnership?

NB: Don’t be afraid to be open and collaborate. Don’t think that one solution can do absolutely everything for everyone. This is a new way of working and it’s something that a lot of partners have to get used to because if we don’t start looking at networks and how we’re able to interoperate with each other, we’re going to be taking people out of day to day operations into maintaining bespoke connections between solutions. Whereas when we are in a collaborative space within a network, you’re able to really have that ability to connect once to connect to many, which can affect your operations in an extremely positive fashion.

DP: Thank you very much. I think partnership and collaboration is certainly something that we at TFG will be reporting on quite a lot in the next 12 months!

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.