Invoice finance is a type of asset backed finance, where the underlying asset is the accounts receivable. Accounts receivable essentially means ‘money owed’ and is usually through the form of invoices.

The difference between invoice factoring and receivables-backed asset based loans

There are two ways to fund invoices: sale (invoice factoring) and through revolving credit lines. Firstly, an invoice can be sold to a financing company; a bank, a factoring company, or a specialist lender. The factor will buy the invoices and pay for up to 80% of their value straight away.

Secondly, a company can access a ‘revolving credit line’ which is essentially an asset backed loan from a factor.

These two invoice financing methods are quite different in process but the end result (faster payment using accounts receivable as security) is very much the same.

What is factoring and why is it suitable for small businesses?

Invoice factoring accounts for the majority of asset backed finance. A type of invoice financing, factoring allows businesses to sell their accounts receivable up front to a financier. The immediate benefits of this include improving working capital and cash flow within a business, rather than waiting 30-90 days (sometimes even 180 days) for payment from customers.

Factoring requires much less process than getting a bank loan or overdraft facility because the underlying asset is the invoice, rather than an assessment of a businesses ability to repay an unsecured loan. The most important qualifying criteria for invoice factoring is the credit rating of the supplier (or end customer); these are normally larger corporates with strong creditworthiness and a good trading history.

Invoice factoring is good for small and medium enterprises (SMEs) who have only recently started trading as the risk lies with the end debtors (large corporates or blue chip organisations).

What is an asset backed loan?

Asset based loans allow businesses to access finance which are backed on securities such as invoices, equipment and stock. Asset based loans are used by businesses to fund their accounts receivables, and are often considered a midpoint type of financing between bank loans and invoice factoring.

Asset backed loans are quite different from invoice factoring as they have an element on unsecured asset, rather than one single invoice or asset. For this reason, asset based loans take slightly longer to secure when compared to invoice factoring, but it’s still faster than getting a term loan from a bank. Asset backed loans or asset based finance is generally available for mid-sized companies with a turnover in excess of £3m per year, requiring around £1m.

How does an asset based loan work?

Asset based loans work in a similar way to a line of credit or a recurring overdraft facility. A company can draw down funds that a financier provides and pays the line down once the end customers pay the invoices issued. The total amount that is normally available to draw down stands at around 80-90% of the total value of receivables (i.e., equipment + total outstanding invoices + other assets).

As you can see, receivables-backed asset based loans can substantially increase the value of the line of credit, which can be beneficial for a capital intensive business (e.g. manufacturing companies which might have multiple blue chip clients and invoices issued as well as tangible assets such as machinery).

To access asset based loans, companies will be required to fill out a borrowing certificate or form which determines the amount they are eligible to borrow, based on their existing assets. Total amount available to borrow is normally calculated by the following:

Total line of credit = [Outstanding goods receivable + other tangible assets] – ineligible assets

In summary, asset based loans work as follows:

-

- Company fills out a borrowing certificate or form outlining all outstanding assets (such as unpaid invoices and assets)

- Funder calculates amount eligible and offers a line of credit

- Funder verifies the credit status of the end customers and the value of the assets

- Funder will normally request a financial audit and credit check to be undertaken on the company requesting the line of credit

- If the end customer is creditworthy, factor covers 80-90% of the total value of outstanding assets

- Customer has access to the credit line, which is drawn down each time outstanding assets are paid for, less administrative fees and charges

Should I use invoice factoring or an asset based loans for my accounts receivables?

Invoice factoring is a fast way to pay for one-off invoices quickly, relying at the creditworthiness of the end customer to advance payments to small and medium enterprises. Asset backed loans on the other hand are for more complex requirements, combining accounts receivable to access a line of credit from a bank.

To find out more about invoice finance, read our guide on the different types here.

Should I use invoice factoring or an asset based loans for my accounts receivables?

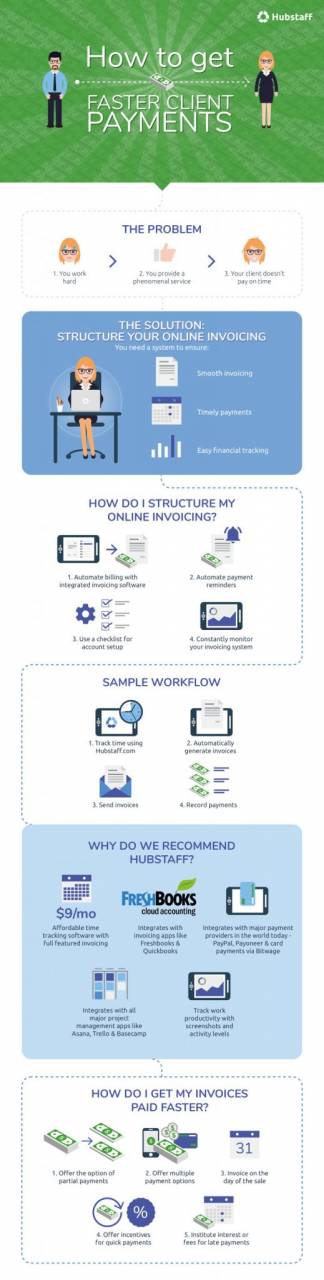

We spoke to Hubstaff to get some insight on other ways SMEs can get paid faster. As well as invoice financing, there are simple measures around communications, early payment incentives, interest rate charges, and automation to speed up payments.

Here is their infographic:

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.