International Commerce Terms (Incoterms®) 2020 Rules

What are Incoterms?

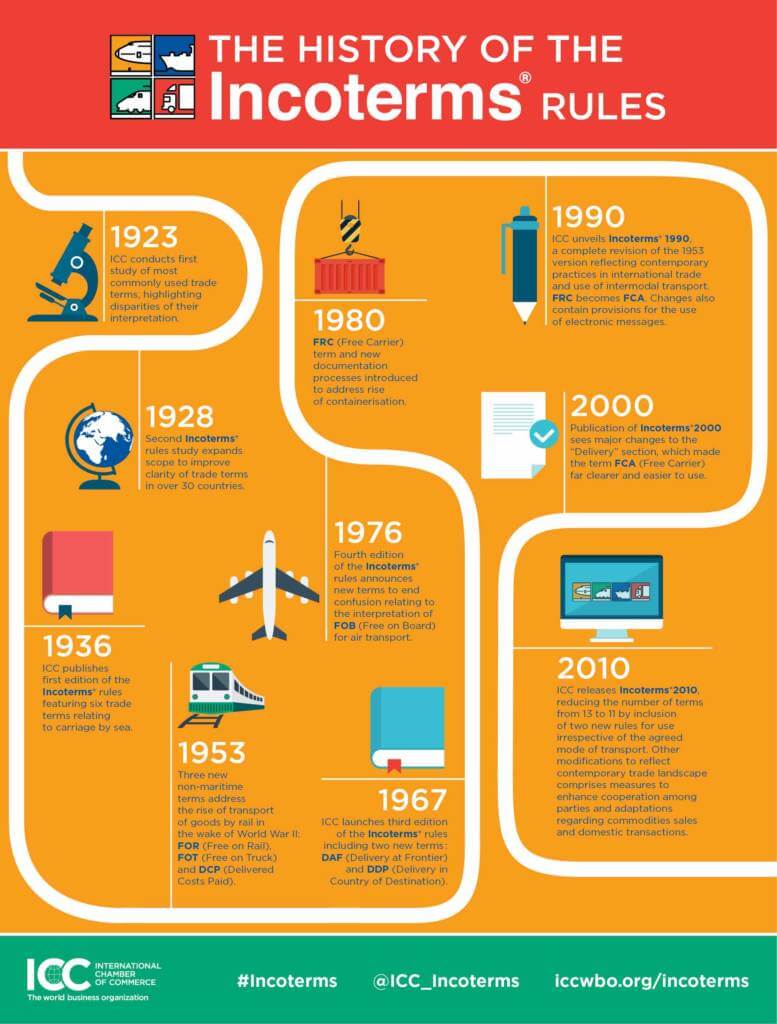

Incoterms, short for International Commerce Terms, represent a standardized set of terminology universally recognized in the field of freight forwarding. Established by the International Chamber of Commerce (ICC) in 1936, these terms define crucial aspects of international trade. Our concise guide summarises the 11 revised Incoterms for 2020 (as defined by the ICC Incoterms Drafting Committee).

Incoterms 2020

This comprehensive guide, authored by Bob Ronai CDCS, a member of the ICC’s Incoterms® 2020 Drafting Group, in collaboration with Trade Finance Global (TFG), offers a succinct overview of each Incoterms® 2020 rule. With one page dedicated to each rule, this guide provides essential insights into the significance of Incoterms® Rules.

Download the free PDF now

Introduction to Incoterms Rules

Incoterms 2020 Rules play a key role for anyone engaged in the global supply chain, including traders, producers, buyers, sellers, governments, and banks.

The language established by Incoterms guidance covers critical areas of international commerce, encompassing tasks in shipping, contractual parties, risk responsibilities, goods delivery, insurance duties, and customs and taxes.

Download free PDF now

The main purpose of Incoterms is to provide a uniform, constant and authentic interpretation of the commercial terms of delivery of goods, most frequently used in International transactions, and, by means of their application, removing any uncertainty due to divergent interpretations.

By providing a uniform framework, Incoterms facilitate fair cost and risk sharing among operators from different countries with distinct legislations.

The application of Incoterms is discretionary, requiring mutual agreement between parties in advance through specific contract mentions.

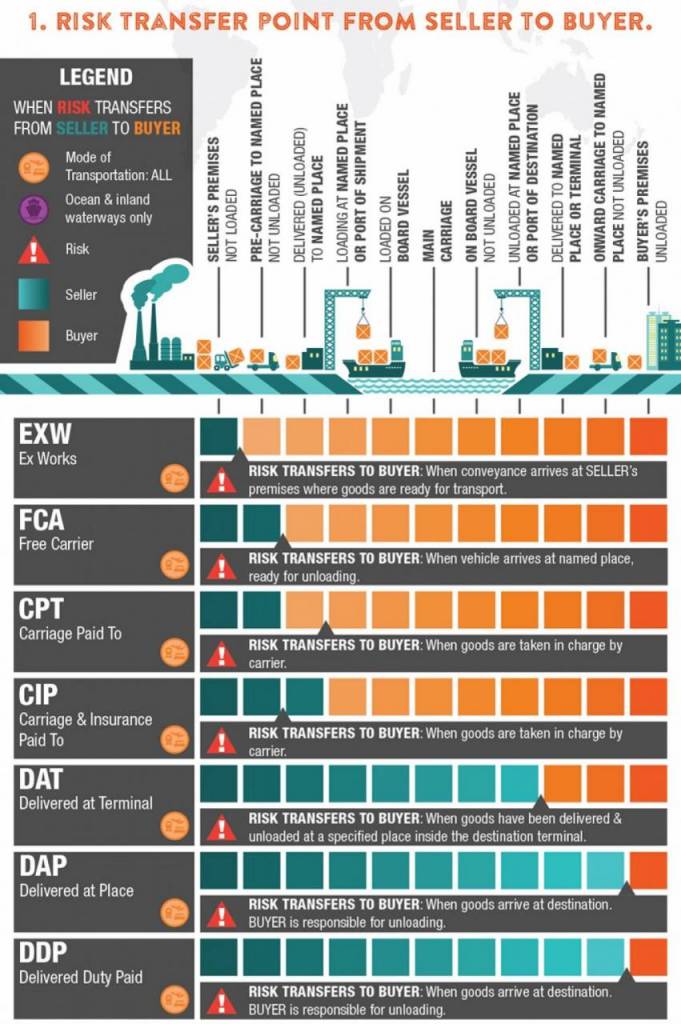

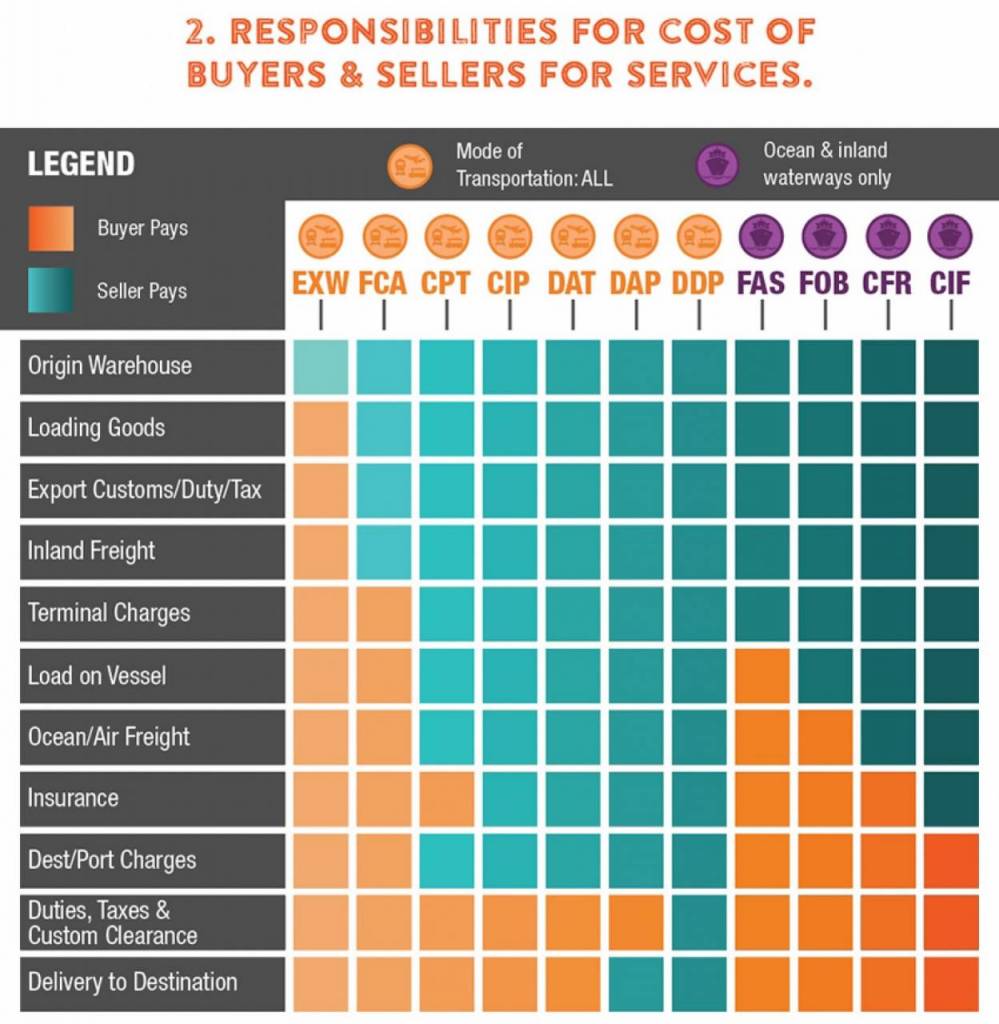

The four key “moments” identified for Incoterms’ action and function include determining:

- Who pays for the main transport?

- Where does the delivery take place?

- Where and when the risk is transferred from the Seller to the Buyer?

- Who bears all the fees arising from transport (i.e. issue of documents, unloading of goods at destination, customs clearance when necessary, insurance of goods etc.)

Incoterms 2020 – 7 Key Changes & Updates

Incoterms 2020 introduces seven key changes and updates. While the fundamental substance remains consistent, these subtle adjustments are important for trade specialists to understand.

Here are the key differences between Incoterms 2010 and Incoterms 2020:

1. DAT Incoterm changed to DPU (Delivery at Place Unloaded)

After several rounds of consultation, the Drafting Group removed the word ’terminal’ as it often caused confusion, and so changed to ‘place unloaded’. As such, it was decided to change the term to DPU (Delivery at Place Unloaded), to broadly cover ‘any place, whether covered or not’.

2. Insurance cover differs between CIF and CIP

Under CIF / CIP, the seller buys insurance for the buyer. In Incoterms® 2010, insurance is required under Cargo Clause (C), but in Incoterms® 2020, CIP requires insurance complying with Institute Cargo Clause (A).

Why the change in clauses? Clause A covers a more comprehensive higher level of insurance (e.g. for the manufactured goods), whereas a lower level of cover from Clause C would more likely apply to the commodities world.

3. The Listing of Costs

All costs are now listed in the ‘Allocation of Costs’ sections for each rule, to avoid confusions. These now appear in the A9/B9 section of each rule (as the ordering of articles within the Incoterms 2020 rules has changed).

In the 2010 Incoterms®, costs were a key issue. Carriers often changed their pricing structure to deal with add ons and sellers were often surprised by being back charged terminal handling charges.

The A9 sections in the Incoterms rules guide now collects together the costs, with the principle aim of clearly stating the costs to each party.

4. Security Requirements

Cargo security has been particularly important since 9/11, and the 2020 rules now address many of the security-related requirements that became so prevalent in the early part of this century.

From a carriage requirements perspective, security related allocations have been added to A4 and A7 of each Incoterms rule, and the necessary costs associated have been added to A9/B9 (see 3).

5. Own transport

Incoterms 2010 rules assumed that goods carried from the seller to the buyer were via a 3rd party. Incoterms 2020 allows for own means of transport by the buyer in the FCA rules and by the seller in the D rules.

6. FCA and Bills of lading

According to FCA, part B4, ‘The buyer must contract or arrange at its own cost for the carriage of the goods’. There is a gap in delivery between FCA and FOB. If you’re selling FCA, your delivery point is different to FOB. The difference between FCA and FOB to the seller is a significant cost and risk. In the 2010 Incoterms rules, exporters of goods in containers were encouraged to use FCA, which seemed best for both parties.

Why were people using FOB instead of FCA? Even sophisticated sellers said they wanted to use FOB, because a standard Letter of Credit requires an onboard Bill of Lading (BoL) to be presented. Therefore the sellers were often taking the risk and using FOB instead, because they wanted to get paid under the LC.

The Incoterms® 2020 FCA extra provision now states that if the parties have so agreed, the buyer must instruct the carrier to issue to the seller, at the buyers cost and risk, a transport document stating that the goods have been loaded (such as a BoL with an on board notation).

7. Presentation and design

Incoterms® 2020 rules have more extensive explanatory notes and improved diagrams, with a different structure for users and a reordering of rules to make delivery and risk more obvious.

Maritime related rules still haven’t changed and remain at the back of the rule book as they still might be used for bulk commodities.

Rule by Rule

EXW – Ex Works

Ex Works (EXW) is the term used to describe the delivery of goods to an available designation at their place of business, normally in their factory, offices or warehouse.

The seller does not need to then load items onto a truck or ship, and the remainder of the shipment is the responsibility of the buyer (e.g. overseas shipment and customs duty). EXW is therefore more favourable to the seller as they do not need to worry about the freight once it has left their premises.

FCA – Free Carrier

Unlike EXW, Free Carrier pushes the responsibility of delivering the goods to the buyers nominated premises onto the seller, so they have to organise shipping and various export documents.

CPT – Carriage Paid To

“Carriage Paid To”, or CPT, goes into a little more detail than FCA, specifying that the seller bears the costs for transporting the goods to the nominated place that the buyer requests.

Carriage Paid To can be used in any transport mode, and the risk transfers from the seller to the buyer as soon as the goods reach the nominated destination and the carrier takes charge of these.

CIP – Carriage Insurance Paid To

“Carriage and Insurance Paid to”, or CPI, specifies that the seller needs to pay the costs of transport as well as the insurance cover for the goods in transit (by any transport mode) to the destination named by the buyer.

In terms of level of insurance, the cover level can be minimum, defined by the ICC’s INCO Terms, and should they request a higher level of insurance, this would need to be agreed on the contract.

The risk is then transferred from the seller onto the buyer once the goods reach the nominated point.

DAP – Delivered At Place

“Delivered at Place”, or DAP, can also be used for any mode of transport. An extension of DAT, the seller delivers the goods at a named destination, specified by the buyer, although under the ICC rules, the unloading of the goods are the responsibility of the buyer.

The buyer is also required to sort out duties and taxes, as well as clearing the goods through customs.

DPU – Delivered at Place Unloaded

“Delivered at Place Unloaded”, or DPU, can be used for any mode of transport. The seller delivers the goods and transfers the risk to the buyer when goods once unloaded from the arriving means of transport are placed at the disposal of the buyer at a named destination at the agreed point within that place. The seller bears all risks involved in bringing the goods to and unloading them at the named place of destination. Therefore the delivery and arrival at the destination are the same.

DDP – Delivered Duty Paid

“Delivered Duty Paid”, or DDP, can be used for any mode of transport. The seller delivers the goods and transfers the risk to the buyer when the goods are placed at the disposal of the buyer, cleared for import, on the arriving means of transport, ready for unloading at the named place of destination. The seller bears all risks involved in bringing the goods to the named place of destination or to the agreed point within that place.

FAS – Free Alongside Ship

“Free Alongside Ship”, or FAS, is used in situations when the seller can place the goods alongside other non-containerised goods (e.g. on a vessel or barge).

The seller might do this if they have access to sea or inland waterway routes and want to place the goods en route to the buyer alongside other goods on the ship. It’s not recommended for goods that can be placed in a container (more on this below, see FCA).

The risk of transporting the goods ‘alongside ship’ move from the seller to the buyer once the goods are delivered to a terminal or port and unloaded.

FOB – Free On Board

“Free On Board”, or FOB, occurs when the seller delivers the goods to the port of shipment, at which then it becomes the responsibility of the buyer once unloaded onto a vessel. If the goods are damaged when on board the vessel, it’s the responsibility of the buyer.

CFR – Cost and Freight

“Cost and Freight”, or CFR, incurs more risk and responsibility onto the seller. The seller delivers the goods up and takes all responsibility and cost right up until the ship has docked at the end point and the goods have been unloaded. The seller will also cover the cost of insurance at atleast the minimum level.

CIF – Cost, Insurance and Freight

“Cost, Insurance and Freight”, also known as CIF, is also restricted to sea or inland waterway modes of transport. In this case, the seller insures the goods transported up until they arrive at the port, but it becomes the responsibility of the buyer (in terms of risk and insurance).

Incoterms 2020 Rules PDF

A comprehensive 96 page guide on Incoterms® 2020, to be used in conjunction with The International Chamber of Commerce’s (ICC) new book, INCOTERMS® 2020.

Written by Bob Ronai CDCS, a member of the ICC’s Incoterms® 2020 Drafting Group, in partnership with Trade Finance Global (TFG). This 94 page guide provides an article by article commentary on Incoterms® 2020.

- Introduction and layout of the rules

- A1 / B1: GENERAL OBLIGATIONS

- A2 / B2: DELIVERY

- A3 / B3: TRANSFER OF RISK

- A4 / B4: CARRIAGE

- A5 / B5: INSURANCE

- A6 / B6: DELIVERY/TRANSPORT DOCUMENT

- A7 / B7: EXPORT/IMPORT CLEARANCE

- A8 / B8: CHECKING / PACKAGING / MARKING

- A9 / B9: ALLOCATION OF COSTS

- A10 / B10: NOTICES

- Advantages and Disadvantages of each rule and whether they work with LCs

- Rules for Any Mode or Modes of Transport

- Rules for Sea and Inland Waterway Transport

- Conclusions

Transfer of Risk in Incoterms

The subject of Incoterms is restricted to the aspects relating to the rights and obligations of the parties, Seller and Buyer, of a commercial contract with reference to the delivery of the goods.

It is essential for the Seller / Exporter not to misunderstand the actual application of Incoterms 2020 that refer to the sales contract and NOT to the transport contract, even though, in order to make a sale of goods, there are correlations with aspects and contracts that will be finalized later, such as transport, insurance, financing etc.

It is furthermore important to keep in mind that Incoterms shall not be considered “laws” as their legal effect lies in the will of both parties to opt for them in their commercial transactions by making explicit written mention on.

In short, Incoterms 2020:

- are optional rules, not laws;

- do not affect the transport contract, as they relate with the sales contract;

- do not concern the property transfer or any other sales right;

- do not govern all of the obligations undertaken by the parties of a sales contract, as they are confined to the delivery of the goods;

- do not concern the breach of the contract, with the relevant consequences for the party in breach.

ICC, i.e. the International Chamber of Commerce, grouped the obligations of the Seller and the Buyer in 10 points, marked by the “A”, for the Seller, and by the letter “B”, for the Buyer, so that each point (title) related with the Seller, under the letter “A”, matches with the position of the Buyer, under the letter “B”.

Obligations of the parties under Incoterms 2020

| Seller’s obligations | Buyer’s obligations |

| A 1. General obligations | B 1. General obligations |

| A 2. Delivery | B 2. Taking Delivery |

| A 3. Transfer of risks | B 3. Transfer of risks |

| A 4. Carriage | B 4. Carriage |

| A 5. Insurance | B 5. Insurance |

| A 6. Delivery / transport document | B 6. Proof of Delivery |

| A 7. Export / import clearance | B 7. Export / import clearance |

| A 8. Checking / packaging / marking | B 8. Checking / packaging / marking |

| A 9. Allocation of costs | B 9. Allocation of costs |

| A 10. Notices | B 10. Notices |

Therefore, the obligations governed by the Incoterms 2020 are the following:

- the Seller shall make the goods available for the Buyer, or his carrier, for transportation and delivery to the agreed destination.

- the breakdown of the risks between Seller and Buyer, as for the transportation of goods from the place of origin to the final destination.

- the obligation to clear customs in export and import.

- the obligation by the Buyer to take over the goods

Although Incoterms deal with a large number of specific obligations, they do not govern the following aspects:

- transfer of property or any other sales right;

- breach of the contract, with the relevant consequences for the party in the breach;

- liabilities, financial conditions in connection with the execution of the main legal transaction;

Incoterms 2020 do not belong to “international contracts”. Instead, they only refer to the sales contract signed the Seller and the Buyer.

Incoterms Diagrams

Incoterms Videos

Introduction to Incoterms

Incoterms – Origins and History

Incoterms® 2020 – Key Changes

Incoterms® Top Tips

Download our free Incoterms guide

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.