Receivables Finance

Welcome to TFG’s receivables finance hub. Find out how our team can help your company unlock working capital from accounts receivable financing, on both a recourse and non-recourse basis. Alternatively, learn more about the different types of receivables and receivables finance: be that from a discounting or factoring perspective, or through our latest research, information and insights, right here, in our receivables finance hub.

What is receivables finance?

Receivables finance is a tool that businesses can use to free up working capital which is tied up in unpaid invoices. Receivables loans work for businesses in the case where unpaid invoices (accounts receivable) are used as collateral to release working capital, either as an asset sale or a receivables loan. A funder (bank, alternative lender, factoring company) are usually the facilitators in this.

Sellers face a major problem when buyers prolong their invoice payment for weeks or even months in some cases. In addition to running the risk of buyers not giving them full payment at the due date of the invoice, sellers must also fill the cash flow gaps that occur during this period.

Receivables finance offers a simple yet effective way out of this tricky financial situation for the sellers. It allows them to sell their outstanding invoices to finance providers or factors at a discounted rate. This way, sellers receive the remaining invoice amount before the due date of the invoice. The factors get their money back at invoice maturity through the sellers, acting as collecting agents, or directly from the debtors.

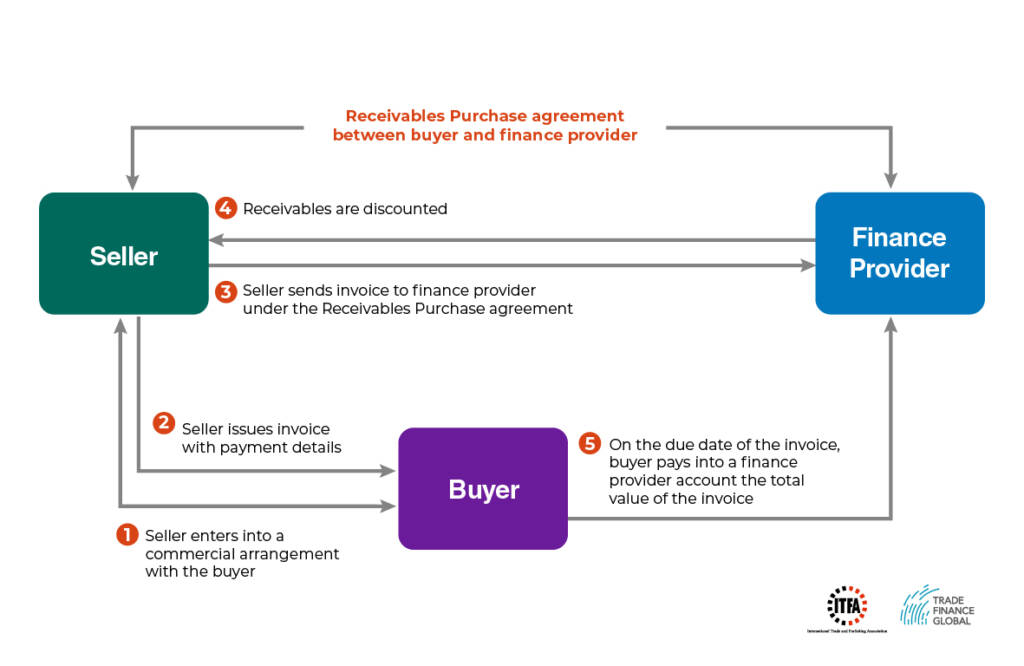

Diagram: How receivables finance actually works

We teamed up with the International Trade & Forfaiting Association (ITFA) to put together this diagram on how a receivables purchase agreement works between a buyer and a finance provider

Sellers deliver goods and services to buyers and request that lenders fund the outstanding invoices. The factors (financers) look at the invoice, perform the cost and benefit analysis and evaluate the risks of debtors before providing a cost of finance to the seller; or putting a finance facility in place.

What are the common forms of receivable financing?

Receivables finance takes many forms, but usually, the true sale (where there is no recourse to the supplier) is seen as receivables purchase. Once a facility is set up and the seller elects to discount or sell a receivable, the buyer pays the seller a nominal amount at a discounted rate known as receivables discounting. The remaining invoice amount is collected at the due date of the invoice by the seller and given to the factor. The diagram above illustrates how receivables factoring operates.

How can receivables finance benefit my business?

Is factoring receivables a good idea for your business? Here are some of the key benefits of receivables finance:

- The receivables financier will sometimes take on the responsibility to look after your sales ledger which means more time to focus on the business

- A receivables financier will conduct know-your-customer or due diligence on clients and suppliers, in order to assess and price any possible risk of default

- Receivables discounting can also be done in a confidential manner (confidential receivables discounting), which means that your clients won’t know that you are using a discounting facility; one for consideration when it comes to reputation

- Receivables finance can also help businesses grow their trade lines and fulfil customer orders without having to worry about working capital and cash flow cycles

How can TFG help?

The TFG receivables finance team works with the key decision-makers at over 270 banks, funds and alternative lenders globally, assisting companies in accessing receivables finance facilities.

Our team are here to help you scale up to take advantage of both your domestic and international customers. We have product specialists based around the world, from automotive and vehicles, to media and data.

Often the financing solution that our clients may require can be complicated, and it’s our job is to help you find the appropriate receivables solutions for your business.

Read more about Trade Finance Global and our team.

Receivables Finance - Client Case Studies

Get started – talk to our team

Contact Information

If you have an receivables finance enquiry, please use the contact form.

Otherwise, you can reach us on the email addresses below.

Trade Finance Global

201 Haverstock Hill

Second Floor

London

NW3 4QG

Telephone: +44 (0) 2071181027

Receivables Finance Enquiries

Want to learn more about receivables finance?

Look no further! Here you can find our latest features, receivables research and trending articles in the world of accounts receivables finance. So put your feet up, and dig in to the latest thought leadership and interviews from the TFG, listen to podcasts and digest the top stories in the world of receivables finance right below.

From the Editor - Receivables Finance Insights

PODCAST | FCI’s Neal Harm on kicking off inclusive growth in the factoring industry – To better understand the principles of financial inclusion, equitable regulation, and sustainable growth in the factoring industry, Trade Finance Global’s (TFG) Deepesh Patel spoke with new FCI Secretary General, Neal Harm.

PODCAST | FCI’s Neal Harm on kicking off inclusive growth in the factoring industry – To better understand the principles of financial inclusion, equitable regulation, and sustainable growth in the factoring industry, Trade Finance Global’s (TFG) Deepesh Patel spoke with new FCI Secretary General, Neal Harm.  Football, factoring and fraud: Kicking out the bad actors, creating rules and standards – Factoring, invoice financing, and open account methods are vital for the global economy, aiding businesses in managing cash flow & liquidity.

Football, factoring and fraud: Kicking out the bad actors, creating rules and standards – Factoring, invoice financing, and open account methods are vital for the global economy, aiding businesses in managing cash flow & liquidity. The role of asset-backed securitisation: Can it bridge the financing gap for micro and SMEs? – In the world of finance for micro and small and medium-sized enterprises (SMEs), there’s a clear division between two crucial groups: Capital Deployers and Capital Providers. On one side, we have micro, small, and medium enterprises in emerging markets, brimming with potential due to growing local demand and export opportunities.

The role of asset-backed securitisation: Can it bridge the financing gap for micro and SMEs? – In the world of finance for micro and small and medium-sized enterprises (SMEs), there’s a clear division between two crucial groups: Capital Deployers and Capital Providers. On one side, we have micro, small, and medium enterprises in emerging markets, brimming with potential due to growing local demand and export opportunities. Latest Insights

Videos - Receivables Finance

Invoice Finance Podcasts

Receivables Finance - Frequently Asked Questions

Receivables finance includes factoring and discounting.

Factoring is present when a business assigns their invoices to a third party and the factoring company has full visibility of the sales ledger and will collect the debts when due.

- The customer has knowledge that the invoices have been factored. (This is the typical route a lot of funders offer, however – some can offer Confidential Factoring)

- Factoring gives businesses up to 90% pre-payment against submitted invoices

- This enables improved cashflow, and reduces the need to wait for payment

- The company may receive their funds up to two days after invoices are sent out. Many factoring companies will offer to send money same day (TT Payment, usually carries a charge) or by BACS (Free)

- A business can choose a ‘selective’ factoring or invoice discounting facility, dependent on the funder.

Typically, with Invoice Discounting, the borrower will have more control over their ledger. Again – like factoring, there is the option to do this on a completely confidential basis.

- Invoice discounting is an alternative way of drawing money against the invoices of a business

- The business retains control over the administration of their sales ledger

- Invoice discounting usually involves a company reconciling with their invoice financier monthly

- With factoring – each individual invoice is uploaded – with Invoice Discounting, a bulk figure is uploaded and then drawn down against with the monthly reconciliations showing where money is allotted to

- Under a selective facility a business can opt to factor (i.e. lend) or invoice discount just some of the submitted invoices

- A selective facility is a good option if a business needs a certain amount of cashflow guaranteed each month or if one or two customers are good payers.

The main difference between factoring and invoice discounting is that with factoring, a funder will have full visibility of your sales ledger and maintain this by chasing debts on your behalf. Invoice discounting on the other hand, allows you to keep your credit control in house but as we already discussed, it would require a monthly reconciliation with the invoice financier. Naturally, management fees for invoice discounting are usually a lot lower, however a company must demonstrate they have the correct procedures in place to support an Invoice Discounting facility.

Factoring solutions offer the seller of a receivable a wider service than just the advance of funds to shorten its cash conversion cycle as the entity buying the receivable will also usually take on the responsibility of collecting the debt.

Factoring can take several forms. For example, a factor may agree, subject to limits, to buy the whole of a seller’s receivables. This is known as whole turn-over factoring. Conversely, a factor may select which invoices he wishes to buy. It can be with or without recourse to the seller and may or may not be notified to the buyer or obligor.

The vast majority of factoring is domestic and individual invoices are often of a low value. Cross-border factoring is possible using the two-factor system. One factor is in the buyer’s country (known as the ‘Import Factor’) and the other in the seller’s country (known as the ‘Export Factor’). The two Factors establish a contractual or correspondent relationship to service the buyer and the seller respectively under which the Import Factor in effect, guarantees the receipt of funds from the importer and remits payment to the Export Factor. Typically, the two factors use an established framework such as the General Rules for International Factoring (GRIF), provided by FCI. Read more about factoring here.

Receivables discounting solutions tend to focus on shortening a seller’s cash conversion cycle, as opposed to encompassing debt management and collection aspects. The degree of disclosure to the debtor under this type of facility varies, ranging from full disclosure to no-disclosure, depending on the level of comfort taken by the purchaser of the receivables over the nature and standing of the seller. In most cases, the greater the control the financing entity/purchaser of the receivables manages to attain over the process, the better the discounting conditions offered.

A receivables discounting facility without disclosure to the debtor will grant the seller of the receivables full confidentiality, and therefore avoid reputational hazards. Most receivables discounting is without recourse to the seller so as to ensure de-recognition of the receivables from the seller’s balance sheet (so-called “true sale”) but recourse is normally retained for commercial dispute e.g. where the buyer refuses to pay because the goods or service are defective. Read more about invoice discounting here.

- Sellers do not have to wait for the payment of invoice as factors pay invoices before invoice maturity at desirable discounts.

- The early sale of receivables diminishes the risk positions associated with debtors.

- Sellers are able to better manage their cashflow and do not have to worry about bridging liquidity gaps as receivables finance helps to free trapped liquidity.

- Receivables factoring allows firms to expand their business by allowing debtors prolonged credit terms.

- Sellers also receive insightful advice from factors about the credit strength of the debtors which assists them in striking better deals in future.

- Receivables finance includes the translation of a company’s debts into cash without having any unwanted effects on the company’s business.

- Profit from goods is reduced as the factor deducts a certain amount from the value of accounts due to be received, as fees for the service provided. In addition to this, interest is also charged on the advance made in some cases, which results in a loss of profit on the final amount.

- Risks such as the credit wellness of the factor are beyond the control of the seller. A factor may withdraw credit advances due to poor credit ratings of a party in question.

- Following the discounting of a receivable, the seller is no longer due the receipt of a payment from the customer. The seller also has no control over the book debts. This asset can no longer be provided as collateral while acquiring another type of finance.

- In the case of recourse factoring, the seller’s liability is not completely waived. If a financier is unable to recover their debt from the factor, then they are legally entitled to obtain it from the seller. This leaves the seller liable to pay the factor, in case of non-payment. Such a situation would impact business projects already under execution.

- Factors comes at a cost and may be more expensive than other forms of finance.

- The buyer may not be willing to involve a third party factor or lender, due to their professional and strict dealing methods. Agencies send weekly reminders to the buyers for their debt, which will result in loss of personal touch that may present a negative image of the seller. Due to this the buyer may consider switching vendors which will be damaging to the seller.

Rather than waiting 30 – 90 days, an invoice financier can pay for most of the invoice amount up front, and the interest rate is the amount charged for this service. Interest rates are often linked to base rates the bank will pay for borrowing money, such as the LIBOR, as well as a management fee.

At first instance, receivables finance lenders can advance around 90% of the invoice amount value up front, whether that be through invoice discounting or factoring. Once the invoices are paid by the end customer, the borrower will be paid the remaining difference, excluding interest rate and management fees. Even if the company has existing finance arrangements such as an existing bank loan or overdraft, invoice discounting or factoring may still work for a business.

Normally, a lender will analyse the business prior to implementing a factoring or invoice finance facility. They may audit the financial records of the business and list the approved customers, and the decision is down to legal and contractual implications such as security and existing lenders.

The company should always read the offer letter and look at all (including the following) costs:

- Discount costs

- Service or management fees (including the minimum service fee which is normally derived as a % of the service fee)

- Audit charges

- Re-factoring charges

- Transactional costs

- Notice period for ending service and associated fees

- Annual service costs

- Trust account costs

- Additional costs for services such as credit protection

Receivables Finance Insights

PODCAST | FCI’s Neal Harm on kicking off inclusive growth in the factoring industry – To better understand the principles of financial inclusion, equitable regulation, and sustainable growth in the factoring industry, Trade Finance Global’s (TFG) Deepesh Patel spoke with new FCI Secretary General, Neal Harm.

PODCAST | FCI’s Neal Harm on kicking off inclusive growth in the factoring industry – To better understand the principles of financial inclusion, equitable regulation, and sustainable growth in the factoring industry, Trade Finance Global’s (TFG) Deepesh Patel spoke with new FCI Secretary General, Neal Harm.  Football, factoring and fraud: Kicking out the bad actors, creating rules and standards – Factoring, invoice financing, and open account methods are vital for the global economy, aiding businesses in managing cash flow & liquidity.

Football, factoring and fraud: Kicking out the bad actors, creating rules and standards – Factoring, invoice financing, and open account methods are vital for the global economy, aiding businesses in managing cash flow & liquidity. The role of asset-backed securitisation: Can it bridge the financing gap for micro and SMEs? – In the world of finance for micro and small and medium-sized enterprises (SMEs), there’s a clear division between two crucial groups: Capital Deployers and Capital Providers. On one side, we have micro, small, and medium enterprises in emerging markets, brimming with potential due to growing local demand and export opportunities.

The role of asset-backed securitisation: Can it bridge the financing gap for micro and SMEs? – In the world of finance for micro and small and medium-sized enterprises (SMEs), there’s a clear division between two crucial groups: Capital Deployers and Capital Providers. On one side, we have micro, small, and medium enterprises in emerging markets, brimming with potential due to growing local demand and export opportunities.  VIDEO | From the boardroom: FCI reflections on receivables finance and factoring – In this video, Neal Harm, (incoming) Secretary General of FCI, sat down with Peter Mulroy, (outgoing) Secretary General of FCI and Daniela Bonzanini, (outgoing) FCI Chairwoman reflect on the organisation’s evolution, strategic initiatives, and the future of factoring.

VIDEO | From the boardroom: FCI reflections on receivables finance and factoring – In this video, Neal Harm, (incoming) Secretary General of FCI, sat down with Peter Mulroy, (outgoing) Secretary General of FCI and Daniela Bonzanini, (outgoing) FCI Chairwoman reflect on the organisation’s evolution, strategic initiatives, and the future of factoring. Video | UNIDROIT’s Model Law on Factoring and IFC’s Knowledge Guide in Marrakech – The FCI 55th Annual Meeting in Marrakech marked an important moment in receivables finance as the International Institute for the Unification of Private Law (UNIDROIT) launched the Model Law on Factoring.

Video | UNIDROIT’s Model Law on Factoring and IFC’s Knowledge Guide in Marrakech – The FCI 55th Annual Meeting in Marrakech marked an important moment in receivables finance as the International Institute for the Unification of Private Law (UNIDROIT) launched the Model Law on Factoring.  FCI scores hat-trick in Marrakesh: A giant leap for factoring – FCI, the global representative body for the factoring and receivables finance industry, has achieved a significant milestone by securing three major agreements during its annual meeting in Marrakesh.

FCI scores hat-trick in Marrakesh: A giant leap for factoring – FCI, the global representative body for the factoring and receivables finance industry, has achieved a significant milestone by securing three major agreements during its annual meeting in Marrakesh.There are three parties involved directly in receivables finance:

- the funder who advances money against the invoice or receivable

- the business (or customer) who sends out the invoice

- and the debtor who is required to pay for the invoice

A brief explanation: The receivable, associated with the invoice for services or goods acts as an asset and provides the company the legal right to collect money from the debtor. A percentage of funds are then advanced against the value of the invoice.

Key Case Study: Receivables Finance

Virtual Creators is a hardware start-up that is looking to expand its business. This firm sells its goods in mass quantities to online and brick & mortar retailers. They produce their goods in Shenzhen and have recently moved to a new producer in the region. Virtual Inc does not have any prior affiliation with this new manufacturer. The latter does not offer trade credit and requires immediate payment on the arrival of goods at the U.S. port.

Virtual Creators keeps its gross margins fixed at 40% at wholesale to their retail buyers. However, the retailers do not pay before the end of 60-day period after getting the product. Virtual Inc depends upon receivables finance to generate the cash required for the immediate payment that its manufacturer needs upon the arrival of goods at the U.S. port.

Strategic Partners:

Get in touch with our Receivables Finance team

Invoice Finance Hub – Contents

Invoice and Receivables Finance Hub

Download our free receivables finance guide

Our receivables finance partner

Latest News

FCI releases preliminary World Factoring Statistics, showing subdued growth

0 Comments

ITFA to Provide Members with MARA, open account distribution framework developed by HSBC

0 Comments

PODCAST | FCI’s Neal Harm on kicking off inclusive growth in the factoring industry

0 Comments

Prime Bank signs factoring agreement with FCI to support Bangladesh exports

0 Comments

Football, factoring and fraud: Kicking out the bad actors, creating rules and standards

0 Comments

The role of asset-backed securitisation: Can it bridge the financing gap for micro and SMEs?

0 Comments

VIDEO | From the boardroom: FCI reflections on receivables finance and factoring

0 Comments

Video | UNIDROIT’s Model Law on Factoring and IFC’s Knowledge Guide in Marrakech

0 Comments

ICISA releases top 2022 trade credit insurance highlights

0 Comments

FCI scores hat-trick in Marrakesh: A giant leap for factoring

0 Comments

Navigating the future of B2B commerce: A conversation with HSBC’s Vinay Mendonca

0 Comments

A common credit insurance hub: The solution to streamline credit insurance?

0 Comments

VOXPOP | Live from Sibos, with Ravesh Lala, IBM

0 Comments

Trade Finance Global, in collaboration with FCI, announces a forthcoming livestream, “Desert Dialogues: Pulse Check on Receivables Finance.”

0 Comments

Introducing Aida: TradeLedger’s GenAI solution to receivables and working capital management

0 Comments

Cash is king, and helping suppliers may be in buyers’ best interest

0 Comments

Is trade and receivables finance the new home for private credit?

0 Comments

Tradecast – Desert dialogues: Pulse check on receivables finance

0 Comments

Bridging the trade finance gap: Absa’s digital journey in Africa

0 Comments

The evolution of Supply Chain Finance: From banks to distribution

0 Comments

FAB and Alfanar extend trade finance reach in KSA with supply chain finance programme

0 Comments

Breaking: FCI releases World Factoring Statistics survey, reports double-digit growth

0 Comments

PODCAST | Breaking: First cross-border factoring facility between Armenia and Georgia supported by EBRD

0 Comments

Barclays and TransferMate partner to launch international receivables solutions for UK businesses

0 Comments

PODCAST | Factoring in the UAE: Developments and global implications

0 Comments

Factoring landscape in Georgia: What is next?

0 Comments

Evolution of electronic invoicing: watch for the explosive growth

0 Comments

HSBC sees APAC corporates shifting to local supply chains

0 Comments

PODCAST | Trade and receivables finance, in football terms

0 Comments

Marco Polo Network runs insolvent with €5.2m debts

0 Comments

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom