Estimated reading time: 9 minutes

Usance (or deferred) letters of credit (LC) are a specific type of LC payable at a predetermined time period.

When Letters of Credit were first introduced, there were a number of specific Letters of Credit that developed.

This is a short guide about usance or deferred LCs.

On this page

How does a letter of credit work?

What are usance letters of credit?

Why should SMEs use usance letters of credit?

Usance letter of credit and sight letter of credit – what’s the difference?

When will a usance letter of credit be used?

Letter of Credit Explained

Before we get into usance or deferred letters of credit, let’s first recap what a normal letter of credit is. If you’re an importer or an exporter, you will probably want your goods and cash to be as safe as possible during a trade transaction.

To protect against non-payment or non-delivery, one of the best ways to reduce your risk in a trade transaction is to use a letter of credit.

Letters of credit are legally-binding financial instruments that are issued by banks or specialist trade finance institutions to ensure that payment is made for goods received.

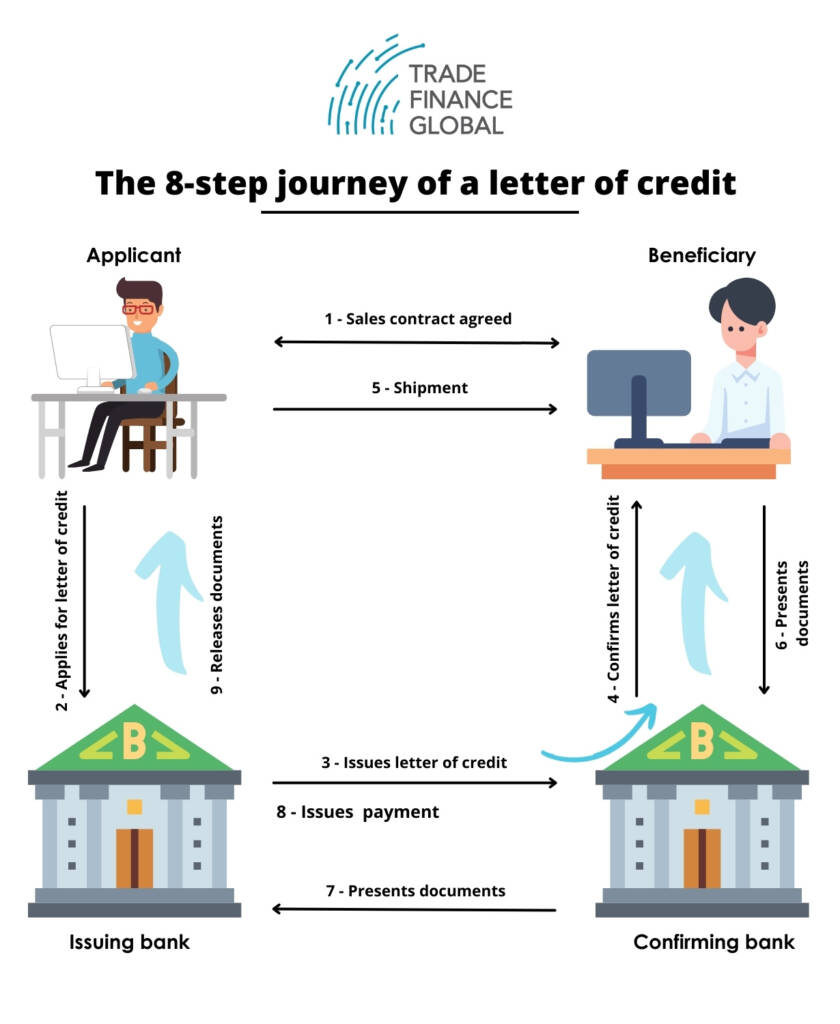

Let’s suppose that an importer wants to purchase goods from an exporter in a trade transaction. To secure the transaction using a letter of credit, the importer can apply for a letter of credit from an ‘issuing bank’ (so called because this is the bank that will issue the letter of credit).

Meanwhile, the exporter must get in touch with a ‘confirming bank’ – so called because this is the bank that will confirm the letter of credit on the seller’s behalf. (This bank is also known as the ‘advising bank’.)

When the terms set out in the letter of credit are met – such as receipt of goods or bills of lading – then the issuing bank is legally obliged to issue payment for the goods to the confirming bank.

Put simply, a letter of credit helps ensure that the seller will get paid, as long as the terms specified in the letter of credit are met.

This reduces the risk to the importer (the buyer), and increases security for the exporter (the seller) – and as a trading business, that’s exactly what you want.

Usance Letters of Credit Explained

A usance or deferred letter of credit is a type of letter of credit used often in trade finance whereby the issuing bank must make payment by a preset date.

Once a sale contract is agreed upon between a buyer and a seller, the buyer can request that a letter of credit be used to secure the transaction.

The buyer will nominate their bank of choice (the issuing bank) and the seller can nominate their own bank (the confirming bank).

The terms are negotiated between buyer and seller, including the delivery date and the description of goods being sold.

If using a deferred or usance letter of credit, this means that the payment will be made by the issuing bank at a preset date, and after the relevant documents are presented.

The date of payment is set either after the bills of lading are confirmed upon shipment, or when the issuing bank receives confirming documents and is typically set at 90 days.

Once the seller ships the goods, they send confirmation of shipping with the letter of credit to their confirming bank, which will review the documents and send them to the buyer’s issuing bank.

Once the issuing bank and buyer have reviewed and confirmed the documentation, the issuing bank must pay the confirming bank within the time period set out in the letter of credit, while deducting a fee (or ‘advising charge’) for itself.

On the seller’s side, there is the option to negotiate payment discounting, which allows the seller to receive payment faster.

In such cases, the confirming bank will release the payment to the seller ahead of the deferred payment date but will deduct a greater percentage fee for itself.

SMEs and Usance Letters of Credit

Cross-border trade can be risky, but using a letter of credit can help facilitate trust in transactions, both during shipping and in the payment stage of the trade.

Letters of credit are widely recognised by banks worldwide, and using one should help you safely complete cross-border transactions.

Buyer:

If you are the buyer, using a letter of credit provides evidence that you can make payment to the seller, which increases trust between you and the seller.

Sellers are more likely to stick to the letter of credit’s terms and conditions, making it more likely that your business plan will run on time and the goods you purchase will be in the condition required for your business needs.

And if the seller doesn’t or can’t meet the conditions stipulated in your letter of credit, you won’t be legally obliged to issue payment at all.

Using a deferred letter of credit makes cash flow management even easier, because it gives you more time to pay for the goods, and therefore more time to utilise those goods for sale, which frees up working capital.

Seller:

If you are the seller, you will receive payment for your goods shipped as and when the terms specified in the letter of credit are met.

If the terms are met, then the buyer’s issuing bank is legally obliged to pay you even if the buyer changes the order, cancels the order, goes bankrupt, or refuses to pay.

By using a deferred letter of credit, you are sure to receive the payment by a certain date, so that you can plan your business with a more certain cash flow.

If your buyer offers long payment terms, or has previously made late payments, then this can be extremely useful for you from a security point of view.

Better still, the letter of credit itself can be used as collateral in the meantime, to finance working capital loans that can help cover production and shipping costs.

Sellers can also add the option of discounting, whereby they agree to receive a slightly lower payment for the transaction, albeit at an earlier date.

Usance letter of credit and sight letter of credit – the difference

A usance or a deferred letter of credit (LC) is also known as a time or term LC.

Thus, it will be an LC that is payable at a predetermined point once its conditions are fulfilled and the confirming documents are presented.

The simplest way to understand a usance or deferred LC is to compare it to a sight LC;

Sight LCs are a variation where funds are transferred to the supplier once the confirming documents are submitted.

Where a usance LC is used, once the issuing bank receives documents that comply with the terms of the LC, the issuing bank will accept the draft and agree to transmit the agreed funds at the later maturity date.

Thus, the buyer is provided with a form of credit since they will take receipt of the product but will not need to transfer payment until a future date.

Usance Letters of Credit – use cases

Usance LCs are generally used when the buyer and seller lack a degree of trust.

In order to begin reconciling this trust, both parties must unequivocally agree on the eventual amount to be paid and the interest rate on the product.

The LC will set out the time to maturity and the actual payment date so that both parties can use this as a reference.

The tenor is typically set out as being a certain amount of days following the bill of lading date or following sight.

If it is “following sight” then this will be from the date the documents are received by the issuing bank.

Having a usance LC allows the purchaser to deploy funds into other areas of the business until payment is made.

Things to watch out for when using letters of credit

Application stage:

When applying for a letter of credit, remember that your application can be rejected due to incorrect or incomplete documentation.

This could include submission of the wrong documents, typos and other errors, or ambiguity in your application.

You must also consider the difficulty of meeting the terms set out in the letter of credit from the counterparty’s point of view if your application is to be successful.

Payment stage:

Once an application has been approved, the seller should double-check that the quality and quantity of goods meet the requirements set out in the letters of credit before they ship.

Once the goods have arrived, the buyer should double-check the quality and quantity of goods, to ensure that they meet the requirements set out in the letter of credit, before submitting documentation to the banks for confirmation.

As noted above, banks are under no obligation to pay the seller until the right documents or other evidence is presented, and this process generally incurs administrative costs.

Confirmation and issuing banks normally charge commission and administrative costs for the letter of credit.

How can TFG help?

At Trade Finance Global (TFG), our advisers are experts in all things international trade, and we can help you find the perfect partner bank or financial institution to suit your financing needs.

TFG can advise you on what financing works best for your business, so that you can feel safe and assured during a trade transaction.

By working TFG, we can help you with all the documentation and procedural requirements, bringing added trust and security to your trade.

Get in touch with our team

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.