Delivery at Terminal - What is the DAT Incoterm®?

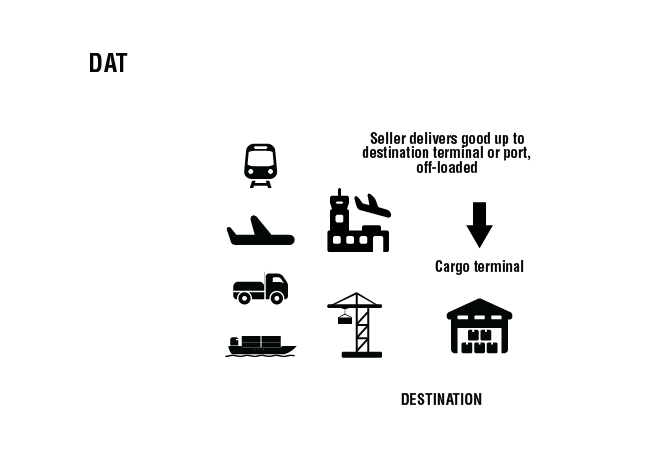

DAT, or, Delivery at Terminal, is where the seller clears goods for export and is fully responsible for the goods until they have arrived at a named terminal at the end destination. The goods must be unloaded at the terminal. DAT can be used with any transportation mode.

It is recommended that the seller’s contract with their forwarding company mirrors the contract of sale.

How does DAT work?

Delivery at Terminal is used when the seller’s responsibility includes the full delivery of goods up until the end terminal or port of destination, as well as the unloading of the goods. The seller pays for all of the expenses incurred until the place of delivery and the buyer pays for customs clearance and taxes at destination.

‘Terminal’ means a quay, warehouse, container yard or any road for rail, air or road.

As with all of the ‘D’ Incoterms®, the risks and responsibility of goods gets transferred from the seller to the buyer at the same point – the end destination. DAT was specifically designed to meet airport and port deliveries.

For ocean cargo and shipping goods by sea, any discharged containers are then moved to a container yards (CY), which is where containers are stored before they are moved to their final destination. Sellers are responsible for any destination terminal handling charges and the buyer only pays for customs clearance, duties and taxes.

Benefits of the DAT Incoterm®

The key advantages of Delivery at Terminal are around convenience and reduced risk to the importer:

- The supplier delivers goods to the destination place (importer doesn’t need to cover these costs)

- The risk is transferred from the supplier to the importer once the goods have been dispatched and unloaded at a defined place at the destination

- The supplier bears the responsibility for most of the carriage/transport of the goods from the origin to the destination

- Less hassle and organisation for the buyer of goods

Critical issues of DAT:

The moment when goods are discharged from the means of trasport and placed inside the named terminal at destination.

Buyer and Seller Obligations of DAT

| THE SELLER’S OBLIGATIONS | THE BUYER’S OBLIGATIONS |

|---|---|

| 1. Provision of goods

The seller must deliver the goods to the buyer as agreed, providing the necessary invoice or equivalent electronic document, as well as proof of delivery |

1. Payment

The buyer must pay for the price of the goods as quoted in the contract of sale |

| 2. Licences

The seller must provide the export licenses or local authorisations for exporting the goods from their factory / country of origin |

2. Licences, authorisations and formalities The buyer must get any export license and import permit for the export of goods |

| 3. Shipping and Insurance

Contract of carriage (transport of goods) is the seller’s responsibility, and so is insurance |

3. Shipping and Insurance

Contract of carriage – no obligation, this is the seller’s responsibility to cover costs and risk Contract of insurance – no obligation, this is the seller’s responsibility to cover costs and risk |

| 4. Delivery of the goods

The seller must deliver the goods and unload them at the agreed destination point and time |

4. Taking delivery

The buyer must take the goods which are delivered at the agreed destination point and time |

| 5. Transfer of risks

The seller is responsible for the goods until they are available to connect at the end destination port or terminal as agreed |

5. Transfer of risks

The buyer must bear all risks of loss or damage of their goods once they have been offloaded at the agreed place of delivery |

| 6. Costs

The seller must pay for:

|

6. Costs

The buyer pays for all cost relating once the goods are made available, as well as import customs duties and taxes |

| 7. Notice to the buyer

The seller must notify the buyer that the goods have been delivered at the place of destination |

7. Notice to the seller

The buyer must provide a clear time of shipment and the port of destination |

| 8. Proof of delivery

The seller must obtain proof of delivery at their own expense, which is a document that allows the buyer to pick up the goods |

8. Proof of delivery

Must accept the seller’s delivery document |

| 9. Checking

The seller must bear the cost of checking the goods, quality control, measuring, weighing, counting, packing of goods and marking. If a special package (e.g. fragile goods) is being shipped, the seller must inform the buyer and have them agree any extra expenses |

9. Inspection

Unless it’s a mandatory at origin, the buyer needs to pay any pre-shipment inspection |

| 10. Other

The seller must help in obtaining additional information required by the seller |

10. Other

Assist obtaining additional information required by the seller |

Benefits of DAT

The key advantages of Delivery at Terminal are around convenience and reduced risk to the importer:

- The supplier delivers goods to the destination place (importer doesn’t need to cover these costs)

- The risk is transferred from the supplier to the importer once the goods have been dispatched and unloaded at a defined place at destination

- The supplier bears the responsibility for most of the carriage / transport of the goods from the origin to the destination

- Less hassle and organisation for the buyer of goods

Testimonials

Metal construction parts needed to be transported from Singapore to Frankfurt, Germany. The seller cleared the metal through customs at the port in Singapore, and paid for the contract of carriage and insurance up until the goods reached Franfurt. Once unloaded in Frankfurt, the goods were the buyer’s responsibility.

Case Study

A receivables facility structured by TFG was implemented so that our end customers in Germany could invoice us on their terms without burdening our cash flow, and we used DAT as the means of transport which was the most effective solution for our deliveries, and working with our Singapore based manufacturers.

Freight Forwarding Hub

1 | Introduction to Freight Forwarding

2 | Air Freight

3 | Bill of Lading (BL)

4 | Container Shipping

5 | Demurrage

6 | Import General Manifest (IGM) and a Bill of Entry

7 | Full Container Loads vs Less than Container Loads

8 | Inbound Logistics

9 | Container Freight Stations

10 | Container Yards (CY)

11 | Ocean Freight

12 | Reefer Containers

13 | Telex Releases

14 | HS Codes

15 | HSN Codes

16 | IGST, SGST and CGST

17 | Marine Insurance

18 | DSV Tracking

19 | Certificate of Origin

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom