UK Specialists

Our United Kingdom specialists offer professional and structured finance solutions which include export finance and import finance. Our normal trade finance facility starts at £50K and there is no higher limit on the size of the trade.

Invoice Financing

What is invoice financing?

Invoice Financing allows firms to not have to wait up to 90 days for an invoice to receive payment. Around 70% of SMEs face late payment cash flow issues during their growth.

Simply put, invoice finance helps SMEs to sell up to 95% of invoices issued within 24 hours.

Invoice finance offers advantages over more traditional working capital finance such as commercial mortgages, and trade finance.

If you’re a London based organisation who has to release cash from an invoice, one of our London based invoice finance professionals could be of assistance.

Invoice finance enables firms immediate access to finance with minimum financial risk, because the security is guaranteed through the invoices from the supplier.

Invoice Finance Solutions – How can we help?

We can support companies which need trade finance services to release working capital from invoices from their merchants all around the world.

At Trade Finance Global, our network offers specialist and invoice finance and factoring solutions especially SME Finance and Shariah Finance. Our normal finance facility starts at £100k and there is no limit on the invoice size.

A Short Guide to Invoice Finance

Trade Finance

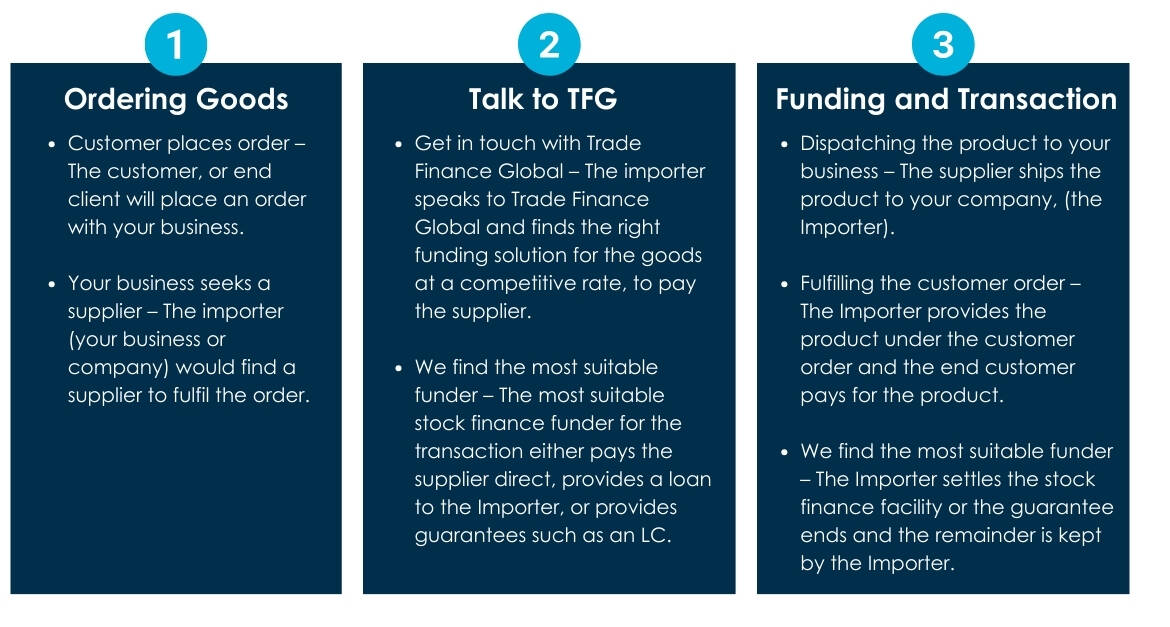

How does trade finance work?

Trade finance, a versatile tool, facilitates global or domestic trade, involving purchase orders and invoices for goods acquisition. Companies often leverage complex options like uncommitted trade finance facilities, letters of credit, or standby letters of credit.

Trade finance can mean many different things including:

- Receivables finance

- Letters of Credit

- Standby Letters of Credit

- Cash flow lending

- Revolving credit facilities

- Uncommitted trade finance lines

- Tripartite trade finance agreements

- Borrowing base facilities

- Reverse factoring

- Stock finance

All facilities are intended to increase trade where there is a buyer and seller confirmed. However, in some industries this is not always absolute and so variations of this model will be true. This may be seen in stock finance or a revolving credit facility where there are not 100% purchase orders, due to a specific industry or trade.

Our network provides specialised solutions like Structured Finance and Purchase Order Finance, with facilities starting at £100k and no upper limit. If your organisation seeks to buy or trade over £50k, is creditworthy, and has end buyers, contact us for assistance.

Types of trade finance houses in the UK

We see many different types of lending companies in London including:

- Sharia-compliant finance houses

- Private trade finance companies

- Invoice finance products

- Banks

- Private equity funds

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom